Although cleaned and conditioned biogas is indistinguishable from fossil-based natural gas, barriers for injecting it into the natural gas pipeline network persist.

Marsha W. Johnston

BioCycle September 2014

At BioCycle’s REFOR14 West conference in April, Byron Washom, director of strategic energy for the University of California at San Diego, wowed attendees with his tale of building one of the world’s most advanced, near-zero-carbon microgrids (see “Symphony Of The Microgrid At An Urban University,” July 2014). Getting excess methane from the local wastewater treatment plant purified and injected into the utility’s natural gas pipeline was one of the most difficult pieces, he said, as it involved meeting standards that “were written never to be met.” A participant in a later conference session also referred to pipeline standards for biomethane that even “natural gas would never meet.”

After a dozen interviews with experts, it is clear that Renewable Natural Gas (RNG) from biomethane is virtually indistinguishable from traditional natural gas, and is competing successfully in the vehicle fuel market. But when it comes to injecting it into the huge network of existing natural gas pipelines, RNG is mostly viewed with skepticism and subject to draconian regulatory barriers that could severely hamper its cost-effectiveness.

“It is a tremendous challenge for biomethane producers to get cost-effective access to the gas grid, because it’s new, and not a source that utilities are accustomed to dealing with,” explains Harrison Clay, president of Clean Energy Renewable Fuels in California, which produces, markets and distributes high volumes of RNG vehicle fuel. “Because they are public utilities, they are enormously risk-averse, so even if a producer says, `I want to deliver 100,000 gallons of high-quality RNG’, they will often say `no thanks’.”

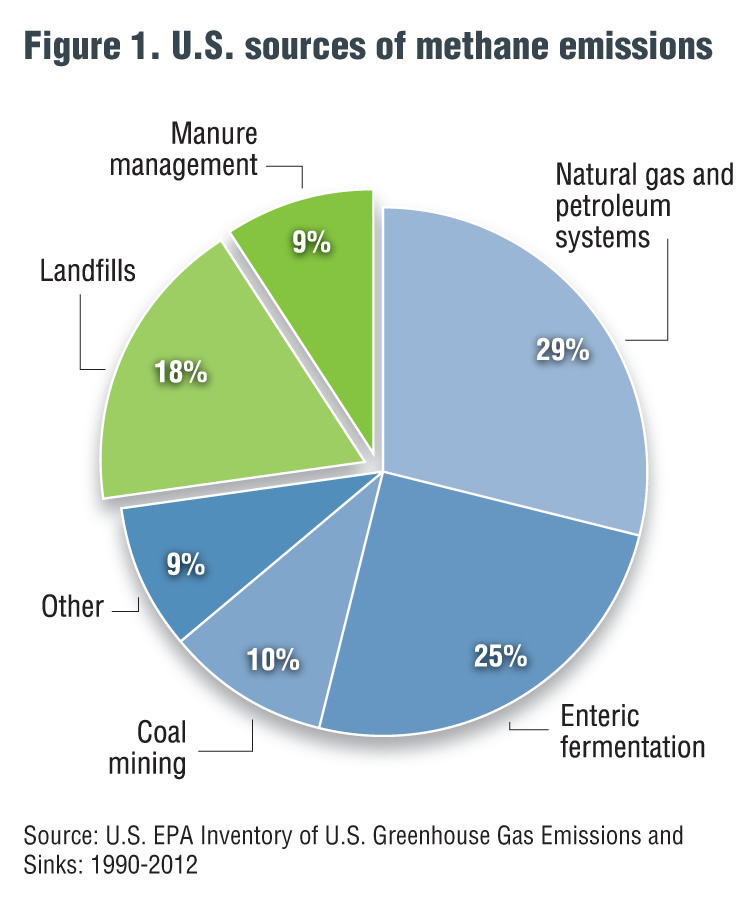

Methane is the primary component in RNG, biomethane and fossil-based natural gas. RNG and biomethane, high-BTU gases with a minimum of 90 percent methane, are upgraded versions of raw biogas, which is typically 50 to 70 percent methane (see sidebar “Navigating Biogas Terminology”). Methane is a greenhouse gas (GHG) that is 20 to 30 times more potent to the atmosphere than carbon dioxide; it originates from man-made and natural sources, from oil and natural gas operations to wetlands. In the U.S., landfills and livestock operations together account for approximately one-quarter of all methane emissions (Figure 1).

The potential for RNG and biomethane in gas applications in the U.S. is virtually untapped. According to figures from the Coalition for Renewable Natural Gas, of more than 1,000 landfills that could be candidates for biogas production, only 42 high-BTU landfill gas-to-energy projects are producing RNG, biomethane, upgraded or pipeline-quality biogas. Of 3,500 potential wastewater treatment plant biogas projects, only 1,200 have operational facilities that are recovering biogas to either generate renewable electric power or provide transportation fuel. Out of more than 12,000 potential agricultural digester projects that could produce biogas, only 239 biogas production facilities are in operation.

In a 2011 white paper on RNG, Massachusetts-based National Grid, which has been upgrading biogas to pipeline quality at the Fresh Kills landfill in New York for nearly 30 years, said that “renewable gas has the technical potential to meet up to 25 percent of the natural gas demand” in the four states it serves — New York, Massachusetts, New Hampshire and Rhode Island. The utility’s figure, which assumed using all available feedstocks with process efficiencies, excluded the natural gas demand for power generation.

Bernard Sheff, principal at Sheff & Sons Engineering and cochair of the American Biogas Council (ABC) and its RNG Working Group, concurs with the coalition’s figures, saying that he knows of maybe half a dozen digesters in the U.S. connected to pipelines or upgrading to vehicle fuel, and only one connected landfill in all of Michigan, where he is based. Sheff adds, however that “it is certainly on the upswing.” Sean Mezei of Dekany Consulting Inc., the other chair of ABC’s RNG Working Group, estimates that less than 10 percent of operational biogas projects in North America are injecting into a pipeline.

Favoring Electrons

One of the biggest reasons for a lack of use of bio-methane in gas pipelines is that biogas projects have been driven by energy policies that favor renewable electricity production. Consequently, the vast majority of anaerobic digesters and landfills today use the biogas to generate electricity and/or heat on site, or simply flare it off, transforming it into CO2 and reducing the greenhouse gas by a factor of 20.

“There have been a lot of tax incentives for the production of electrons, which is why we see more on-site power generation than we do production of MMBTUs,” notes Clay. “It is the legacy of decades of policy…energy developers took the low-hanging fruit and said, `Let’s just produce electricity.’” Indeed, of the 604 projects listed on the U.S. Environmental Protection Agency’s Landfill Methane Outreach Program database, 406 generate electricity.

“Currently, there is a significant disparity between government policies supporting renewable gas and renewable electricity,” says Anthony LaRusso, National Grid’s principal program manager for Emerging Gas. “If you take biogas and upgrade it to pipeline quality and use that gas to heat your home, it is not considered a renewable source of energy and you don’t get any credits. However, if you take that same gas and generate electricity with it, it is considered a renewable energy project and the project qualifies for credits and incentives. Public policymakers need to level the playing field by offering comparable incentives for renewable gas that are offered for renewable electricity.”

Furthermore, that old paradigm has run smack into the wall of super low-cost fossil-based natural gas, which has plummeted in price due to the boom in shale gas production, or fracking. “A lot of developers with biogas rights are finding that starting new, or even continuing old, power generation projects is problematic due to lower power prices and/or air quality regulations,” says Clay, adding that instead they are looking at upgrading their biogas to biomethane or further to RNG and moving the product into the vehicle fuel market.

In the 2011 RNG white paper, National Grid noted the huge environmental benefit of using RNG: “Renewable gas reduces GHG emissions by fuel substitution, essentially switching from a fossil fuel to a renewable fuel. Using renewable fuel represents the recycling of carbon already circulating in the environment, [while] using fossil fuel represents new emissions of carbon that was previously trapped geologically.”

California’s Biomethane Injection Standards

Taking advantage of that environmental benefit was precisely the reason behind California’s Assembly Bill 1900, introduced by Assemblyman Mike Gatto (D-Los Angeles), and signed into law in 2012. Before it was passed, it was against the law in California to inject landfill gas into a pipeline under any circumstances. The law directed the California Public Utilities Commission (CPUC) to develop the human health and safety, pipeline and pipeline facility safety and integrity standards for injecting biomethane, including landfill gas, into the state’s pipelines.

By January 2014, the CPUC published its decision, after many weeks of comment by all parties to the issue. It stipulated that, in order to for a biomethane supplier to connect to a utility pipeline, the supplier “must meet the gas quality requirements in the utility’s existing tariff,” as well as incremental specifications for 17 “constituents of concern” (CoCs) trace elements. (It defined 17 for landfill gas, and 9 for digester gas.)

The first problem, says Norma McDonald, North American sales manager for OWS Inc., is that the state utilities’ existing tariffs, SoCal Gas’s Rule 30 and Pacific Gas & Electric’s Rule 21, are not the same. First, Rule 30 has a BTU target of 990, whereas Rule 21 has a target “To Be Determined” based on the supplier’s source. Second, Rule 30 has an upper limit for oxygen of 0.2 percent whereas Rule 21 has a 0.1 percent limit. “Given the commingling of natural gas in California pipelines, the lack of uniformity is puzzling,” notes McDonald, “and without a uniform specification, developers and biogas upgrading equipment providers may have geographically limited market opportunities or, at a minimum, greater costs of production in some locations than others.”

Many developers and biomethane advocates were particularly disappointed with the CPUC’s “CoCs” technical specifications. They include arsenic, ethyl benzene, copper, vinyl chloride, antimony, lead, hydrogen sulfide, toluene, mercury and siloxanes. “In the first phase of AB1900, the Commission said, ‘What are we looking at?’ and the utilities said, `Biogas could have these things in it, especially landfill gas, there are a lot of other chemicals in there,’” explains McDonald. “That’s how they came up with the list of CoCs. It’s a technical assessment as to what might be in there and if in there, why it would be of concern.”

During the comment period, the Bioenergy Association of California (BAC) objected to various aspects of the constituent list, such as the inclusion of copper, even though “it was not found in raw biogas.” Says Julia Levin, BAC’s executive director, “The irony is that fossil fuel gases probably can’t meet the new standards. The CPUC is being exceptionally cautious about renewable gas, but fossil fuels have been given a free pass because they’ve been injected into pipelines for 100 years. The [AB1900] standards are not necessarily inappropriate, but they should be applied equally to fossil fuels or we will still not have a level playing field.”

Indeed, asks McDonald, for the more than a dozen mostly out-of-state suppliers of conventional natural gas to PG&E, “when and how often is the quality of that gas checked in its travel from Texas? The likelihood is high that there are small, even infinitesimal, ingress points for impurities, such as oxygen or biofilms that develop inside pipelines. There is a high probability that the average quality of gas in a California pipeline will be different than [PG&E’s] Rule 21, since the quality parameters for conventional gas suppliers are negotiated as part of the supply agreements. Rule 21 outlines default limits where no other agreement is in place. These other gas providers do not have to test for these CoCs, and the utilities and the Commission would say this is justified since there is no reason to expect to see the constituents of concern from conventional sources.”

Clay, of Clean Energy, says McDonald is far from a lone voice. “Many in the industry believe that the testing and quality requirements that came out of AB 1900 are unnecessary and excessive, and will impose significant costs and risks on aspiring RNG producers in California,” he notes.

The Coalition for Renewable Natural Gas worked very closely with California’s investor-owned utilities to pass AB 1900. “The technical aspects of the new regulations are the most stringent in the United States,” explains Johannes Escudero, the coalition’s Executive Director. “Biomethane is nearly identical to fossil natural gas, with the primary difference being its renewable source. Our members have safely and reliably transported biomethane via existing natural gas common carrier pipelines throughout nearly every state in the union for the last 30 years.”

National Grid testified to the Commission that its 30 years of injecting biomethane into the grid has shown no additional erosion. “But because the data presented was not from California, the CPUC erred on the side of caution,” explains Levin. “The standards may help in limited circumstances with more certainty and consistency, but they are far and away the strictest in the world. Without some allocation of the cost to utilities or ratepayers, using cap and trade revenues or other funding, I don’t think the effect will be a significant improvement in the market, which was the intent of AB1900.”

In addition to safety, the Coalition for Renewable Natural Gas is also concerned about the costs that may be associated with adhering to the regulations arising from AB1900. These costs include initial testing, ongoing monitoring for achieving and maintaining a 990 BTU heating value — and the costs of interconnecting a project with a pipeline. The Coalition conservatively estimates that one-time compliance costs are between $2,007,500 and $3,837,500 per project, with an ongoing annual cost of approximately $422,400. Because of the costs, says Escudero, “we expect that less than 10 percent of the 300 candidate landfills identified in California by U.S. EPA will be developed by our industry.”

Fortunately, he adds, the utilities appear willing to consider a rate-based subsidy to cover the costs, which makes sense, given the environmental benefits that will be realized from the increased use of biomethane. But even with a subsidy, Escudero notes there is likely to be a limit on how many miles of interconnect pipeline a utility would cover. “Many of the 300 landfills are more than five miles away from the nearest pipeline,” he explains. “By California’s utility interconnect estimates of $1.5 million to $3 million/ mile, at five miles, that would be anywhere from $7.5 million to $15 million/project.”

The Commission is expected to rule on the cost allocation part of AB1900 in October 2014. Levin of BAC notes that, although the CPUC provides a procedure for revising the standards, the industry must first “get enough biogas into the pipeline to prove that it isn’t a threat.”

Low Carbon Fuel Market

Meanwhile, the market for low carbon biomethane vehicle fuels is growing quickly. “In the last five years, Clean Energy has seen the emergence of a really big and growing natural gas vehicle fuel market,” says Clay. “You now have 18-wheelers running on natural gas. Five years ago, only 5 percent of trash trucks bought in any given year ran on natural gas. Now it is over 60 percent in the U.S. and it’s going up every year.”

Furthermore, he notes, high-value Low Carbon Fuel Standard (LCFS) credits in California, the potential expansion of LCFS markets in Oregon and Washington, and the U.S. EPA’s recent determination that biomethane vehicle fuel qualifies for D3 cellulosic Renewable Identification Numbers, will continue to create attractive economic incentives for RNG vehicle fuel. Clean Energy sold 20 million gallons of its “Redeem” RNG last year, and projects to sell 30 million gallons this year, adds Clay. All of the Redeem Clean Energy sold last year and projected to be sold in 2014 was sold through pipeline nomination (a request for a physical quantity of gas under a specific purchase, sales or transportation agreement) to Clean Energy stations and customers in California.

Clean Energy produces 60,000 gallons/day of biomethane for use as vehicle fuel, marketed as Redeem RNG (example of fueling above). Photo courtesy of Clean Energy

According to Levin, biogas from all organic waste sources could provide more than 2 billion gasoline gallon equivalents, enough to replace almost two-thirds of California’s total diesel consumption. “That would be a phenomenal public health benefit and GHG reduction,” she notes. Without easy access to pipelines, however, Levin believes the vehicle market is limited compared to the overall potential of biomethane. “I think the vehicle fuel market can grow without pipeline access as long as there is a vehicle fleet nearby, but if you’re talking about dairies or wastewater treatment facilities that are not serviced by a lot of vehicles, you need to be able to put the biomethane in a pipeline to use elsewhere as vehicle fuel or for other applications,” she explains.

Harrison Clay agrees: “If you want to do high-volume production, you have to inject it into a pipeline.” Producing 60,000 gallons a day, as Clean Energy is doing, “cannot be done economically with today’s technology except by putting it into the grid.” He adds that “the standard California published for biomethane is the most strenuous, restrictive and expensive requirement of anywhere in the world. It’s not technically impossible to meet the requirements, it just depends on how much money you can spend and how much risk you want to take.”

Kristine Cruz Wiley, program manager at the Gas Technology Institute (GTI), says GTI is addressing the concerns of those in the biogas industry who believe the playing field with fossil-derived natural gas is far from level. “We are executing a study with the same comprehensive testing of conventional and unconventional sources of gas, from natural gas, to coal bed methane, and specifically looking at their trace components,” she explains. “Part of the motivation behind that was to show everything on an even playing field.” Cruz Wiley could not provide a publication date for the study, but expects it to be soon as the research has been going on for a few years.

Marsha Johnston is a Contributing Writer to BioCycle.