WRAP report on the United Kingdom’s organics recycling industry finds rapid growth in anaerobic digestion capacity, and a slight increase in composting capacity.

Craig Coker

BioCycle June 2017

The United Kingdom’s Waste Reduction and Action Programme (WRAP) released its status report on the organics recycling industry for 2015, based on 2014 data with additional information for 2015 where is available. WRAP has been conducting this survey since the mid 1990s. This current report utilizes public and commercial data to deliver a snapshot of the industry.

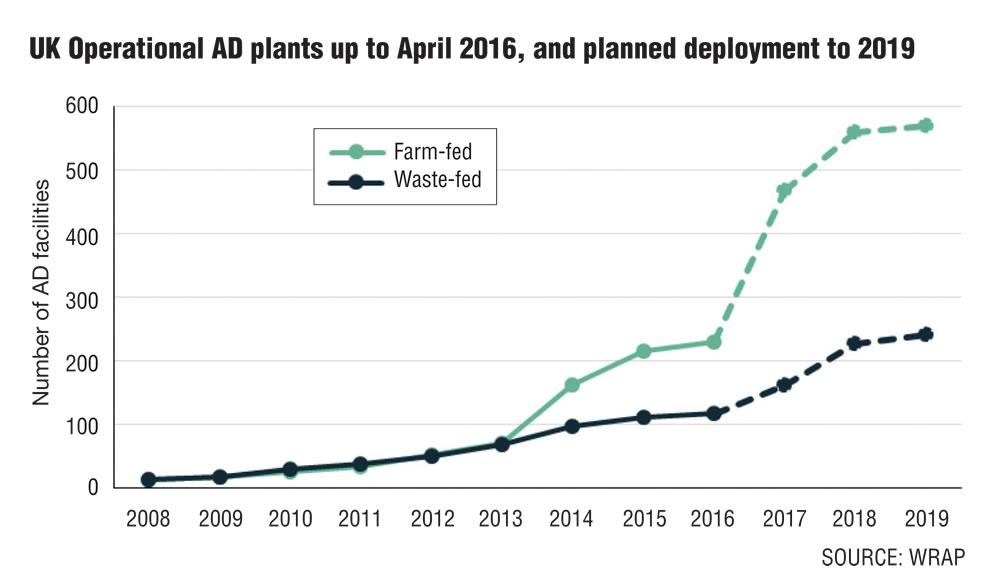

The anaerobic digestion (AD) sector has been growing at a rapid pace, from a small industry in 2004 with a handful of plants to becoming an established industry in 2014. In 2012, 105 AD plants processed 2.6 million tons of inputs with 120 MWe output capacity, and by 2014, 259 AD facilities processed 5.8 million tons of feedstock (with 7.2 million tons of operational capacity) and provided 238 MWe of generating capacity. This trend is set to continue with around 500 AD projects in the pipeline, to potentially double or triple the size of the sector between 2014 and 2019.

The majority of feedstock processed in 2014 was food waste (1.98 million tons, 35%), followed by energy crops (1.5 million tons, 26%), other waste, including industrial processing wastes (1.2 million tons, 21%), manure/slurry (0.82 million tons, 14%), and crop waste (0.23 million tons, 4%). The majority (1.7 million tons) of food waste processed by AD facilities in England, Wales and Scotland came from commercial and industrial sources. An estimated 5.2 million tons of food waste are contained in domestic waste (WRAP Synthesis of Food Waste Compositional Data, 2014/15); accounting for the tons already processed through AD, this leaves a major potential untapped feedstock source — and great potential to increase food waste collections, to help the AD industry grow.

It is estimated that 4.96 million tons of digestate were produced in 2014, based on declared input volumes and typical conversion efficiencies. This was a 56 percent rise from 2013, where 3.2 million tons of digestate were estimated to be produced.

In 2014, 19 AD sites were PAS110 accredited under the Biofertiliser Certification Scheme (the UK’s digestate quality standard). However, site certification has been increasing, from 10 sites in 2013 to 42 sites in 2015, suggesting markets for digestate are developing and the scheme is becoming more widely recognized. The market value for digestate has been low in past surveys (~$16.70 to $3.85/metric ton); however, as markets develop recognition of the value is expected to improve.

The number of jobs in the AD sector has been increasing, coinciding with the increase in deployment; growing from an estimated 688 jobs in 2013 to 1,007 jobs in 2014 (46% increase). The increase in employment has the potential to continue as the deployment pipeline remains strong.

Composting Sector

The UK’s composting sector is more mature than the AD sector, and continues to grow albeit at a steadier rate, from 271 permitted sites in 2012, to 310 in 2014 and 330 in 2015. There were 6.4 million tons of organic material received by composting facilities in 2012, and 6.5 million tons of input in 2014. The scale of compost production appears to be in decline.

In the UK, between 2007 and 2012, the majority of feedstock processed by the composting sector was consistently sourced from local authorities (70-88%), and consisted mainly of green waste — contributing more than 70 percent — and food waste.

Historically, the largest market for compost has consistently been agriculture (60-70%), which holds true in Scotland (53%) and Wales (71%) in 2014. There was limited data to evaluate compost markets in England in 2014, except noting that 46 percent of England’s composting sites had PAS100 accreditation (UK’s quality standard for compost), indicating higher value markets were accessible for these sites.

In the UK in 2012, the landscaping market had the highest value (mean $13.50/mt), followed by horticulture ($10.93/mt), turf ($7.55/mt), energy recovery ($3.75/mt), agriculture ($0.96/mt), and landfill restoration ($0.81/mt). Insufficient responses to the recent survey mean that no data is available for England in 2014. However, the compost market is more mature than digestate and as such compost markets are not expected to have changed dramatically in England since 2012.

Access to higher value compost markets in the UK has grown, as Quality Compost Certification continues to rise. Over half of all permitted sites achieved PAS100 accreditation in 2014, increasing from 84 sites in 2008 (47% of total sites), to 180 sites in 2014 (51% of total sites). Uptake of the PAS100 scheme is markedly better in Scotland and Northern Ireland (100% uptake), compared to England and Wales (50% of sites), mostly due to recycling targets, development of end markets and product value recognition.

The composting industry has a growing workforce, with an estimated 1,434 jobs in 2014, compared to 1,184 in 2009.