Craig Coker

Operating costs are all the costs you will incur to make a cubic yard of finished compost/soils product. Normally those costs include some factor for amortizing the capital investment in the facility (see sidebar), plus the cost of money acquired to finance that capital. But for the purposes of this section, operating costs will be defined as non-capital related costs, e.g. fuel, labor, electricity, and maintenance.

For new facilities, those costs can be estimated with a time-and-motion projection. For existing facilities, operating expenses can be measured in a similar manner along with detailed cost accounting of equipment costs. As composting is essentially a materials handling exercise, it takes a certain amount of time at a certain cost, to perform each task in the compost manufacturing process. The time to perform each task is estimated (or measured in existing facilities), and the cost of each task is defined by the loaded labor rate and the machine rate.

Proposed Facility Example

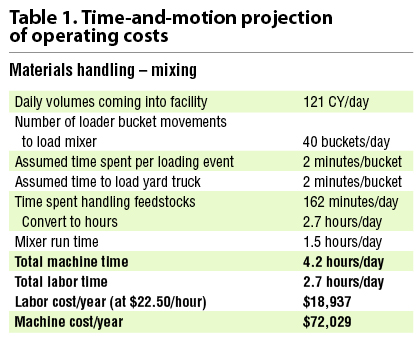

An example of performing a costing exercise is shown in Table 1. This estimates the total annual cost of mixing feedstocks in a mechanical mixer for transport to the ASP composting pad in a yard truck at a proposed 10,000 tons/year food scraps composting facility in Martha’s Vineyard, Massachusetts. These types of costing exercises can be used to help make equipment decisions, e.g., one composting facility used this approach to decide whether to keep moving compost into the curing area with loaders, or to invest in a dump truck to move the compost.

An example of performing a costing exercise is shown in Table 1. This estimates the total annual cost of mixing feedstocks in a mechanical mixer for transport to the ASP composting pad in a yard truck at a proposed 10,000 tons/year food scraps composting facility in Martha’s Vineyard, Massachusetts. These types of costing exercises can be used to help make equipment decisions, e.g., one composting facility used this approach to decide whether to keep moving compost into the curing area with loaders, or to invest in a dump truck to move the compost.

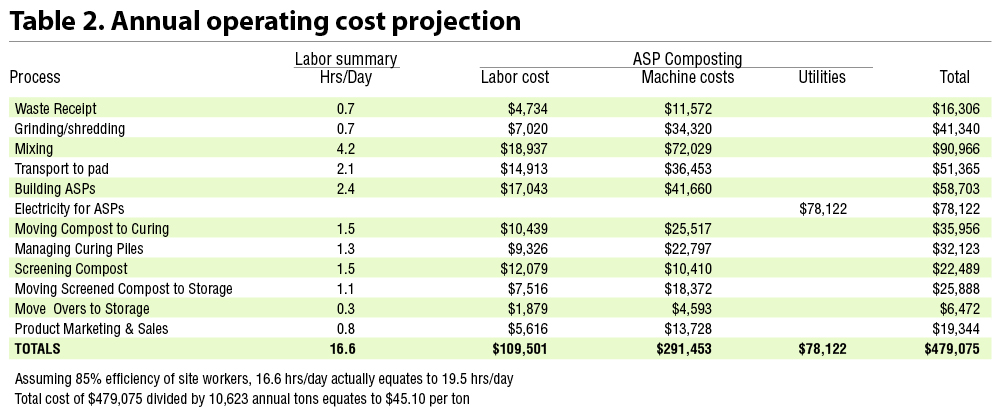

This calculation step is repeated for each task in the compost manufacturing process, then summarized to provide a projection of the entire facility’s annual operating cost, as shown in Table 2.

Note that this projection assumes 85% worker efficiency; that is to say, in a normal 8-hour day, only about 6.8 hours of real work is done but you’re probably paying for the full 8-hour day.

Note that this projection assumes 85% worker efficiency; that is to say, in a normal 8-hour day, only about 6.8 hours of real work is done but you’re probably paying for the full 8-hour day.

Loaded Labor Rates

For operating facilities, this same time-and-motion approach can be used to pin down your actual operating costs. As with projections, the actual cost analysis is based on your actual loaded labor rates plus your measured machine costs.

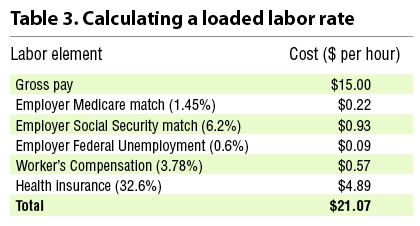

Loaded labor rates include the pay actually paid to the worker, plus amounts needed for employer Federal taxes and State Unemployment Insurance, plus any fringe benefits you pay your workers. Table 3 illustrates how to perform this calculation.

Loaded labor rates include the pay actually paid to the worker, plus amounts needed for employer Federal taxes and State Unemployment Insurance, plus any fringe benefits you pay your workers. Table 3 illustrates how to perform this calculation.

Machine Rate

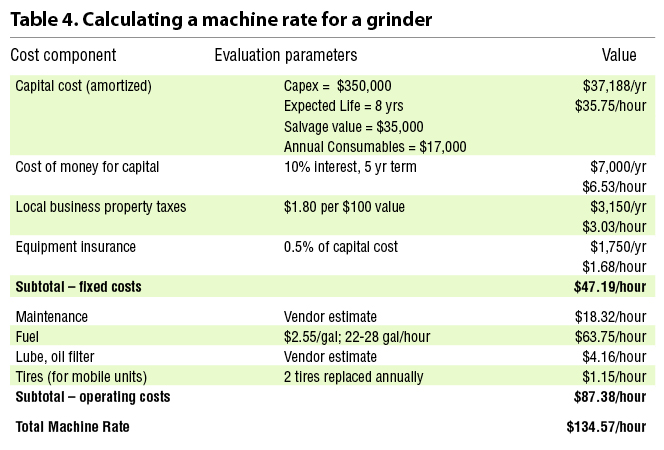

The machine rate is the cost of owning or leasing and operating a particular piece of equipment. The objective in developing a machine rate should be to arrive at a figure that, as nearly as possible, represents the cost of the work done under the operating conditions encountered. The machine rate is a compilation of fixed costs, operating costs and labor costs that are expressed over a particular unit factor, usually dollars per hour. The machine rate multiplied by the actual or estimated hours of use in a budget year gives the annual projected cost for that piece of equipment. These rates will be based on best professional judgment and/or established rates elsewhere for start-up facilities.

For operating facilities, a more rigorous approach to information management and bookkeeping will be needed to track the details of these costs for each piece of operating equipment. An example of how to calculate the machine rate for a grinder is presented in Table 4 (these costs are expressed in 2015 dollars). The grinder is used 4 hours/day, 5 days/week (1,040 hours/year)

Factoring In Overhead Costs

The other cost element to consider is your overhead costs, often labeled Selling, General and Administrative (SG&A) on financial statements. These costs are obviously very company specific, but one multi feedstock composter handling about 50,000 tons/year reported 2019 SG&A costs of $5.97/ton accepted for composting. This facility does not use separate sales staff for either product sales or feedstock contracts, so their SG&A number may be low compared to your operation.

Craig Coker is a Senior Editor at BioCycle and CEO of Coker Composting & Consulting near Roanoke, VA.