Starting in 2013, California will begin the nation’s most comprehensive cap-and-trade program. Dairy and swine digester projects anywhere in the U.S. are eligible to sell carbon credits.

Peter Weisberg

BioCycle April 2012, Vol. 53, No. 4, p. 44

Hopes for a federal cap-and-trade bill, dashed by Congress several years ago, would have priced carbon emissions and likely allowed many digester and composting projects to sell carbon credits. Focus has shifted to California, which starting in 2013 will begin the nation’s most comprehensive cap-and-trade program. Digester and composting project developers throughout the United States looking to generate revenue based on the climate benefits of their projects must now turn their attention to the intricacies of the emerging California carbon market.

The regulatory entity overseeing this market, the California Air Resources Board (ARB), has approved four types of projects as eligible to sell carbon credits to regulated emitters in California. One project type is avoidance of methane emissions from installation of anaerobic digesters at dairy and swine farms. Projects of these types anywhere in the United States qualify for the California market. Two of the other categories are related to sequestration in urban and rural forestry; the fourth is destruction of ozone depleting substances.

Many of these livestock digester projects are already generating carbon credits, mostly for voluntary markets. Most recent projects are certifying their credits according to the Livestock Protocol from the Climate Action Reserve (CAR). After a review, the ARB will allow these CAR-certified livestock projects to transfer their credits to be compliant in California; future livestock projects must use the protocol written directly by the ARB. As it stands now, ARB’s protocol is nearly identical to CAR’s.

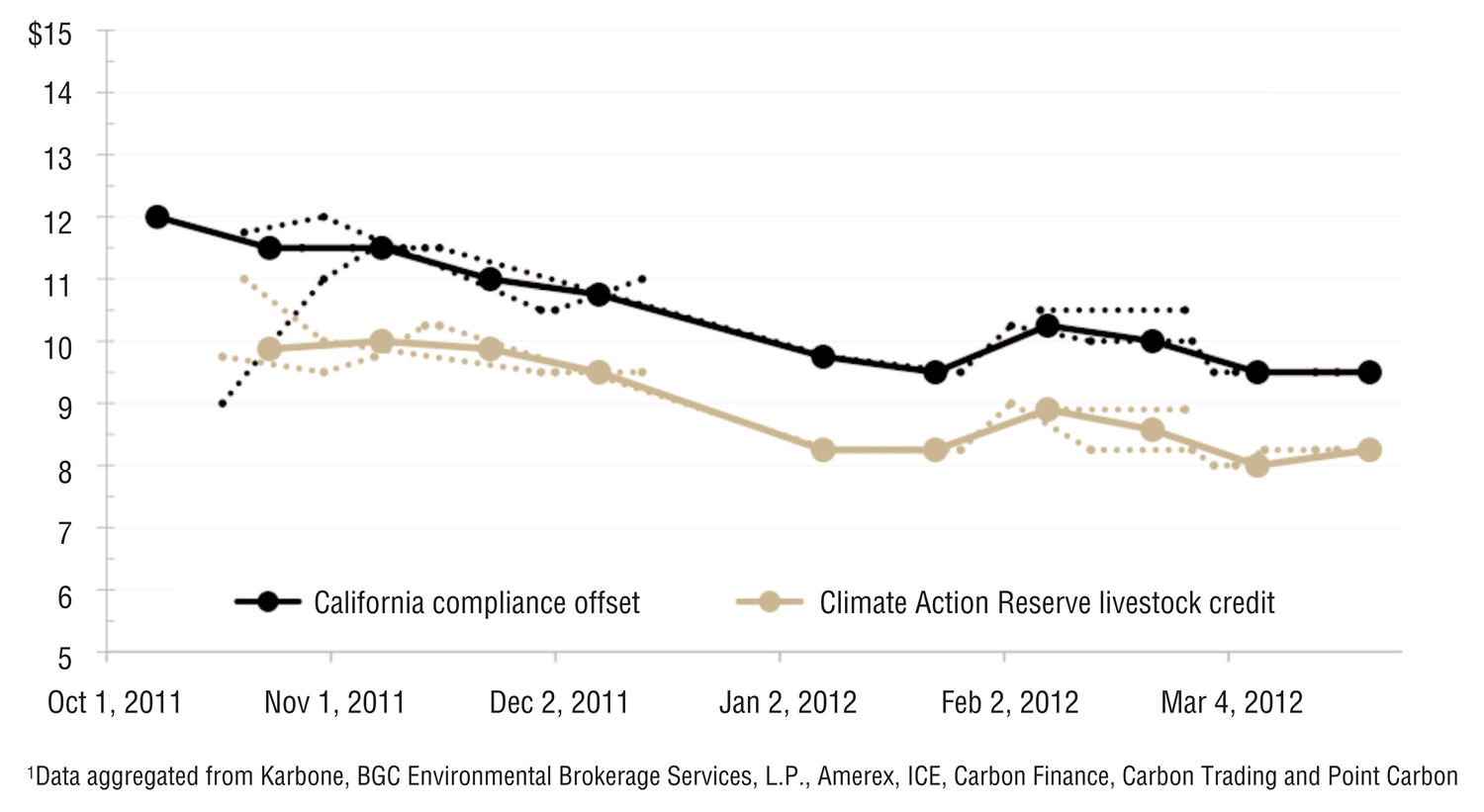

Depending upon the price at which digester project developers can sell their carbon credits, the California market could become a major incentive for livestock biogas development. A February 2011 USDA report on digesters estimates that at a carbon price of $13/metric ton of carbon dioxide, half of the dairy operations with more than 500 cows could profitably operate digesters; at $26/ton, that number jumps to almost 70 percent. Table 1 illustrates the net revenue of selling carbon credits for a 2,500-cow digester. In the example, it’s assumed that each cow generates 3.5 carbon credits. (This number will vary widely from project to project based on historic manure management practices, temperature, and other site-specific variables.) Carbon prices are shown under several scenarios: an assumed voluntary price ($4/ton) under a scenario where credits cannot be sold into California; at current “precompliance” prices ($8.50/ton), i.e., what entities are currently willing to pay in anticipation of the California market; and a “compliance” price ($15/ton), a guess at what strong, future prices could be in California.

Impacts On Carbon Pricing

What are some of the factors that will affect the California carbon price? First are the big-picture hurdles to overcome, such as legal challenges to the legislation. For example, there was recently a ruling that similar legislation, the Low Carbon Fuel Standard, violated the commerce clause; lawyers caution that a similar argument applies to the cap-and-trade system and anticipate that some regulated entities may sue. Another suit was recently filed on the grounds that the ARB offset protocols do not meet the quality requirements outlined by the California law. Legal challenges add risk and uncertainty today and could derail the market.

Energy prices and the status of the fragile economic recovery also will play a role in determining carbon prices. If fossil fuel energy prices drop, for example, demand may increase, thus increasing emissions and therefore raising the carbon price. Finally, some yet-to-be-determined policy details could strongly impact price. For example, as projects transition into California compliance, managing the liability that credits have been incorrectly issued will arise. As it stands now, the buyer of the credits is liable to replace invalidated credits; contracts will be drafted, however, to share the liability. How contracts are structured with both private companies and regulated utilities could drastically change the prices project developers are able to negotiate.

Project developers with an appetite for risk can hold on to credits, knowing that future developments in California may increase the carbon price over time. On the other hand, project developers trying to finance projects today can work with carbon buyers like The Climate Trust to sell all the credits that a project will generate at a fixed price to guarantee carbon revenue, regardless of future market developments.

Even with a strong carbon price to drive investment in digesters, the California carbon credit market will almost certainly be undersupplied; recent estimates from Point Carbon indicate that only 35 percent of the total quantity of offsets that could be used in California can be generated from the four currently approved project types.

More project types are needed to increase supply and, at the same time, expand the impact of California’s carbon market. (As a point of reference, California regulated entities, like utilities or fuel refiners, cannot use offsets for more than 8 percent of the total number of emissions they are allowed under the cap. Regulated utilities can use up to 218 million metric tons of carbon dioxide emission reductions by 2020, but it is highly unlikely that the currently allowed project types can generate this quantity of emission reductions.)

Two protocols from the Climate Action Reserve are of particular importance to BioCycle readers — the Organic Waste Digestion and Composting Protocols. Under these protocols, projects that digest or compost postconsumer food waste or agroindustrial waste previously managed in an anaerobic lagoon qualify to generate carbon credits for their avoided methane emissions. Qualifying organic waste digestion and composting projects to generate California-compliant carbon credits would increase supply and enable carbon markets to support the growing biogas and composting sectors. With success in California, perhaps a federal cap-and-trade bill will again become a possibility.

Peter Weisberg is a Senior Project Analyst for The Climate Trust, based in Portland, Oregon. The Climate Trust (www.climatetrust.org) is a 501(c)(3) nonprofit organization with over 15 years of carbon financing experience. Their mission is to provide expertise, financing, and inspiration to accelerate innovative climate solutions that endure.To arrest the rise in greenhouse gas emissions and avoid the most dangerous impacts of climate change, The Climate Trust works to accelerate project implementation, develop financing solutions, and establish a supportive policy environment in the renewable energy, agriculture, forestry, energy efficiency and transportation sectors.