The Omnibus Act passed by Congress and signed into law in December 2015 includes short extensions of production and investment tax credits for biogas-to-electricity projects.

Craig Coker

BioCycle January 2016

Laws are like sausages. It’s better not to see them being made. To retain respect for sausages and laws, one must not watch them in the making.” This quote (often attributed to Otto von Bismarck, former Chancellor of Germany) remains true today, most recently for the December 18, 2015 Congressional approval of H.R. 2029, The Consolidated Appropriations Act, 2016, which President Obama promptly signed into law (P.L. No. 114-113, 114th Cong. 1st Session).

H.R. 2029 (the “Omnibus Act”) and companion legislation (the “Protecting Americans from Tax Hikes Act of 2015”) that was folded into it provided appropriations for continued operation of the U.S. government through September 30, 2016 and extended a number of favorable tax treatments for renewable electricity and renewable fuel projects. In exchange for lifting the 40-year ban on exports of heavy crude oil, Congress extended the Production Tax Credit (PTC) and Investment Tax Credit (ITC) for renewable electricity projects — though not equally for all of them.

H.R. 2029 (the “Omnibus Act”) and companion legislation (the “Protecting Americans from Tax Hikes Act of 2015”) that was folded into it provided appropriations for continued operation of the U.S. government through September 30, 2016 and extended a number of favorable tax treatments for renewable electricity and renewable fuel projects. In exchange for lifting the 40-year ban on exports of heavy crude oil, Congress extended the Production Tax Credit (PTC) and Investment Tax Credit (ITC) for renewable electricity projects — though not equally for all of them.

Wind and solar projects received the most favorable treatment — what amounts to a 5-year extension of the PTC and ITC from 2014 for wind projects and a similar extension of the ITC from 2016 for solar projects. The latter is coupled with an eligibility change from prior mandates that solar projects be “placed in service” by the end of 2016 to a more flexible provision that they merely “begin construction” by certain dates. (The PTC already included such language.) Both extensions have sunset provisions that phase down the amount of the credits by the end of 2019 for wind and 2021 for solar, although wind projects that begin construction in the next two years and solar projects that begin construction in the next three years will generally receive 100 percent of currently applicable credits. Thereafter, these projects generally will receive a reduced dollar amount of credits applicable to the year they begin construction, until phase out. The credits disappear for wind projects that begin construction after 2019, and for solar projects, drop down to the ITC’s permanent 10 percent level where construction begins after 2021. However, to remain eligible, all solar projects must be placed in service before 2024.

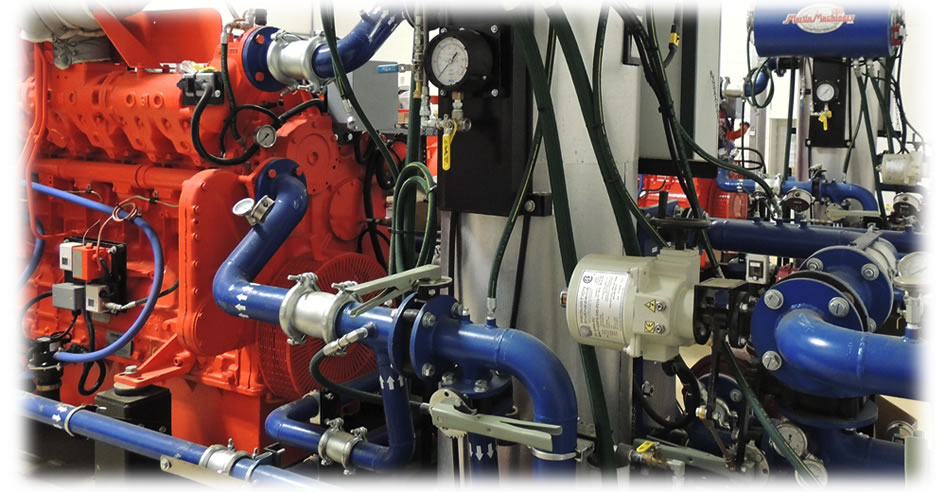

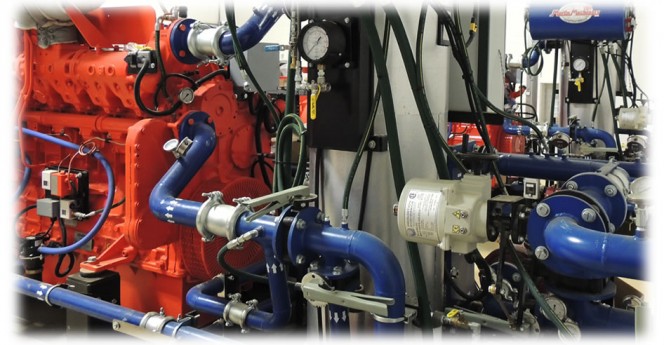

Biomass-to-electricity projects — including anaerobic digesters — received an extension of the PTC from January 1, 2015 through December 31, 2016 — a retroactive but substantially shorter two-year extension which nevertheless allows potentially beneficial “look backs” for developers to qualify projects that began construction in 2015. The extension also continues the biomass developers’ option to elect or “jump to” the ITC instead of the PTC for projects that begin construction during the same two-year period.

PTC vs. ITC

The PTC is an inflation-adjusted per-kilowatt-hour (kWh) tax credit for electricity generated by qualified energy resources and sold by the taxpayer to an unrelated person during the taxable year, claimable each year for ten years’ production after a project is placed in service. For wind projects, the credit currently is 2.3 cents/kWh; for most other qualified renewable electricity projects, the credit currently is half of that amount. By contrast, the ITC allows an upfront dollar-for-dollar reduction (up to 30% of qualified investment in a project) in the federal income taxes that a company claiming the credit would otherwise pay, entirely claimable in the year that the project is placed in service. The “30 percent ITC” often may be preferable to the per-kilowatt hour PTC when developers seek funding. For example, from an investor’s perspective, the ITC does not involve long-term production risks.

When construction “starts” was generally explained by Michael Levin in an earlier BioCycle article (see “Getting Renewable Energy Projects Done In Still Tougher Times,” February 2015). Under current IRS guidance documents, there are two broad ways — physical or financial — to “have begun” construction, Levin noted. Assuming that current IRS guidance routinely will be updated to track the new extensions, these are:

• “Physical: A project may begin physical construction in or before 2016 by relatively small actions and still qualify for the PTC, as long as it pursues ‘a program of continuous construction’ until completion. ‘Physical construction’ includes off-site work done by digester or other equipment providers under binding contracts, as well as site work on biomass supply roads or other tangible things ‘integral’ to the project.

“’Physical construction’ can be as little as pouring foundations for one wind turbine on a 20-turbine wind farm (though developers who do the bare minimum may find their projects rejected by investors later on). It need not be ‘continuous’ in the sense of work done all day, every day, as long as the project keeps moving forward and the developer makes diligent efforts to advance the project on a daily basis. Normal force majeure exceptions generally should cover uncontrollable work suspensions, such as agency delay issuing permits that have been pursued in a timely manner. Moreover, projects can be expected to have ‘continuously constructed’ if they’re completed within 3 years, although this IRS ‘safe harbor’ has not yet been confirmed.”

•“Financial: Alternatively, a project may have ‘begun construction’ financially if its developer ‘spent’ (for cash-based taxpayers) or ‘incurred’ (for accrual-based taxpayers) 5 percent of that project’s total cost in or before 2016, and then made ‘continuous efforts’ towards completion. ‘Continuous efforts’ generally is easier to meet and subject to fewer investor concerns than ‘continuous construction.’ Funds may be ‘spent or incurred’ directly or indirectly (for example, by paying equipment vendors under binding contracts), even if delivery occurs after 2016. The same safe harbor as for physical construction should presume that projects completed before 2019 have made ‘continuous efforts,’ although again the IRS has not yet confirmed this safe harbor. Projects that no longer meet their 5 percent ‘spend or incur’ target due to cost overruns still may qualify separable project portions under a ‘partial financial safe harbor,’ if they spent or incurred at least 3 percent of total cost before 2017 and the portions’ cost is not more than 20 times what was spent or incurred.

“Under either the ‘physical work’ test or the ‘financial’ test for having ‘begun construction,’ developers who miss completion by the end of 2019 still may be able to show that they ‘continuously constructed’ or made adequate ‘completion efforts.’ . . . Developers also may qualify by acquiring other projects that timely ‘began construction,’ or by shifting qualified components from their other projects.”

Levin notes that there are at least two potentially important qualifications to the paragraphs quoted above. “First, in extending the solar ITC with new ‘begin construction’ language, Congress also included for the first time in connection with that language an absolute cutoff date — December 31, 2023 — by which otherwise-eligible solar projects must be ‘placed in service’ or drop back down to the permanent 10 percent ITC. This provision could be read to supersede the previous IRS presumption that projects ‘completed’ within two to three years of beginning construction will be deemed to have been ‘continuously constructed.’ If so, it could both expand that presumption by several years, and contract it by eliminating solar project developers’ ability to show that they nevertheless ‘kept constructing’ after 2023 until project completion. Whether that will be the ‘official’ interpretation, and the extent to which this concept might apply to non-solar projects, remain to be seen.”

Second, continues Levin, “the ITC extension through 2021 tacitly extended developers’ ability to claim the ITC for the cost of battery storage ‘used in connection with’ a renewable electricity project — at least where more than 75 percent of annual battery charge generally is from the project rather than the grid. [See, e.g., IRS Private Letter Ruling 121432-12 (Nov. 20, 2012).] Because tax principles for storage are evolving and rules other than this ‘75% test’ may apply in different circumstances, tax counsel often have advised developers to make sure that in general, 90 percent of the battery’s charge each year is attributable to the project.”

This “storage” extension mostly will benefit intermittent generators like wind and solar, adds Levin. “However, it also could benefit anaerobic digesters or other baseload renewable electricity generators located in areas where time-of-use or similar rate tiers allow generation to be stored and then shifted to higher value intervals such as peak demand periods.”

The American Biogas Council (ABC) plans to bring together other non-solar and non-wind renewable energy groups in 2016 to seek more equality with the extensions for wind and solar. “When looking at [tax] scoring, having wind and solar removed from future federal budget cost analysis because these high-cost credits will already have been extended will lower the costs of further extending the credits for other technologies,” explains Patrick Serfass, ABC’s Executive Director. “Both length of credit in existence and rate [amount of the credit] should be more equal to what solar and wind have.”

The “score” to which Serfass refers is the estimate as to how much revenue the government will lose by granting the tax credit. “The extension of tax credits just for wind power will reduce IRS revenue by about $14.5 billion, and continued solar tax credits will cost $9.3 billion,” explains Ted Niblock of NewAg Development, and author of BioCycle’s “BioEnergy Outlook” column. “Extending the PTC for biomass from 2014 to 2018 is estimated to only cost about $1.9 billion. It is therefore correct that renewal of the PTC for biomass alone would have a very low score, and be a small request. If there is another piece of legislation passed by Congress this year to which such an extension could be attached, in theory it would be a very small request.”

This tax credit saga is not over yet. Some renewable energy tax credits were not extended at all; the biogas-to-electricity section plus several related ones were granted relatively short extensions, mostly for budget-scoring reasons. And House leaders have indicated willingness to revisit and expand these Congressional actions. However, as cliff-hanger tax history demonstrates, such promises are easily made but difficult to keep. The jury likely will be out on further extensions until after elections this fall.

Craig Coker is a Senior Editor at BioCycle and a Principal in the firm Coker Composting & Consulting (www.cokercompost.com), near Roanoke, Virginia. Michael Levin, who reviewed and contributed to this article, is managing member of the virtual law firm Michael H. Levin Law Group, PLLC (Washington DC) and a principal in NLGC, LLC and Carbon Finance Strategies LLC, which respectively focus on capital formation for renewable energy projects and the optimization/development of ground-mounted solar PV facilities. John Marciano, a partner at Chadbourne & Parke LLP (Washington DC), commented on an earlier draft.