Craig Coker

Biogas upgrading equipment used at SoCalGas demonstration project at Hale Avenue Resource Recovery Facility in Escondido (CA). Photo courtesy of SoCalGasThe California General Assembly passed AB 1900, Renewable Energy Resources: Biomethane, which was signed into law by Gov. Jerry Brown in September 2012. This bill required the California Public Utilities Commission (CPUC) to adopt pipeline access rules for biogas producers that ensure nondiscriminatory open access to private gas pipeline systems for the purposes of physical interconnection. It applies to development of pipeline interconnections for biogas-derived renewable natural gas (RNG, also known as biomethane) to be delivered to existing gas transmission and distribution systems.

Southern California Gas Company, known as SoCalGas®, is the regional gas distribution utility in an 11-county region of southern California, providing natural gas service to 21.4 million customers over a 20,000 square mile area. SoCalGas has been engaged in activities to enable and promote use of biogas for nearly a decade. In 2009, SoCalGas published a “Biomethane Guidance Document” to supplement its Rule No. 30 gas quality requirements to address receipt of biogas on its network. This document was then replaced via the CPUC proceeding related to AB 1900 to provide statewide nondiscriminatory access for biogas producers. As part of the AB 1900 Biomethane Proceeding, Biomethane-specific Quality Specifications were adopted into the California gas utilities’ gas quality requirements (see Table 1).

In Table 1, the Trigger Level is the level where additional periodic testing and analysis of the constituent is required. The Lower Action Level, where applicable, is used to screen biomethane during the initial biomethane quality review and as an ongoing screening level during the periodic testing. The Upper Action Level, where applicable, establishes the point at which the immediate shut-off of the biomethane supply occurs.

Feasibility Analysis

In order to catalyze the biogas market in California, SoCalGas manages programs to conduct research, outreach and education. Additionally, in April 2012 SoCalGas filed an application with the CPUC to offer an optional Biogas Conditioning/Upgrading Services (BCS) Tariff. This tariff was approved in December 2013 and allows SoCalGas to invest in infrastructure on customers’ premises to process biogas for use on-site or to be injected into the pipeline as a replacement for traditional natural gas. This service is fully compensatory, and SoCalGas recovers its investment from BCS customers through a monthly tariff fee. Customers within SoCalGas’ territory can optionally participate in this program, but it is fully elective and isn’t tied to any other service SoCalGas provides.

“We have had discussions with several biogas producers in the past few years about bringing biomethane into our distribution system,” explains Jim Lucas, Market Development Manager for SoCalGas, “and we continue to work on developing new tools and services to enable this important market. The BCS Tariff is one example of a service we offer to help enable this market, and we continue to perform market studies to better understand the challenges and opportunities that the biofuels market presents.”

SoCalGas hired Black and Veatch (B&V) to investigate current biogas upgrading technologies, with a focus on technology availability, performance, cost, and possible future research and development (R&D) needs. Scott Olson, Director of Strategic Planning for Renewables and Energy Efficiency at B&V, and Project Manager for the SoCalGas study, presented the study findings at the BioCycle West Coast Conference in April 2016 in San Diego.

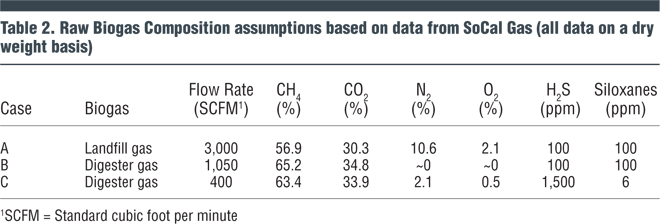

“We developed several scenarios for cleaning raw biogas to pipeline quality biomethane, using different flow rates and compositions,” he noted. “We surveyed a range of technology providers to determine the appropriate designs for each case. From our past work in this field, we saw that the technologies available for biogas cleaning have clearly improved. The key questions we wanted to address in the study were: Which technologies are best suited to upgrade biogas at a scale commensurate with various expected biogas sources in SoCalGas’ territory? At a conceptual level, how would these projects be designed? And which R&D activities should SoCalGas pursue or support to improve biomethane quality and reduce upgrading costs?” The scenarios B&V developed are shown in Table 2.

Several technology suppliers were reviewed in each category of gas cleanup:

- Carbon dioxide (CO2) separation using pressure-swing absorption: 3 suppliers

- CO2 separation using membrane: 4 suppliers

- CO2 separation using amine/water wash: 2 suppliers

- Siloxane removal: 5 suppliers

- Hydrogen sulfide (H2S) removal: 4 suppliers

- Nitrogen/oxygen removal: 3 suppliers

The project team felt that the technologies to clean siloxanes and H2S are well established, commercially proven, and fairly standard across upgrading solutions.

Economic Considerations

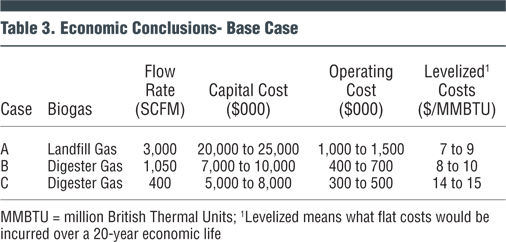

B&V looked at the economic considerations in a base case that was subjected to a sensitivity analysis. The base case included gas cleaning only and did not include any costs for AD or other biogas production equipment. The base case utilized “all-in” costs, which included all costs necessary to design and build a gas cleaning and pipeline injection facility. B&V’s economic conclusions are shown in Table 3.

B&V found that the costs of removing nitrogen from the biogas were more important to reducing costs than the economies of scale derived from a central gas cleaning facility. The sensitivity analysis B&V conducted focused on pipeline interconnection costs, evaluating the sensitivity of those costs to a 50 percent reduction in interconnection costs. They found it created a 3 to 10 percent reduction in biomethane costs, with a greater impact on the smaller-scale scenario (Case C).

B&V examined biomethane projects nationally to gauge where the emerging (both commercial and precommercial) technologies were. It found that many of the emerging commercial gas clean-up technologies were cryogenic (i.e. very low temperature, at or below −150°C (123 K; −238°F) separation techniques. Cryogenic technologies are often used in production of liquefied natural gases, and B&V found that the costs of cryogenic separation were not warranted unless SoCalGas wished to make a “bio-LNG” product. The precommercial technologies B&V examined included microporous adsorbents for CO2 removal, a low-pressure solid-state amine scrubber, and a solvent-based scrubbing process.

B&V’s main conclusions on the economic evaluation were:

- Commercial gas clean-up systems available today could meet the requirements of AB 1900 and of SoCalGas’ Rule 30.

- Economies of scale hamper smaller projects, where costs are unfavorable below 1 million standard cubic feet per day (SCFD) capacity.

- Incentives of $3/MMBTU to $5/MMBTU are needed to reduce the cost of biomethane to a value similar to natural gas prices (as of Spring, 2016).

- The presence of nitrogen and oxygen from air entering into landfill or digester gas systems greatly impacts the project economics and should be prevented.

- Olson’s group also compiled a list of barriers to biogas project development for SoCalGas interconnection based on what was learned in this study:

- The gas monitoring requirements resultant from AB 1900 (Table 1) don’t account for quality variations at the source and could have potential issues with measurement reliability and consistency, potentially impacting operating costs and procedures.

- Interconnection costs are very difficult to quantify in the early stages of a project and the high cost estimates may jeopardize project economic viability. However, interconnection incentives, such as the statewide monetary incentive program approved by CPUC Decision (D.)15-06-029, can help offset the interconnection costs to improve the project’s economic feasibility. (The CPUC authorized total funding of $40 million for this monetary incentive program in accordance with Public Utilities Code Section 399.24 to encourage the in-state production and distribution of biomethane.)

- Smaller projects are disadvantaged due to higher capital and development costs.

- Most private R&D in gas clean-up technologies is aimed at carbon capture, not biomethane quality improvement technologies.

Craig Coker is Senior Editor at BioCycle and a Principal in the firm Coker Composting & Consulting (www.cokercompost.com), near Roanoke VA. He can be reached at ccoker@jgpress.com.