Quantitative and qualitative analysis conducted in Massachusetts indicates growth in employment and revenues after implementation of the commercial organics waste ban.

John Fischer and Elizabeth Johnston

BioCycle March/April 2017

Reducing disposal of food materials, and driving food to higher and better uses, are increasingly top priorities all across America and internationally. Wasting food wastes resources that could be put to a much better use, whether to feed people, produce animal feed, or create valuable products and energy through composting or anaerobic digestion. And, as is often the case, when this value is captured, it fosters economic opportunities as well as environmental gains.

In Massachusetts, reducing wasted food has been a top priority for many years. In the Commonwealth’s 2010-2020 Solid Waste Master Plan, the Massachusetts Department of Environmental Protection (MassDEP) set a goal to reduce disposal by 2 million tons on an annual basis by 2020. A key component of achieving that goal is to reduce wasted food and other organics by 350,000 tons on an annual basis by 2020.

In 2012, MassDEP issued its Organics Action Plan, laying out a comprehensive strategy to achieve this goal, building on more than a decade of work to gradually increase the infrastructure to manage wasted food. As part of this Plan, MassDEP promulgated regulations for its commercial food waste disposal ban, which took effect on October 1, 2014. At the same time, Massachusetts implemented several other important initiatives to reduce food waste, such as Recycling Works in Massachusetts, which provides free assistance to businesses, and a combination of grants, loans and regulatory changes to help foster development of the Commonwealth’s infrastructure to manage wasted food.

Over the course of implementing these programs, MassDEP heard anecdotal feedback that the ban and supporting programs were helping to drive business growth and economic development opportunities across food rescue and donation, food waste hauling, and facilities to process food waste. However, MassDEP lacked clear data to understand these trends and their significance. In order to better understand this data and the economic opportunities associated with reducing food waste, MassDEP issued a Request for Proposals (RFP) in spring 2016 and selected ICF’s Cambridge (MA)-based team to analyze the recent trends in Massachusetts’ organic waste industry, as well as economic impacts of implementing the Commercial Food Waste Disposal Ban.

Job Generation, Tonnages Diverted

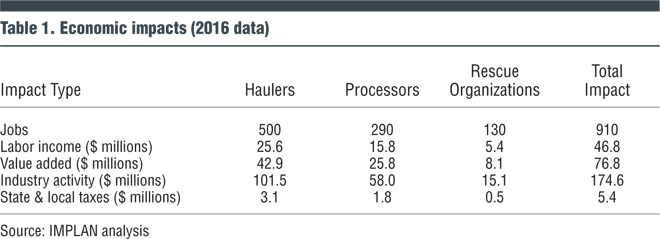

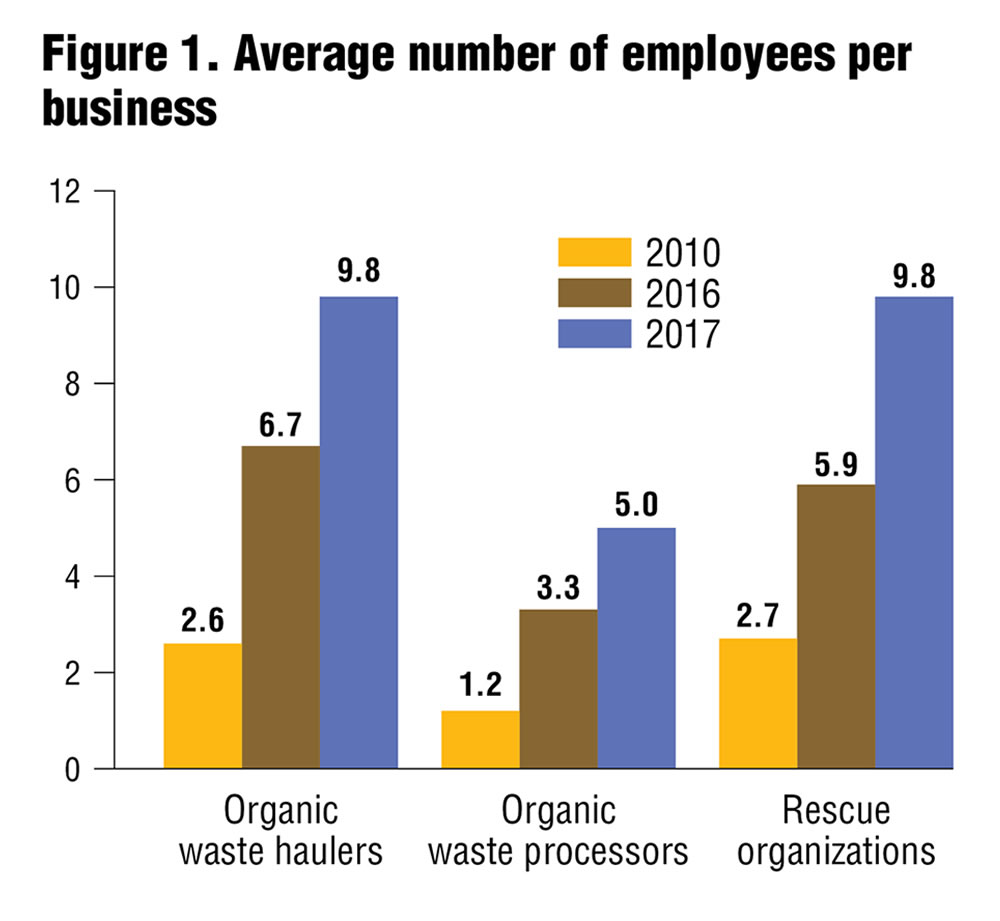

Results from ICF’s quantitative and qualitative analyses indicate that organic waste diversion activities, including composting and food rescue, are gaining traction in the Commonwealth. According to the survey data, stakeholder segments, including organic waste haulers, processors, and food rescue organizations, have reported growth in the number of employees between 2010 and 2016, and indicated that additional growth is planned for 2017. Based on the average employees per organization in each segment, direct employment across all segments was roughly 490 in 2016, a 150 percent increase from 2010, in which there were roughly 190 employees (Figure 1). That number is expected to increase to 750 employees by the end of 2017.

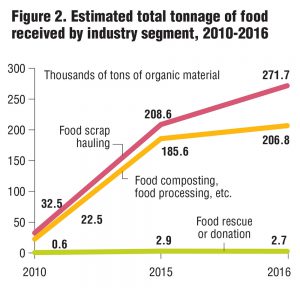

Trends in the food tonnage handled are another indicator of the industry’s growth. Across all three segments, the average annual amount of material received or processed increased significantly between 2010 and 2015 (Figure 2). Haulers and processors handled between six and eight times as much material in 2015 as they did in 2010. Based on the average tonnage per organization in each industry segment, total tonnage per segment was estimated. The response rate for the food rescue organization category was smaller than other categories and thus the results for that industry segment in particular may represent an underestimate.

Furthermore, companies, particularly anaerobic digestion facilities in the processor segment, are also planning significant capital investments in facilities and equipment in 2017, suggesting a stable market and a positive long-term outlook.

Furthermore, companies, particularly anaerobic digestion facilities in the processor segment, are also planning significant capital investments in facilities and equipment in 2017, suggesting a stable market and a positive long-term outlook.

Financial Impacts

Overall, the organics industry supported more than 900 total jobs (including direct jobs) in Massachusetts (a 150 percent increase over the estimated 360 total jobs supported in 2010), and generated more than $46 million in labor income. These industries contributed nearly $77 million to gross state product and produced approximately $175 million in industry activity in the Commonwealth (Table 1).

Additionally, economic activity in the organics waste industry has generated more than $5 million in state and local tax revenue. The sum of these contributions demonstrates the measureable impact that the activity surrounding the ban is having in Massachusetts currently. Looking ahead, by the end of 2017 it is expected that the organics waste industry will support roughly 1,370 total jobs across the Commonwealth.

While the ban itself is undeniably beneficial in promoting organic waste diversion, an equally important factor is the growth of public support for alternative organic waste disposal. Cultural acceptance for reducing food waste, especially increased composting, is strong in the greater Boston area for many residential and commercial food waste producers and was so prior to the ban’s implementation. While the support for organic waste diversion is strong, key barriers to address include lack of space for composting facilities, better source separated wastes in order to prevent contamination, and more stringent enforcement of the ban.

Across all sectors, significant opportunities for growth were identified, including the growing market for compost and alternative energy generation. The untapped market for prepared food from the region’s many universities, hospital and conference centers was also identified by stakeholders in the food rescue segment as a significant opportunity for growth. One of the most exciting findings of this study is that those in the food waste reduction industries see continued growth and business opportunities over the next several years, as food waste reduction initiatives and infrastructure continue to grow in Massachusetts. And, while this study was focused solely on Massachusetts, it appears clear that this economic growth can be replicated in other states throughout the Northeast United States, and throughout the entire country.

John Fischer is the Branch Chief for Commercial Waste Reduction at the Massachusetts Department of Environmental Protection. Elizabeth Johnston is a Senior Manager at ICF’s Cambridge office.