Applying a proven project finance model to the anaerobic digestion industry is the best way to ensure projects get built and operate profitably over the long-term.

John Dannan and Janice Tran

BioCycle July 2017

The U.S. anaerobic digestion (AD) market represents an attractive, multibillion dollar investment opportunity. However, structural industry obstacles must be overcome before the market can realize its full potential. As a renewable energy investor with deep experience in the U.S. solar industry, Generate Capital believes there is knowledge and experience that can be transferred from the solar industry to the AD market.

The landfill industry is in decline and food waste diversion regulation is on the rise. Proven AD technology already exists, with a market potential for hundreds of new biogas projects in the U.S. It is time for the AD industry to expand its role from a compliance technology for dairy manure to transforming our organic waste management system.

Standardization Is The Key

Macro drivers are falling into place, providing a foundation for the AD market to flourish. But the industry simply has not established the ground rules necessary for developers to attract institutional capital (e.g. experienced project finance equity and debt investors). There is neither shortage of talent in the industry nor projects under development. The question now is, how does the industry justify continuing development investments in the absence of dedicated institutional capital that understands and supports these long-term, good cash flow projects? The answer lies in business model design, which starts with a new standardization of project development and asset operations.

While the U.S. AD industry is often compared to the European biogas market, a more appropriate comparison is to the U.S. solar industry from 20 years ago, which also endured skepticism from investors who asked questions like: “Does it work?,” “Can it be scaled?,” and “Will it ever be competitive with other forms of power generation?” Solar struggled to obtain mainstream status as a power generation source for much of the late 1990s and early 2000s. Today, however, the U.S. solar industry is the fastest growing energy sector in the country, accounting for 39 percent of new electric generating capacity installed in 2016.

The solar industry has thrived at all levels of development, from utility through residential scale, largely due to the standardization that was implemented across project development and the organizing force that project finance played in the ecosystem. Standardization enabled capital providers to reduce risk, replicate their efforts more efficiently, and cut down transaction costs, thereby accelerating capital deployment and liquidity.

Unfortunately, the U.S. biogas industry has not yet figured out how to achieve the same level of standardization. There is a need for dedicated, industry-focused capital to help bring talent together and shape the standardization required to catalyze the next phase of industry development.

New Financing Paradigm Emerging

Laws that target food waste diversion from landfills have led to tremendous progress in recent years, primarily in the Northeast U.S. and in California. They have spurred development of projects with stronger feedstock contracts — the commercial backbone of a successful AD project — than were previously available to developers and operators.

Consequently, a new financing paradigm is emerging around food waste diversion that is attracting dedicated investors, such as Generate Capital, who seek out good distributed infrastructure projects. These investors are making hundreds of millions of dollars available for AD projects.

To attract institutional capital, a project has three primary prerequisites:

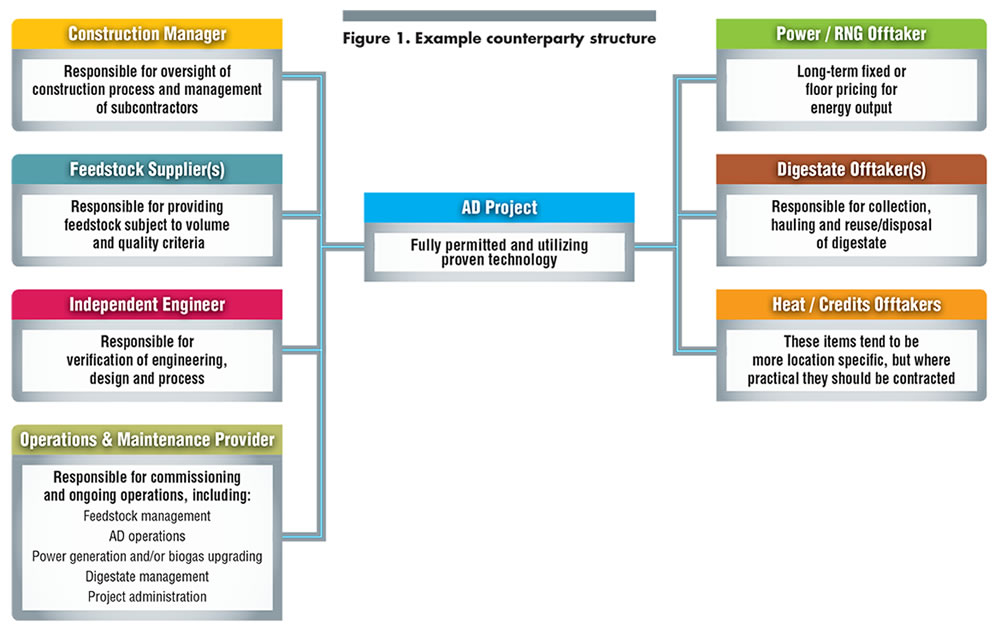

A Well-Developed Commercial Structure: The commercial structure of the project must be buttoned down through executed or final-form contracts for feedstock, engineering, procurement and construction (EPC), operations and maintenance (O&M), off-take, and digestate management. Likewise, the permitting process must have no outstanding questions or risks. Credible partners for the EPC/construction management and O&M work need to have been identified as part of the funding proposal.

There is always cause for latitude, but in the absence of final-form contracts or permits, some risk-capital investors may be willing to invest with only a clearly defined and actionable path to obtaining those missing items. Long-term, lower-risk (read: lower-cost capital) investors do not want to take binary risks (such as a key permit being denied) on any parts of their investments; that risk profile belongs in the development stage of a project and with capital providers or developers who have a tolerance for it.

Proven Technology and Processes: A well-developed project will only attract capital if it is based on proven technologies and processes, and all successful projects require independent engineering verification. Financial projections must be rooted in reality and based on mass balance analysis of the feedstock’s biogas potential, the throughput and equipment capabilities at each stage of the digester’s operations, and the properties of the digestate being generated. This level of analysis and certainty around financial projections cannot be achieved in situations where a technology “scale-up” or first commercial deployment are still being considered.

Investors are generally unwilling to finance the first commercial deployment of new equipment or processes, and given the number of proven technology providers and equipment available, it is an unnecessary risk for them to take. Developers’ expertise and credibility will be judged on their choices in this regard, as only the strongest developers and operators attract capital in an emerging category like this.

A Strong Operator: AD projects require multiple operating skill sets from feedstock management and handling to biogas and power generation expertise to digestate management and business administration capabilities. In addition to well trained plant staff, it is necessary to have an operations and maintenance partner who can provide oversight across these critical commercial, administrative, and operational functions.

Figure 1 summarizes these prerequisites. By minimizing commercial risks through strong contracts and assigning remaining risks to the parties best equipped to handle them, a project will have a much greater chance of success than otherwise. This “project finance” model has been demonstrably successful in other waste and energy sectors and it is time to apply it to the AD market.

Opportunity Awaits

This blueprint — having a well-developed commercial structure, proven technology and processes, and a strong operator — provides the best chance for developers and operators to access institutional capital for projects. Multiple skill sets are required at different stages of the project lifecycle to make an anaerobic digester successful. The companies that can provide these services comprehensively will be among the winners as the market expands.

Like solar in the 1990s, we are at the beginning of a multibillion dollar renewable energy investment opportunity by standardizing an approach to the development, operation, and financing of AD projects. Applying a proven project finance model to the industry is the best way to ensure projects get built and operate profitably over the long-term.

John Dannan serves as the Program Manager for Waste-to-Value investments at Generate Capital and has over 15 years of experience in finance including project finance debt and equity investing, asset management and mergers and acquisitions. Janice Tran is an Investment Associate at Generate Capital, where she focuses on originating and underwriting investments in the Waste-to-Value sector and brings over 8 years of renewable energy consulting and finance experience.