Brad Pleima

There is a national trend to reposition biogas-producing assets into renewable fuel production facilities. Biogas is typically used to produce thermal energy, electricity, or is sometimes just flared. With Renewable Identification Numbers (RINs), California Low Carbon Fuel Standard (LCFS) credits, Oregon Clean Fuel Program (CFP) credits, and rapidly developing voluntary carbon markets, interest in converting biogas to renewable natural gas (RNG) and injecting into a commercial natural gas pipeline is at an all-time high.

The primary driver behind many of these projects is monetization of the environmental attributes of the RNG produced. Generating RINs and LCFS credits combined with the commodity value of the natural gas can lead to very attractive payback periods, often less than 3 years. Depending on the feedstock used to generate RNG, values can range from $9 to $80 per MMBtu. But these projects do not come without significant complexities including: understanding the regulatory environments of the Renewable Fuel Standard, LCFS program, and other carbon markets; understanding which RIN D-code can be generated and a facility’s carbon intensity (CI) score for placement into California; and, other common hurdles such as feedstock procurement, pipeline access, construction and operation of facilities, and compliance.

The goal of this article is to help project developers, investors, utilities, agriculture and food production industries, and municipalities, better understand the regulations driving new RNG projects, how projects get done, and outline how some common project complexities can be addressed.

RIN/RNG Pathway Fundamentals

The first Renewable Fuel Standard (RFS1) was passed by Congress in 2005 as part of the Energy Policy Act (EPAct). RFS1 required that all transportation fuel commercially sold in the United States must contain minimum volumes of renewable fuels. The EPAct was expanded and extended by the Energy Independence and Security Act (EISA) of 2007, which proposed a schedule for increasing the amount of renewable fuels to be blended with transportation fuels each year until 2022, when 20 percent of all transportation fuels must come from renewable sources. The RFS does not sunset or expire after 2022 but there is less clarity around the annual obligation volumes and how they will be set year to year in 2023 and beyond.

Renewable Volume Obligations

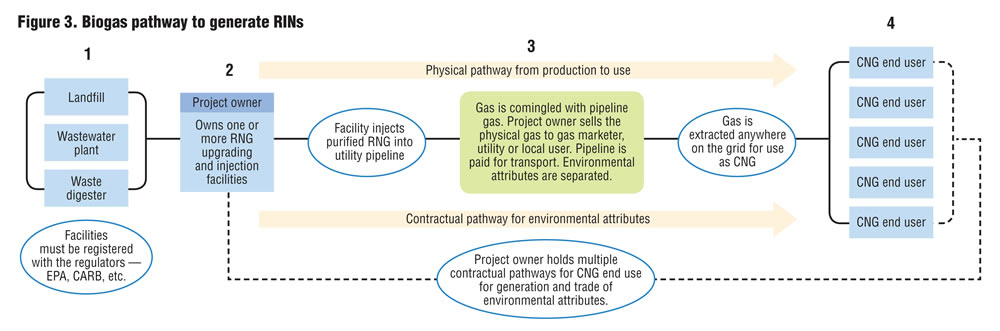

Figure 1 shows the original volume requirements for each renewable fuel category by year. Although this schedule was established by Congress, the United States Environmental Protection Agency (USEPA) determines a specific renewable volume obligation (RVO) annually. The RVO is the actual, total volume of renewable fuels that must be blended into the transportation sector during a given year. Since the inception of the RFS, the available supply of cellulosic renewable fuels has been significantly lower than the volumes proposed by Congress in 2007, causing the USEPA to set an alternate RVO each year. The original schedule established by Congress calls for 29 billion gallons of renewable fuel in 2019 but the industry is well short of producing this amount. This shortfall allowed USEPA to set the 2019 RVO below the target volume at just under 20 billion gallons.

RINs

Each gallon of renewable fuel under the RFS is able to generate credits or “Renewable Identification Numbers” (RINs). RINs are the currency of the RFS and are used by obligated parties as a compliance mechanism to meet the annual RVO mandate. Obligated parties are petroleum refiners and importers of refined fuel into the United States. Obligated parties can obtain RINs by producing renewable fuels that qualify for RINs, purchasing renewable fuels with RINs attached, or purchasing RINs that have been separated from renewable fuels.

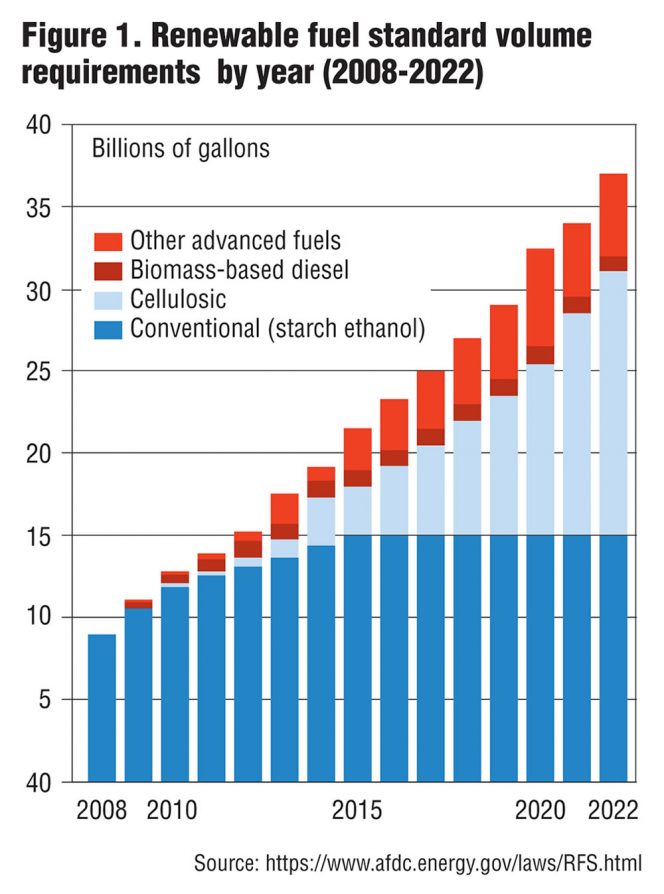

Most RINs produced by RNG facilities will generate RINs, immediately separate the RINs from the fuel, and sell the RINs to obligated parties, i.e., a producer will generate the RINs equivalent to the volume of fuel dispensed as compressed natural gas (CNG) or liquified natural gas (LNG) for transportation use, immediately separate the RIN from the fuel, sell the fuel downstream or to a gas marketer, and then sell the RINs to the obligated parties. RINs are classified by fuel types such as biodiesel, ethanol, renewable natural gas, and other approved renewable fuels. RIN classifications are further broken down according to the type of feedstock and processes used to create those fuels, along with the calculated reduction of greenhouse gas (GHG). These classifications are called D-codes. Figure 2 shows the various categories of renewable fuels, minimum GHG reduction expected, and associated D-codes.

D3 Or D5 RINs

Biogas to RNG can fall into the D5 or D3 RIN category depending on the feedstock processed. RNG produced from cellulosic feedstocks can generate D3 RINs while non-cellulosic feedstocks like fats, oils, sugars, starches, and most food wastes can generate D5 RINs. High demand exists for cellulosic biofuels and D3 RINs due to supply constraints. USEPA-approved D3 RIN pathways include renewable compressed natural gas produced from the following biogas sources (40 CFR Part 80, Subpart M 80.1426, Table 1):

- Landfills

- Municipal wastewater treatment facility digesters

- Agricultural digesters including ag residues and manures

- Separated municipal solid waste digesters

- Other cellulosic feedstocks with greater than 75 percent cellulosic content

All other feedstocks are classified as “other waste digesters” and are eligible for D5 RINs. Many digestion facilities process both cellulosic and non-cellulosic feedstocks. This creates a regulatory issue as 80.1426(f)(3)(vi) states “if a renewable fuel producer produces a single type of renewable fuel using two or more different feedstocks which are processed simultaneously, and at least one of the feedstocks does not have a minimum 75 percent average adjusted cellulosic content, the producer would have to determine how much of the finished fuel is derived from the cellulosic versus non-cellulosic components of the feedstock and assign RINs to the finished fuel based on the relative converted fractions.”

It is virtually impossible to determine and measure the exact volume of biogas produced from the cellulosic and non-cellulosic components codigested in an anaerobic digester. Because of this, facilities codigesting D3 cellulosic feedstocks and D5 non-cellulosic feedstocks will generate 100 percent D5 RINs. Many efforts have been made within the industry to obtain a D3/D5 RIN split for codigestion facilities but, to date, USEPA has not approved any codigestion RIN split methodology.

One method to obtain D3 and D5 RINs from one facility is to physically separate the D3 and D5 feedstocks into separate digestion tanks. Properly measuring and monitoring biogas produced from the D3 and D5 feedstock tanks can generate both D3 and D5 RINs even if one common biogas upgrading system and pipeline interconnection is used. It is possible, and hopefully likely, USEPA will approve a D3/D5 RIN split methodology, but at this time, physical separation of cellulosic and non-cellulosic feedstocks into separate tanks is recommended.

Pipeline Injection Advantage

Pipeline injection RNG projects have a distinct advantage over liquid renewable fuels because the RFS recognizes the principle of displacement. RNG molecules are completely fungible with fossil natural gas molecules in the pipeline. Under the RFS program, RNG can be injected into the natural gas distribution grid anywhere in the 48 contiguous states and qualify as an eligible renewable fuel, as long as an equivalent volume of CNG or LNG is used as transportation fuel at any point along the interconnected distribution grid. The renewable (environmental) attributes of RNG will displace an equal volume of nonrenewable attributes of fossil fuel.

How To Generate A RIN

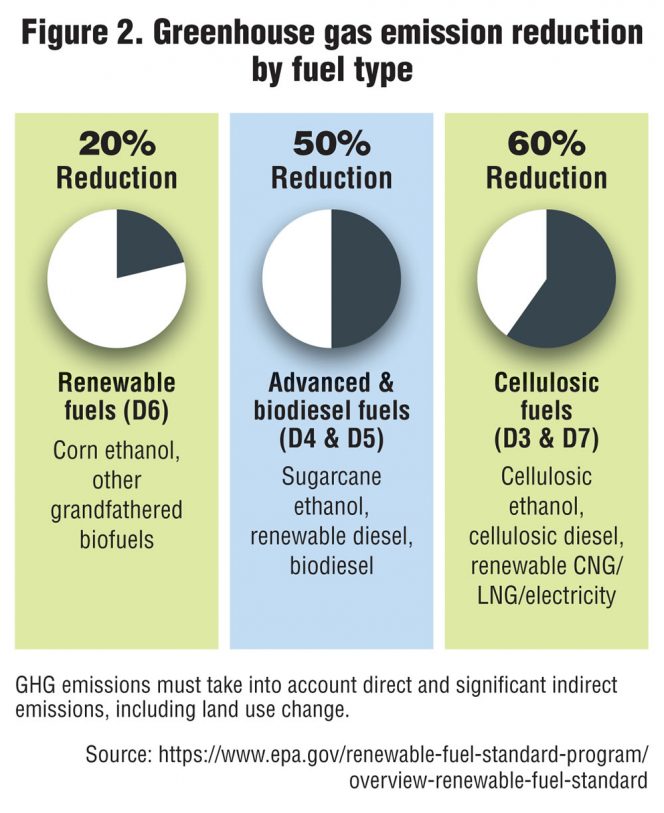

A full pathway showing biogas to RNG to vehicle fuel is required to register the facility with USEPA and generate RINs. Figure 3 shows the four phases of a typical biogas-to-CNG transportation fuel pathway for RIN generation. In most cases, the physical molecules produced by the RNG production facility are never used as transportation fuel. And the CNG dispensed at most fueling stations is not actual RNG molecules. This is where the virtual swapping comes in — most CNG stations use fossil natural gas from the grid and have a virtual contract with the RNG production facility to allocate their dispensing information to the facility’s RNG production data. The four phases in Figure 3 are described below as Steps 1-4:

Step 1: Anaerobic digestion facility generates biogas.

Step 2: Biogas is upgraded/purified to meet pipeline quality specifications for renewable natural gas.

Step 3: The pathway to demonstrate CNG end use is established. Commercial pipeline injection provides the necessary flexibility to connect to CNG end use. The project owner can establish contractual agreements with CNG end users anywhere within the continental U.S. along the natural gas grid. Use of third-party offtakers is advantageous for gaining access to potential buyers.

Step 4: CNG is dispensed for transportation use at a fueling station and dispensing volumes from the CNG end user are allocated to the project owner to match RNG production records.

Once each step is completed, a RIN can be generated assuming the facility has a registered pathway with USEPA. RINs are then sold to obligated parties to meet their annual renewable volume obligation (RVO) under the RFS. A project registration package can be submitted to USEPA for review once the following items are completed:

- Construction of the facility is substantially complete;

- A third-party engineering review is completed; and

- Project documentation showing the RNG to transportation fuel is completed. This includes all contractual agreements with the pipeline company, offtake contracts including CNG dispensing station information, biogas storage facility location, and an overall RIN generation protocol for the facility.

The project owner should allow 3 to 6 months prior to substantial completion of the facility to properly plan and assemble the necessary documentation for submission to USEPA. While review times can vary, plan for 2 to 3 months before registration approval.

Developing A Successful RNGProject

Managing all of the various components and complexities of a pipeline quality RNG project is a challenge. Projects can take longer and cost more than even conservative estimates. And when hundreds of thousands or even millions of dollars of revenue per month are on the line, these delays can be very frustrating and costly. Each component of the project must be carefully planned and coordinated to deliver a successful project. Below are several key components critical to the successful execution of a biogas to RNG project:

Identify Opportunity & Feasibility: Most experienced developers are very good at understanding if an opportunity is a good one. But for those developing a first or second project, the variations in credit prices and changes in the quickly morphing RNG industry can sidetrack it. Putting together solid preliminary numbers is important — but so is understanding that those numbers will change before construction begins. A successful project developer will adapt to these changes.

Financing: Anyone who has funded an RNG project understands the challenges and lengthy schedule associated with closing. We have seen project developers spend years in fundraising mode even for a project that is very lucrative on paper. Working with entities that have funded and are funding RNG projects can greatly reduce the time to close which means getting to revenue sooner.

Feedstock Procurement: Procuring feedstocks in long term agreements before a shovel is ever stuck in the ground can be a challenge. Compensating feedstock providers — especially in manure and agricultural digesters (because of the RNG value) — is often done by alleviating a pain point with their current feedstock disposal. Selling the overall environmental impact and vision may also be beneficial. Sometimes a share of the project revenues may be required to secure commitment from feedstock suppliers as more and more organic waste producers see value in converting their wastes into RNG.

Identify Pipeline Access: Making the assumption that USEPA will approve a new interconnection setup is common but may not be realistic. If a project has a unique component that has not been approved by USEPA in the past, expect delays during the registration process. Engaging with USEPA early in the planning and design process is recommended to avoid these delays or worse, having to install additional equipment after the project is fully constructed. Furthermore, the assumption that the nearby commercial pipeline will work with the project in a timely manner may also cause problems. Contacting the pipeline early in the process to understand its requirements is highly recommended.

Working with the Right Team: Identifying, hiring, and working with the right team may be the most important decision a project developer makes. New players are entering the marketplace on a near daily basis. Working with an experienced team will help deliver a project on schedule and on budget. Considerations when assembling the team include:

- Offtake Partner & Financial Structure: Most RNG projects cannot work without monetization of the environmental attributes of the RNG. Finding the right offtake partner, whether for transportation fuel or into the voluntary markets, is critical. Often times, lenders may require a fixed price revenue component that may mean giving up a portion of the RNG value.

- Technology Assessment & Biogas Upgrading Equipment Selection: Working with experienced equipment vendors with proven technology is highly recommended. Ask for references, installation lists, and visit with other project owners using the technology before making a selection. With all of the excitement and development in the biogas to RNG space, new vendors with new equipment are seemingly coming out every week. When millions of dollars of revenue are at stake, proper due diligence and selecting equipment that will consistently meet the pipeline specifications with minimal downtime is very important.

- Renewable Energy Consultant: A good renewable energy consultant can answer questions, guide you through the complex regulatory environment, help maximize RNG value, and identify potential roadblocks or gaps within your project. Getting to revenue generation one month in advance can typically offset all or more of a good renewable energy consultant’s fees.

- Design Engineer & Contractor Selection: Digesters and upgrading equipment are specialized equipment. Piping material selection, heat tracing or insulation of some lines, moisture capture, appropriate controls and monitoring, and many, many, more decisions like these are crucial to the long term success of a project. Design issues that cause your system to be down for an extra few days per year can be expensive. Hiring an experienced design engineer is your best bet to avoid this.

Digestate Management: A frequent fail point for past anaerobic digestion projects has been what to do with the digestate. It is important to understand the management options, plan of action, and associated costs. Project owners often assume markets will develop for the liquid nutrient-rich stream and the dewatered solids, where both streams will end up as additional revenue sources. If that doesn’t happen, digestate handling can be a cost center as opposed to a revenue generator, especially for the first few years of a project.

Permitting: Local permitting requirements — city, county, state, air quality, and other land use authorities — are complex and almost always vary state to state. Knowing when to submit these permits and the review time required by the various agencies can alleviate frustrations with the project schedule.

Operations and Staffing: All too often, the phrase “these things basically operate themselves,” has been pitched. Things will break, pumps will fail, and feedstock and digestate handling will be more labor intensive than expected, all at inopportune times. An experienced operator will know how to respond, manage the situation, make the necessary repairs and will be worth every penny of cost.

Compliance: Once a project owner successfully navigates all of these areas (and many more) and the project is operational and generating revenue, the work does not stop. Ongoing compliance requirements are necessary to ensure validation and verification of the environmental attributes. This compliance work may be as little as sending pipeline injection volumes to a voluntary offtake party or may be much more complex with RIN and LCFS credit auditing and validation.

A common theme is evident in this complex process. Working with the right project team and project partners through all phases — from conception to completion and operation — will lead towards more successful projects.

Brad Pleima, is a Senior Engineer and leads EcoEngineers’ renewable natural gas line of business, guiding municipalities, industries, and project developers implementing biogas to RNG projects. He is a licensed Professional Engineer with over 15 years of experience in the planning, engineering design, and construction of water, wastewater, and renewable energy projects and has toured nearly 50 renewable energy production facilities to help with consulting or compliance related activities.