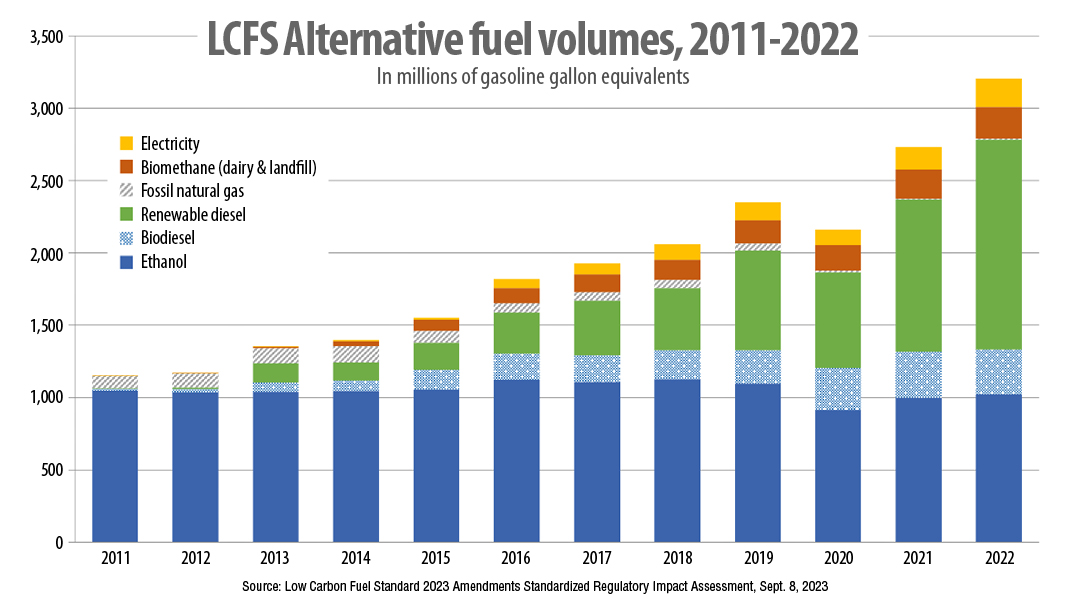

The California Air Resources Board (CARB) proposed a rulemaking update to its Low Carbon Fuel Standard (LCFS) in September 2023. CARB initially approved the LCFS regulation in 2009 as an early action measure under California’s AB 32, the Global Warming Solutions Act of 2006. The LCFS requires reductions in the carbon intensity (CI) of California’s transportation fuels over time; the CI of a fuel is the amount of carbon emitted through its life cycle. The regulation sets annual benchmarks for the average CI of fuels, which gradually become more stringent over time. “Over the past 13 years, the basic framework of the LCFS has worked well and continues to support growth in an increasingly diverse and low-carbon transportation fuel pool,” notes CARB in its proposed rulemaking update report. ”Since implementation, the LCFS has helped displace over 25 billion gallons of petroleum fuel. The volume of low-carbon fuels supplied for use in California has nearly tripled, and as of 2023, the State’s current diesel fuel is over 50% biomass-based (i.e., not fossil-based). The LCFS is contributing to the rapidly increasing use of low-carbon fuels in California. Before the LCFS, the only low-CI fuels with significant market share were fossil natural gas and ethanol. … The value of credits generated in the LCFS is approximately $4 billion/year, which incentivizes the development of innovative low-carbon fuel. Since the LCFS went into effect, California has achieved a reduction of more than 12.5% in the average CI of the transportation fuel pool from a 2010 baseline, exceeding the 2022 benchmark of 10% CI reduction.”

The LCFS regulation has been updated multiple times since its inception to reflect the increasing need for a diversity of fuels and more ambitious climate goals. For example, in 2018, the LCFS amendments included a signaling of the needed support for zero-emission vehicles (ZEVs) through the LCFS and other policies. “Beginning in 2019, the LCFS began crediting ZEV refueling infrastructure capacity for light-duty vehicles, acknowledging the need for widespread ZEV fueling deployment, and other electricity-based credit generation opportunities to support early ZEV adoption,” continues the CARB proposed update report. “Since then, the LCFS has seen nearly a four-fold increase in electricity credits and provided support for 3,800 fast chargers and 67 hydrogen stations.”

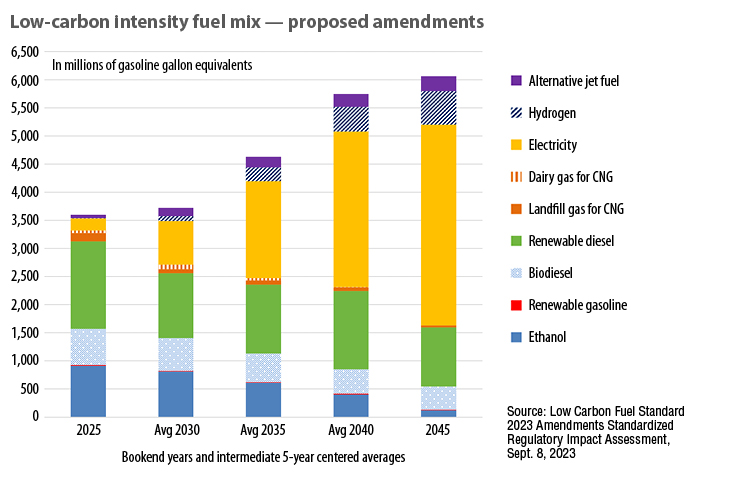

With this current rulemaking update, CARB is proposing several changes to the regulation to reflect the effectiveness of the program in recent years, the need to accelerate the CI reduction goals and policy objectives in line with the 2022 Scoping Plan Update and AB 1279, and to maintain program integrity and increase program efficacy. The most significant proposed change is increasing the stringency of CI reduction targets through 2030 and extension of declining CI targets through 2045. This is equivalent to achieving a 30% reduction by 2030 and a 90% reduction by 2045. The current target in California is a 20% reduction in fuel carbon intensity by 2030. According to the Low Carbon Fuels Coalition, “California’s transportation sector is already transforming with biodiesel and renewable diesel supplying most of California’s diesel fuel demand, renewable natural gas (RNG) surpassing fossil natural gas use in compressed natural gas (CNG) vehicles, new electric vehicle purchases capturing over 25% of light-duty sales, and high blend E85 ethanol demand expanding faster than any other fuel” (see figure at top of post). Between 2025 and 2045, CARB anticipates a significant rise in electricity and a gradual increase in hydrogen as a zero-emissions fuels, a gradual decline in renewable diesel, and a significant decline in ethanol. Going forward through 2045, biomethane (RNG) will play a big role in production of renewable hydrogen.

With this current rulemaking update, CARB is proposing several changes to the regulation to reflect the effectiveness of the program in recent years, the need to accelerate the CI reduction goals and policy objectives in line with the 2022 Scoping Plan Update and AB 1279, and to maintain program integrity and increase program efficacy. The most significant proposed change is increasing the stringency of CI reduction targets through 2030 and extension of declining CI targets through 2045. This is equivalent to achieving a 30% reduction by 2030 and a 90% reduction by 2045. The current target in California is a 20% reduction in fuel carbon intensity by 2030. According to the Low Carbon Fuels Coalition, “California’s transportation sector is already transforming with biodiesel and renewable diesel supplying most of California’s diesel fuel demand, renewable natural gas (RNG) surpassing fossil natural gas use in compressed natural gas (CNG) vehicles, new electric vehicle purchases capturing over 25% of light-duty sales, and high blend E85 ethanol demand expanding faster than any other fuel” (see figure at top of post). Between 2025 and 2045, CARB anticipates a significant rise in electricity and a gradual increase in hydrogen as a zero-emissions fuels, a gradual decline in renewable diesel, and a significant decline in ethanol. Going forward through 2045, biomethane (RNG) will play a big role in production of renewable hydrogen.

Other major proposed changes include creating a provision to support medium and heavy-duty ZEV refueling infrastructure, establishing a phase-out date for the crediting of petroleum projects, and revising indirect accounting eligibility to focus on direct delivery of biomethane. A final, comprehensive rules package was released for public comment on December 19, triggering a 45-day comment period beginning January 5, 2024, followed by a public hearing and vote by the full CARB Board on March 21, 2024.