Growth in facility installations is steady, but lack of capital and antiquated energy policies remain obstacles to realizing the broad suite of benefits that manure-based digester systems could achieve.

Allison Costa and Chris Voell

BioCycle February 2012, Vol. 53, No. 2, p. 38

Installation of manure-based digester systems at farms in the United States has been in process since the late 1970s, however the industry is still in its infancy in many ways. Although digester system technologies for capturing and using biogas have been well proven in the United States and around the world, the policies and business models necessary to make these projects viable in most states do not exist. Still, there continues to be growing interest and support in advancing widespread adoption of digesters, especially through the leadership of the dairy sector.

Lack of capital and antiquated energy policies continue to be the two main stumbling blocks to realizing the broad suite of benefits that manure-based digester systems could achieve — local, renewable energy; revenue diversity for farmers and economic growth; greenhouse gas reductions; enhanced environmental protection; and alternative management options for other organic waste streams. Only through coordination between the private, public and NGO (nongovernmental organization) sectors will we be able to see this market grow into a multibillion dollar opportunity.

State Of The Industry

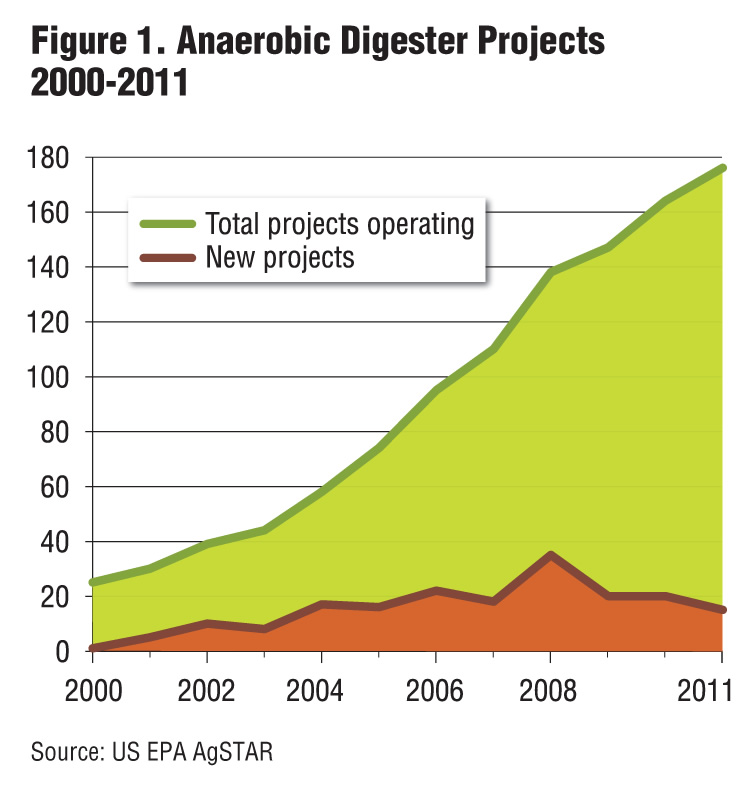

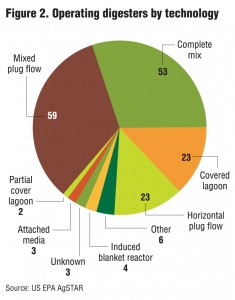

Based on statistics from AgSTAR’s National Digester Database, 176 manure-based anaerobic digestion systems were operating in the United States by the end of 2011, which includes systems that codigest manure and other organic wastes (but not systems that digest wastewater treatment plant (WWTP) biosolids or industrial wastewaters). The number of new anaerobic digesters installed each year remains steady at approximately 16 systems (Figure 1). Almost half of the new projects that became operational in 2011 were complete mix designs, with mixed plug flow designs composing another 40 percent. The remainder of the systems includes covered lagoons, as well as attached growth and induced blanket reactors (Figure 2).

In 2011, the amount of energy produced by digesters —541 million kilowatt-hours (kWh) — was enough to supply more than 36,000 average American homes for a year. The majority of the energy produced is in the form of electricity in combined heat and power systems that also capture heat for useful purposes. Other operations use the gas as a boiler fuel,upgrade it for injection into natural gas pipelines, or simply flare it for odor control.

In 2011, the amount of energy produced by digesters —541 million kilowatt-hours (kWh) — was enough to supply more than 36,000 average American homes for a year. The majority of the energy produced is in the form of electricity in combined heat and power systems that also capture heat for useful purposes. Other operations use the gas as a boiler fuel,upgrade it for injection into natural gas pipelines, or simply flare it for odor control.

Direct and indirect greenhouse gas reductions through capture and destruction of methane in anaerobic digesters were significant in 2011. Direct reduction of 55,000 metric tons of methane emissions, or 1.2 million metric tons carbon dioxide equivalent (CO2e), plus an additional reduction of 301,000 metric tons of CO2e avoided by displacing fossil fuels with captured methane are equivalent to removing almost 300,000 passenger vehicles from the road or reducing oil consumption by almost 3.5 million barrels.

Trends

Trends in 2011 saw approaches other than the traditional farm-based, manure-only systems emerging. For example, approximately 30 percent of systems are adding other organic feedstocks (e.g., food waste, agriculture waste, cheese whey). There is also significant growth in the number of third-party owned and operated systems. While the industry continues to reach less than two percent of the market for manure-based digesters, if the potential for codigestion of other organic waste streams (e.g., food production and processing by-products, agricultural wastes, source-separated organics) with manure is considered, the opportunity is greater.

Electric generating capacity of digester systems has been increasing since 2003. Average project capacities have grown from 125 kW to 454 kW. A number of factors have contributed to this trend, including increasing use of additional feedstocks and the emergence of larger farm and centralized systems. Since 2006, 10 systems have been installed with capacities greater than 1 megawatt (MW) and 7 more have capacities over 2 MW. And a brand new record was set in 2011 — the digester system with the largest electric generating capacity in the U.S. based solely on dairy manure became operational in Idaho and has the potential to create 4.5 MW of energy.

Overcoming Obstacles

The manure-based digester industry has been facing hurdles since the 1970s, when several manure-based digesters were installed, only to fail due to lack of proper maintenance, poor operating practices, or because of financial issues. It was always recognized that the technology was sound, and industry knew that digesters could succeed as long as these problems were addressed. The majority of digesters installed in recent years continue to succeed. From determining true project costs and developing a sound business plan to emphasizing the importance of quality equipment, sampling feedstocks, and performing the required maintenance on schedule, anaerobic digesters today are recognized as part of sophisticated biogas recovery systems that are an integral part of the livestock operation and interrelated to livestock care and crop management.

Traditional manure-based digesters in the 1970s focused on creation of renewable energy — mainly in the form of electricity — to offset a farm’s needs. In the following years, creation of renewable portfolio standards in many states allowed digester operators to command higher prices for the kilowatt-hours produced by generating renewable electricity credits that could be sold to utilities. As natural gas prices rose, other projects were developed to upgrade the biogas to pipeline quality to sell at a premium.

However, markets changed, utilities met the required standards (often through the acquisition of “cheaper” renewable power from wind and solar projects), and prices fell, meaning that projects can no longer be financially justified solely from the viewpoint of electricity generation. Throughout this time, energy policy has remained largely unchanged. Besides the fact that tariffs/rates, net metering rules and interconnection policies vary widely throughout the country, most of the policies place a great burden on the project developer, rather than the utility. However, some utilities shine as leaders in the movement to supply farm-based renewable energy, whether by offering progressive rates for the electricity generated as the Cow Power Program of Central Vermont Public Service does, or by modifying net metering policies to allow for remote net metering as in New York.

Increasing numbers of anaerobic digesters and use of innovative models or cosubstrates raise permitting and regulatory issues for regulators unacquainted with the technology and/or where several agencies must interact to determine jurisdiction over the project. Increasingly, air emissions from energy generation equipment are being scrutinized, especially in regions with nonattainment status. As these issues arise more frequently, relatively simple activities, like publishing case studies or best practices of successful permitting examples, such as those in Michigan and Washington, could spur cooperation among agencies in other states.

Financing continues to be the greatest hurdle facing digester systems. Developers must provide initial capital and public funding is decreasing. Long-term viability of the industry requires projects to be able to be implemented without grant subsidies. To address this, developers are monetizing the on-farm benefits, such as decreased transportation costs for fertilizer that can now be pumped to fields, and considering all potential revenue streams including tipping fees (especially from food waste and other organics as regulators seek to divert those wastes from landfills), carbon credits (especially as California’s market is put into practice), Renewable Energy Certificates and emerging nutrient credits.

Moving past electricity, projects like the one at Fair Oaks Farms in Indiana (see “Indiana Dairy Fueling Fleet With Renewable Natural Gas,” September 2011) are finding ways to offset costly vehicle fuel through production of compressed natural gas (CNG) from their biogas. Groups continue to seek ways to reduce the cost of upgrading biogas to biomethane that can be injected into gas pipelines. Even finding efficient ways to store biogas so that it can be held and sold at peak periods would improve the bottom line of many projects.

New markets for digestate are also being explored. While use of digestate as bedding and fertilizer on the farm offsets costs, there is often leftover material. Profit can be realized by converting the material into consumer products for anything from soil amendment or peat moss replacement to filler in particle board or plant pots. Some digesters are even becoming agrotourist sites, charging nominal fees to learn about the system.

Models To Move Forward

After successfully tackling traditional hurdles, the digester industry is proactively addressing current challenges in a variety of ways. Emergence of third party build-own-operate models of digester systems, where producers often provide land and feedstock to a digester but another company manages the daily operations, helps maximize gas production and revenue by letting each party concentrate on the part of the system they specialize in — whether it’s getting manure from healthy cows or monitoring gas production and ensuring that required maintenance is performed on schedule.

Developers also are working to increase the number of digesters in less traditional settings. More specialized small-scale systems are being built with refinements that enable the capital costs to decrease. Other business models also are being used, such as building multiple systems on small farms in close proximity to each other at one time, allowing materials to be purchased in bulk and the savings passed on, or bringing in additional organic sources for codigestion resulting in a larger system that can capitalize on better economies of scale.

Centralized systems continue to be a challenge due to complexity and price, especially as transport costs continue rising. Some communities are looking at ways that the public sector can be involved when water quality or wide-spread nutrient concerns are at stake. As municipalities recognize the benefits that digesters provide to a community, more may follow Dane County, Wisconsin’s example and shepherd systems into existence. (See this issue’s “Community Sustainability” feature on the Dane County community digester project.) Public sector involvement can open doors to additional sources of funding, such as municipal infrastructure bonds, decrease the costs and hurdles of permitting, and garner public support for the project. Other groups, such as NGOs, can support centralized projects with creative financing models as well.

Several other trends are emerging that may increase revenue from digester systems and encourage their installation at greater rates. Digester systems are a targeted solution for those promoting energy independence as they can offset a number of different energy sources, from electricity to natural gas to vehicle fuel. Ever-increasing fuel prices could also be a driver for digester implementation as more CNG fueling stations are installed and more vehicles are converted to run on CNG. This could especially benefit municipalities willing to support centralized digester systems that have fleets of vehicles that could capitalize on the fuel. Additionally, organizations outside of utilities that are interested in promoting locally produced green power can look for creative ways to match demand with energy producers like digesters.

Manure-based digesters in the U.S. continue to show steady growth. The industry has come a long way and addressed many challenges, laying necessary groundwork. While hurdles still exist, keeping exponential growth at bay, the industry’s commitment to persistence and innovation, whether in technology or financing, keeps hope alive. As more communities get on board and public knowledge of digester benefits is increased, more systems will be installed. With organizations like the Innovation Center for US Dairy and the American Biogas Council backing digesters, the future can only get brighter.

Allison Costa is Program Manager and Chris Voell is National Program Manager with the U.S. Environmental Protection Agency’s AgSTAR office (www.epa.gov/agstar).