New Internal Revenue Service guidance on “begin construction” has takeaways for biogas-to-electricity and other ITC-eligible projects.

Michael H. Levin

BioCycle August 2018

On June 22, 2018 the Internal Revenue Service finally issued long-promised guidance on when solar and certain other facilities will “begin construction” to qualify for an Investment Tax Credit (ITC) under Section 48 of the Internal Revenue Code (the “June Notice”).

On June 22, 2018 the Internal Revenue Service finally issued long-promised guidance on when solar and certain other facilities will “begin construction” to qualify for an Investment Tax Credit (ITC) under Section 48 of the Internal Revenue Code (the “June Notice”).

Since 2013, six rounds of previous guidance had addressed “begin construction” only for wind, biomass and other projects nominally seeking to qualify for the 10-year renewable electricity Production Tax Credit (“PTC”) under Code Section 45. Thus numerous solar facilities were financed on faith — and rafts of tax counsel opinions — that “begin construction” tests under those guidances would apply to the ITC. The delay caused rising concern that “begin construction” rules might differ under Section 48, potentially putting hundreds of solar projects at risk while disrupting PTC-derived financing. (ITC financing can be “derived” from PTC financing because projects that qualify for the PTC generally may elect to “jump” to the ITC.)

The June Notice allays those concerns. It affirms for the ITC the two “begin construction” routes that the IRS previously articulated under Section 45 for the PTC (see “Biomass-to-Electricity Tax Credits Extended,” January 2016); “2018 Bipartisan Budget Act Extends Tax Credits,” March/April 2018). These two routes are:

1) Starting continuous physical construction whether on-site, or off-site by contracted component manufacture (the “Physical Work Safe Harbor”), or

2) “Incurring” at least five percent of a completed project’s total eligible costs (the “Financial Safe Harbor”).

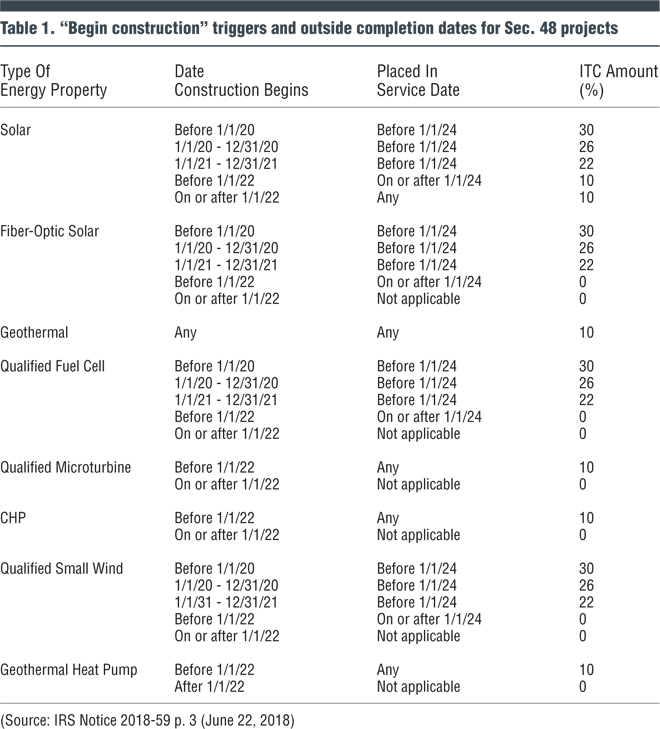

It applies these safe harbors to recently extended Section 48 credits for fuel cells, microturbines, small combined heat and power (CHP) facilities, geothermal heat pumps, and small wind facilities — “Orphan Technologies” that were omitted from Code extensions in 2016, some of which anaerobic digester (AD) developers now may wish to consider incorporating in projects as primary or supplemental sources for compression and evaporation or other process heat. It clarifies ITC phase-downs applicable to these facilities under the February 2018 Bipartisan Budget Act. And it carries over from previous IRS guidance a “Continuity Safe Harbor” that presumes “continuous work” or “continuous efforts” have been made if a project is placed-in-service within a set period (generally four years) after the calendar year in which its construction “begins.”

Some of these developments involve a 10 percent rather than a 30 percent ITC. Few directly apply to AD or other biogas projects that still may elect the upfront lump sum Section 48 ITC because they qualify as “open-loop biomass” facilities under Section 45(d)(3). But their potential availability to AD facilities could be significant.

Some Takeaways

“Look-back” qualification may be even more important. Allowing projects to qualify based on when they “begin construction” — not, as before 2013, when they were “placed in service” — can substantially expand their credit eligibility period. For example, even AD or similar biomass projects which received only a one-year retroactive Budget Act extension to “begin construction” before 2018 can “look back” to establish that construction timely “began” in or before 2017. Seeking to show that construction timely “began” under the Financial Safe Harbor may be particularly advantageous because that path requires only reasonable “continuous efforts” to complete a project, not “continuous significant physical work” (see “Getting Renewable Energy Projects Done in ‘Still Tougher Times’,” February 2015). Moreover, “preliminary” expenses for products or services like site plans, permitting or financing generally “count” for the Financial Safe Harbor, but not towards Physical Work.

The ITCs for “Orphan Technologies” now phase down like those for wind and solar, based on when their construction “began.” For example, if construction of a fuel cell “begins” before 2020 or 2022, it can claim a 30 percent or 22 percent ITC, respectively, if placed-in-service before 2024. A microturbine or CHP unit with construction “beginning” before 2022 can claim a 10 percent ITC whenever it’s reasonably completed, but gets no ITC if “begun” afterwards. Thus look-backs that can show sufficient financial expenditures occurred before 2020 (for the 30% fuel cell ITC) or 2022 (for the 10% microturbine or CHP ITC) may be important.

Unlike the last long extensions for wind and solar, the PTC/ITC for biomass projects is not phased down because that extension nominally was short-term. But AD or similar projects that might install microturbines or CHP units may want to look carefully at when planning, feasibility analysis, or other costs defensibly related to such units will be or were “incurred” to trigger favorable “start construction” dates. That look may run in both directions — projects with otherwise eligible units at risk of having interrupted Physical Work or of exceeding applicable Continuity presumptions may want to establish a later rather than an earlier “begin construction” date, to mitigate those issues.

Developers who can make such showings for an entire project may claim an ITC for 30 percent of all otherwise qualified project costs. They may claim an ITC for 10 percent of otherwise qualified units’ cost, even if they miss a project-wide “begin construction” date under the Safe Harbors. If both the project and the specific unit qualify as having timely and separately “begun construction,” the developer arguably may claim both the project-wide 30 percent ITC on all eligible basis, and the unit-specific 10 percent ITC on that separate component’s eligible basis. This is partly because the pertinent Code provisions contain no “anti double-dip” clause and were enacted to encourage distinct technologies.

The Continuity Safe Harbor is generous, up to a point. For AD projects or separate qualified units within them, the June Notice confirms that force majeure circumstances which interrupt continuous work or continuous efforts will not derail ITC eligibility. It adds two such circumstances to those listed in the previous Section 45 guidances. It also provides, for the first time, examples of what types of physical work or financial efforts may “begin” and “continue” construction, across the suite of ITC-eligible projects.

However, the previous guidances indicated that projects generally could qualify beyond the Continuity Safe Harbor by showing, on a case-by-case basis, that “physical work” or “reasonably continuous efforts” were carried on until completion. Consistent with the Budget Act, the June Notice now includes a firm stop: Whenever “begun,” solar projects generally must be placed-in-service before 2024 or drop back to their permanent 10 percent ITC. Fuel cells must be placed-in-service before 2024, and microturbine or CHP units must “begin construction” before 2022, or forego any ITC. In short, where applicable, the new outside placed-in-service dates trump 4-year Continuity protection. Only solar and certain other projects “begun” in or before 2018 will retain the full 4-year presumption and also be able to show continuous work or efforts towards completion thereafter — up to the end of 2023 (Table 1).

This matrix of “start” and “completion” dates may pose tactical questions for developers. For example, AD projects by themselves (i.e., excluding ancillary systems) have no outside completion date if they’re otherwise eligible. But AD developers may have to weigh the chance of successfully asserting that they have “begun and continued construction” of ancillary microturbine, fuel cell or CHP units under a Physical Work versus a Financial Safe Harbor classification. They also may have to balance possible benefits against the risk of losing eligibility under each of these paths. The choice may be sharpened because Trump Administration tariffs on steel and other commodities may decline after 2020, potentially making deferred acquisition of major components desirable.

The “begin construction” safe harbors are not cumulative. The June Notice suggests that developers may not claim construction has “begun” under one Safe Harbor, then switch to the other to maximize ITCs or avoid losing eligibility due to non-“continuous” work or efforts. Apparently projects will be held to the earliest Harbor they ride in on. Nevertheless the Notice states that “performing physical work” can demonstrate “continuous efforts” under the Financial Safe Harbor. It also indicates that a project failing the Financial Safe Harbor’s 5 percent test due to cost overruns still may qualify under the Physical Work Safe Harbor, and that sufficiently independent components of projects which fail overall to meet both Safe Harbors still may be “disaggregated” so as to qualify under either set of tests. Tensions between these provisions may create room for interpretation.

Distribution-level interconnect costs may be includable in ITC basis and thus may “count” to qualify projects for the Financial Safe Harbor. Prominent tax counsel have advised clients that if, as the IRS has suggested, equipment “up to the 69 kV distribution stage” is includable in basis, the cost of interconnecting a project to a below-69-kV “distribution” circuit also is includable. (Many distribution circuits are 12 kV to 36 kV.) This cost can total seven or more figures — it typically includes utility charges for impact analyses, interconnection service agreement deposits, and costs of underground or overhead extension lines (plus related grid protection equipment) run from the project parcel to a distribution line. Thus ITC “includability” may tip the balance affirmatively for projects located some distance from an interconnect point.

There’s some support for including and counting these costs. In addition, while the IRS never has taken a formal position, it apparently has accepted such costs for ITC-basis purposes in individual reviews. The June Notice arguably comports with these outcomes: It repeats without qualification that equipment operating at “distribution voltage” generally qualifies as long as it’s “integral to power generation,” while “transmission-related” equipment operating above that voltage does not.

Mike Levin, a BioCycle Contributing Editor, is managing member of the virtual law firm Michael H. Levin Law Group, PLLC (Washington DC) and a principal in NLGC, LLC and Carbon Finance Strategies LLC, which respectively focus on capital formation for renewable energy projects and the optimization/development of ground-mounted solar PV facilities. From 1979-1988 he was national Regulatory Reform Director at the U.S. EPA. Jake Peek of Peek and Associates (Jacksonville FL) reviewed an earlier version of this article.