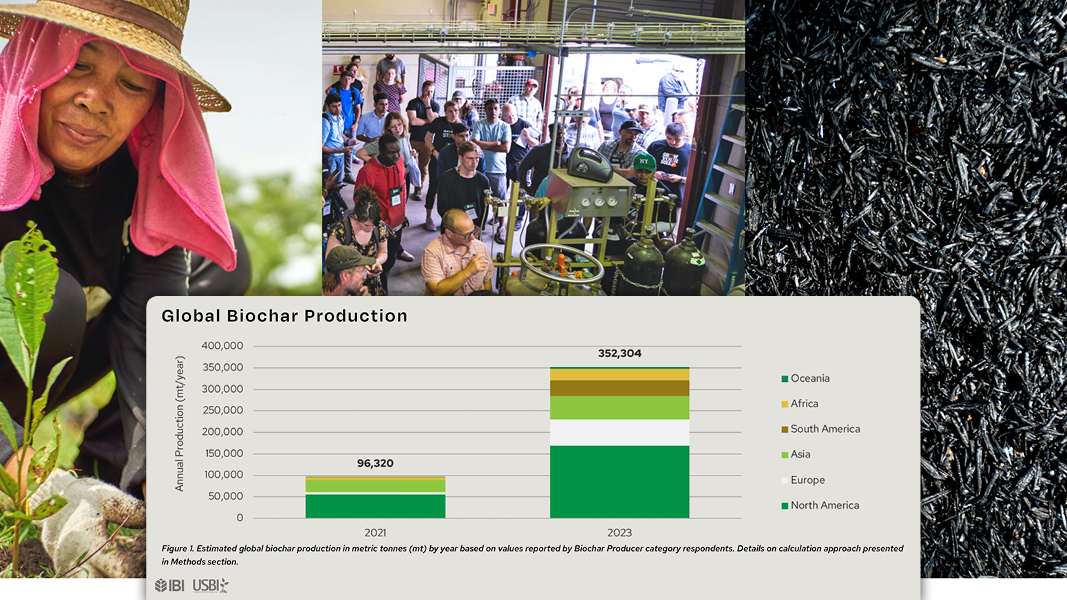

Top: North America accounts for the largest biochar production, followed by Europe and Asia.Photos and graphic courtesy International Biochar Initiative (IBI) and the US Biochar Initiative (USBI)

The International Biochar Initiative (IBI) and the US Biochar Initiative (USBI) released their 2023 Global Biochar Market Report in late March. The findings are based on a survey of over 1,000 respondents. The 2023 Report “represents the first annual survey with goals of improving understanding of the biochar industry and its value to better engage with the industry and with policymakers, investors, and observers; develop reliable estimates for key industry data; generate data and direct feedback for biochar organizations to better serve the industry; benchmark and track long-term industry trends; and create a feedback mechanism between industry and biochar organizations,” note IBI and USBI in the introduction. “This comes at a pivotal time for biochar and biochar carbon removal (BCR). Biochar continues to lead the way in delivering durable carbon dioxide removal (CDR) credits in the voluntary carbon market (VCM), representing more than 90% of global deliveries in 2023. Based on the results from this survey, we estimate significantly higher global production of at least 350,000 metric tons (mt) of biochar annually — a potential 600,000 mt or more of CDR in 2023.”

North America accounts for the largest biochar production (over 150,000 mt/year), followed by Europe and Asia. The analysis also found that biochar production is growing rapidly, with a compound annual growth rate (CAGR) of 91% from 2021 to 2023. “To maintain this high growth rate, developing high value and large volume end-use markets for biochar is a key priority,” say IBI and USBI. Biochar end uses include agriculture (the largest market sector), soil and water remediation, and the built environment, where it can be used in building materials such as concrete and mortar. CDR markets for biochar carbon credits are thriving, but a majority of biochar producers do not generate BCR credits for the VCM. Half of respondents to the industry survey noted that low awareness of biochar inhibits industry growth; about one-third cited limited access to capital. In terms of equipment used to produce biochar, stationary auger/rotary kilns lead with 37%, followed by portable kilns (24%) that process forestry residues on public lands.