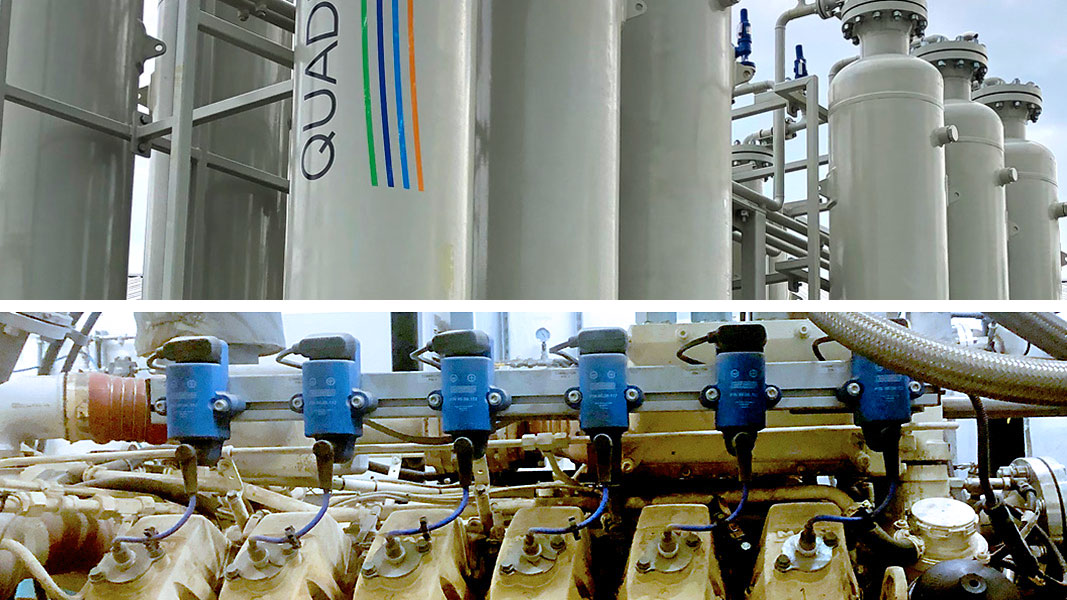

Top: Biogas-to-RNG conditioning system (top); Combined heat and power engine (bottom). Photos by Nora Goldstein

The U.S. Treasury released guidance in late May on clean electricity tax credits (Sections 48E and 45Y of the Internal Revenue Code) initiated by the Inflation Reduction Act (IRA), without specifying clear guidance for renewable electricity created with biogas or renewable natural gas (RNG). “As it has in guidance on previous clean energy credits, Treasury claimed that renewable gas verification tools for biogas systems are not in place,” says Patrick Serfass, Executive Director of the American Biogas Council (ABC). “To the contrary, robust tracking and verification, and lifecycle carbon accounting systems are in place and IRS Section 48 rules have recognized these projects as clean electricity since 2004. Because the current related tax credits are set to expire at the end of 2024, this lack of specific guidance for biogas and RNG leaves investors and developers of these renewable power systems in the dark, delaying construction of infrastructure during an unprecedented time of increasing demand. The ABC calls on Treasury to rectify this and adhere to Congressional intent that biogas and RNG must be included in all clean energy pathways, including electric generation.” A public comment period will be open for 60 days to submit formal written comments to the proposal. “Public hearings are slated for August 12 and 13, which provides an opportunity to express concerns to Treasury directly,” notes Heather Dziedzic, ABC’s Vice-President of Policy.