Top: Calgren Dairy Fuels biogas conditioning operation in Pixley, CA.

Nora Goldstein

California Gov. Arnold Schwarzenegger established the Low Carbon Fuel Standard (LCFS) in 2007 under an Executive Order, building on his signing AB 32, the California Global Warming Solutions Act of 2006. The Act created the California Cap and Trade market and required California to reduce its greenhouse gas emissions to 1990 levels by 2020 — a reduction of approximately 15% below emissions expected under a “business as usual” scenario.

Dairy digester produces biogas as part of Calgren Dairy Fuels project (see sidebar). Photos courtesy of SoCalGas

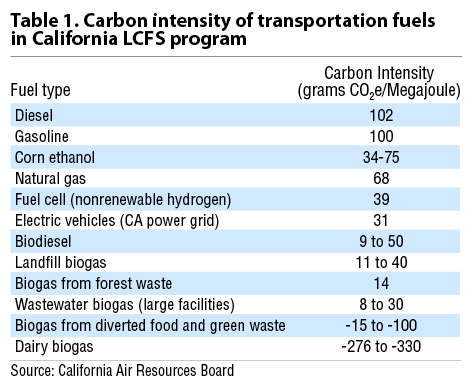

In 2009, the California Air Resources Board (CARB) adopted the LCFS regulations. The standard originally required a 10% reduction in the carbon intensity of on-road vehicle fuels by 2020 and has since been increased to require a 20% reduction by 2030. Carbon intensity (CI) is based on complete lifecycle emissions. As Paul Greene of Montrose Environmental described in his excellent BioCycle article, 101 For Low Carbon Fuel Standard, the fuel’s life cycle is assessed from well to wheel and “maps out a process journey for the exploration, feedstock collection, conversion, upgrading, transportation, distribution, and filling practices for a given fuel. …. The program works by requiring [the state’s] fuel companies to achieve CI targets by either producing lower CI fuel or purchasing credits from lower CI fuels sold in the California market. …. To be eligible for generating credits, renewable fuels must have CI values below the CI of the fuel being replaced. Some renewable fuels have extremely low CI scores.”

The fuel with the lowest CI score, as evaluated by CARB, is dairy biogas, as shown in Table 1. RNG generated out-of-state is eligible for LCFS credits if the gas is injected into a natural gas pipeline with the ability to flow to California. This has led to the significant growth in dairy and some swine anaerobic digestion projects that inject their RNG into pipelines for sale in California. The current LCFS credit for RNG used for conventional fuel replacement in California is close to $200/metric ton of carbon reduction. As the California market for RNG gets saturated, the renewable fuel will need lower and lower CI scores to earn a higher credit price. “That is exactly what CARB intended with the LCFS,” noted Brad Pleima of EcoEngineers during a webinar hosted by the Great Plains Institute at the end of October.

The fuel with the lowest CI score, as evaluated by CARB, is dairy biogas, as shown in Table 1. RNG generated out-of-state is eligible for LCFS credits if the gas is injected into a natural gas pipeline with the ability to flow to California. This has led to the significant growth in dairy and some swine anaerobic digestion projects that inject their RNG into pipelines for sale in California. The current LCFS credit for RNG used for conventional fuel replacement in California is close to $200/metric ton of carbon reduction. As the California market for RNG gets saturated, the renewable fuel will need lower and lower CI scores to earn a higher credit price. “That is exactly what CARB intended with the LCFS,” noted Brad Pleima of EcoEngineers during a webinar hosted by the Great Plains Institute at the end of October.

Greene explained CARB’s intentions in his BioCycle article: “Original targets, as identified in Executive Order S-1-07, detail a program requiring CI reduction of at least 7.5 percent and 10 percent in California’s transportation fuels by 2019 and 2020, respectively. In attempts to make the program more realistic, 2018 amendments now require reductions of 6.25 percent and 7.5 percent for 2019 and 2020 respectively, while mandating a full 20 percent reduction by 2030.”

During a Biogas Americas session on October 1, “RIN Value & LCFS Outlook for 2020” (hosted by the American Biogas Council), Julia Levin, Executive Director of the Bioenergy Association of California presented a figure titled “2011-2019 Performance of the LCFS.” The figure shows the percent reduction in the CI of California’s transportation fuel pool, she explained, starting at 0% in 2011 and increasing to -20% by 2030. According to the graph, in 2019, the reported percent CI reduction was 5.97%. “The gap to get to -20% by 2030 will be a very steep ramp down, and will be reflected in the credit price for RNG with the lowest CI scores,” said Levin.

In-State RNG Production And Electric Vehicles

During her presentation, Levin highlighted a July 2020 report, California’s In-State RNG Supply for Transportation: 2020 to 2024 Assessment, prepared by Gladstein, Neandross & Associates (GNA) in response to a CARB decision in October 2019 — reached after industry input and compromises — that would have incentivized in-state production of RNG for heavy-duty vehicles. Explains the GNA report, CARB “changed the requirements for one of the state’s most popular clean transportation programs — the Heavy-Duty Vehicle Incentive Program (HVIP) — to help bolster the development of in-state renewable gas production facilities. Going forward, in order for fleets to qualify for HVIP funding for natural gas vehicles (NGVs), the vehicle must be fueled with RNG produced within the state of California and be equipped with an 11.9L near-zero emission engine. This new in-state RNG fuel requirement might help the state achieve its SB 1383 goals, as it may encourage investment in facilities that capture and clean methane from major sources of short-lived climate pollutants — but the policy was approved without understanding the availability of in-state RNG supply.” (Ultimately, said Levin, funds for vehicles on the 2019-20 list for HVIP incentives ran out, so the requirement for in-state biogas was not implemented.)

During her presentation, Levin highlighted a July 2020 report, California’s In-State RNG Supply for Transportation: 2020 to 2024 Assessment, prepared by Gladstein, Neandross & Associates (GNA) in response to a CARB decision in October 2019 — reached after industry input and compromises — that would have incentivized in-state production of RNG for heavy-duty vehicles. Explains the GNA report, CARB “changed the requirements for one of the state’s most popular clean transportation programs — the Heavy-Duty Vehicle Incentive Program (HVIP) — to help bolster the development of in-state renewable gas production facilities. Going forward, in order for fleets to qualify for HVIP funding for natural gas vehicles (NGVs), the vehicle must be fueled with RNG produced within the state of California and be equipped with an 11.9L near-zero emission engine. This new in-state RNG fuel requirement might help the state achieve its SB 1383 goals, as it may encourage investment in facilities that capture and clean methane from major sources of short-lived climate pollutants — but the policy was approved without understanding the availability of in-state RNG supply.” (Ultimately, said Levin, funds for vehicles on the 2019-20 list for HVIP incentives ran out, so the requirement for in-state biogas was not implemented.)

At the end of 2019, only 2.7% of the 139.3 million diesel gallon equivalent (DGE) of RNG consumed by California motor vehicles was produced by in-state facilities, according to GNA. Given that low volume at the time of CARB’s policy change, GNA did an in-depth assessment of new biogas projects expected to begin producing by January 1, 2024. It utilized information provided by state and local agencies, project developers, third party marketers and other reliable sources to assess the actual RNG production of existing and developing projects.

For background, GNA explains that in California, the total volume of natural gas used as a transportation fuel is roughly a third of total U.S. consumption of natural gas as a vehicle fuel (29.1%). “In addition, the proportion of natural gas used by vehicles in California that comes from renewable resources is much greater. In 2019, 179.9 million DGE of natural gas was used by NGVs and registered in California’s LCFS database. The percentage of the total natural gas burned as a vehicle fuel in California that was renewable, however, was 77.4%, or 139.3 million DGE. The higher percentage of RNG use in California’s NGVs is directly attributable to the state’s LCFS, and the incentives that it provides for low carbon transportation fuels.”

An RNG production project qualified for inclusion in the study if it met criteria including: Received grant funding or other incentives from a state or local government agency; received other debt or equity financing from private entities; secured feedstock and/or offtake agreements; entered into or completed California Environmental Quality Act review; applied for and received permits from relevant regulatory agencies; can substantiate that significant private resources have been expended for the development of the project; and can demonstrate other attributes that indicate that the project is vested and in the process of development. “The projects that are included in this inventory do not have to demonstrate that they have achieved all of these criteria, but some combination of these attributes that gives both the authors and the developers justification to include the project in this report,” notes GNA.

The study concluded that as of January 1, 2024, 160 new RNG production facilities will be operational in California. By sector, the 160 projects represent the following: Dairy-137; Landfill-8; High Solids Anaerobic Digestion (HSAD)-7; Wastewater treatment plants-7; and Gasification of dry wood-1. HSAD represents biogas facilities processing food waste and/or green waste that are required to be diverted from landfill disposal under SB 1383 regulations. Over $1 billion will have been invested in these facilities in California to build the RNG supply infrastructure, with 77% being private investment.

These new California projects will produced a combined total of 119 million diesel gallon equivalents (DGEs) supplied by 5 sectors: Landfill gas-38.4% (45.7 million DGE); Dairy-36.6% (43.6 million DGE); HSAD-10.5% (12.5 million DGE); Gasification-10.4% (12.4 million DGE); and Wastewater-4% (4.8 million DGE).

The authors note that the average energy-weighted carbon intensity value of all in-state RNG will be -101.74 gCO2e/MJ as of January 1, 2024. Fluctuations in the energy-weighted average are broken down by quarter in the report, starting with a 2019 fourth quarter average of 502,176 MMBTU/year annualized energy production or 3.8 million DGE. (Note: Data referenced in this summary is found in a very helpful Executive Summary of the report.)

In September, California Gov. Gavin Newsome issued an Executive Order that calls for new passenger vehicles to be zero emission (ZEV) by 2035 and new heavy-duty vehicles to be mostly ZEV by 2045. In addition CARB is pushing to use biogas for electricity and hydrogen. “CARB had always been truly fuel neutral when it came to the LCFS,” noted Levin during the Biogas Americas session. “It was based on the lifecycle CI of the fuel. But about 2 years ago, CARB started to add in other factors. One is the Energy Economy Ratio, which assesses not only the lifecycle CI, but also in what kind of engine it will be used. CARB is doing that because it really wants to move to electric and hydrogen fuel cell powered ZEVs. Biogas used in an electric vehicle engine results in a much lower CI score than when used in an NGV.

“When you combine the state’s push to electrify vehicles with CARB’s push for in-state RNG production — which also helps meet our Short-Lived Climate Pollutant reduction requirements in SB 1383 — the California market for RNG from out-of-state producers may diminish. This speaks to the need for other states to adopt their own LCFS programs.”