Recent survey of large, operating composting and anaerobic digestion facilities sheds light on the state’s capacity to process the increasing flow of diverted organics.

Nora Goldstein

BioCycle July 2019

Editor’s Note: This article is adapted from a CalRecycle report, “SB 1383 Infrastructure and Market Analysis, April 2019,” produced under contract by Integrated Waste Management Consulting, LLC.

In 2016, Governor Brown signed SB 1383, establishing methane emissions reduction targets that will aid California in reducing greenhouse gas emissions to below 1990 levels as prescribed in AB 32 (Global Warming Solutions Act of 2006). As it pertains to CalRecycle, the state’s recycling and resource recovery agency, SB 1383 establishes targets to achieve a 50 percent reduction in the level of statewide disposal of organic waste from the 2014 level by 2020 and a 75 percent reduction by 2025.

California currently landfills approximately 20 to 23 million tons of organic waste every year, which equals two-thirds of the state’s overall waste stream. Starting in 2020, California will have a goal of disposing no more than 11.5 million tons/year of organics in landfills. By 2025, the goal is to reduce organics disposed in landfills to 5.7 million tons/year.

California currently has more than 160 permitted composting facilities and more than a dozen anaerobic digestion (AD) facilities. When SB 1383 is fully implemented, California will need to divert an additional 12 to 14 million tons of organics (using 2014 waste generation as a baseline), which includes materials such as carpet and textiles that typically cannot be composted or digested.

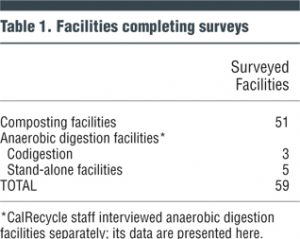

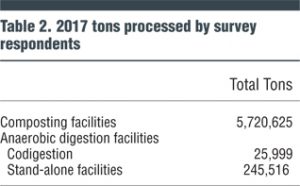

The CalRecycle report is based on a survey of large, operating composting and AD facilities in California that are likely in a position to handle SB 1383 materials. (Determination of “large” was based on facility permit type/size and CalRecycle and contractor experience.) The composting facility portion was conducted under contract by Integrated Waste Management Consulting, LLC (IWMC). Fifty-one composting facilities completed a comprehensive survey covering a range of issues. CalRecycle surveyed 8 anaerobic digesters using different methods (Table 1). This survey represents roughly 6 million tons of organics composted or digested in California in 2017 (Table 2).

Of the 51 composting facilities, 13 reported also doing significant chipping and grinding; seven were colocated at landfills (either closed or open); five were at transfer stations, seven at material recovery facilities, and one was colocated with a wastewater treatment plant. The survey deliberately excluded those composting facilities that are not currently and are not likely to be handling SB 1383 materials.

Overall Findings

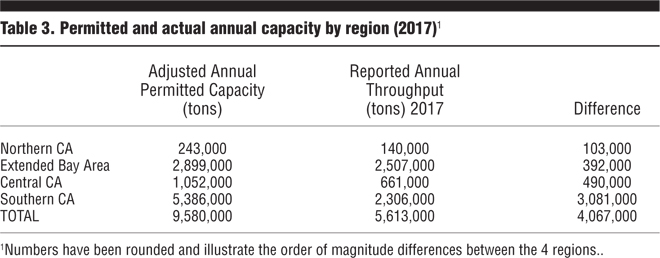

This survey reveals — by measuring the difference between annual permitted capacity and reported annual throughput — that there is approximately 4 million tons of existing permitted capacity currently available to process additional organic materials (Table 3). Across the state, 22 percent of survey respondents indicated they have 500-plus tons of available daily capacity. While this currently available capacity is not sufficient to meet the targets established by SB 1383, these results are different from what CalRecycle previously estimated and what local jurisdictions have reported throughout the SB 1383 regulation workshop process.

Southern California has the most available capacity (3.08 million tons) with 38 percent of the region’s facilities indicating they each have 500-plus tons of daily available capacity. Although these facilities may have permitted capacity to accept a larger quantity of materials, the facilities may need to seek new or adjusted air district permits to accommodate increased emissions from these operations, which may be a barrier to accepting additional material. (See further discussion on capacity in sidebar.)

Based on responses to surveys, 68 percent of composting and AD facilities do not have any plans to expand — and the single biggest factor driving facility growth and expansion is the perceived availability of feedstock materials. Since SB 1383 requires that jurisdictions provide organics collection services to all residents and businesses, these contracts will likely drive facility growth and expansion.

While California has a robust infrastructure to process wood and green wastes, the infrastructure for processing food scraps is still in its early stages of development — less than 50 percent of composters accept food scraps. This is significant considering that food waste alone comprises 18 percent (5-6 million tons) of California’s disposed waste stream. Of the composting facilities that do accept food scraps, 42 percent that responded to the survey say they can process 50 to 500 tons of additional material daily, while 44 percent say they have no additional available capacity.

Many composters are wary of contaminants in collected food scraps and are concerned about the marketability of compost products produced from food scrap feedstock. Compost facilities usually screen out contaminants (like plastic) from finished compost and those contaminants end up in “overs” that are used as alternative daily cover (ADC). SB 1383 has stricter contamination standards, and demand for ADC is expected to decrease due to the passage of AB 1594, which mandates that as of January 1, 2020, the use of green material as ADC will no longer constitute diversion through recycling and will instead be considered disposal in terms of measuring a jurisdiction’s annual 50 percent per capita disposal rate.

Composting And AD Systems

The majority of composters surveyed use an outdoor windrow composting method (71%), with only 25 percent reporting use of aerated static pile (ASP) composting. This ratio of windrow to ASP facilities is likely to change as new and expanded facilities come on line. The promulgation of the State Water Resources Control Board (SWRCB) General Waste Discharge Requirements for Composting Operations (Composting General Order) that addresses water quality protection at composting facilities will likely be driving more large facilities towards ASP composting, as the ability to manage the same or more throughput in a smaller area reduces the cost of compliance. In addition, an increasing number of air districts have rules requiring ASP technology for composting of food scraps (e.g., South Coast Air Quality Management District) and for very large facilities (e.g., San Joaquin Valley Air Pollution Control District). The Bay Area Air Quality Management District (BAAQMD) is currently developing an emissions rule, which may further drive operators of windrow composting to ASP systems.

The majority of AD facilities responding to the survey were stand-alone digesters that accept food and green waste. Thirty-eight percent were facilities that codigest municipal food scraps at a wastewater treatment plant (WWTP). Many observers believe there will be an increase in these types of facilities to help manage SB 1383 feedstocks. Of the five stand-alone digesters surveyed, two were located at transfer stations, two at closed landfills, and one at a rendering facility.

Permit Type, Facility Ownership

Of the responding composters, 64 percent operate under a full Solid Waste Facility Permit (SWFP), and 36 percent operate under an EA Notification. All SWFPs include throughput and capacity limits. Eighty-nine percent of surveyed composters have a Water Quality Control Board permit for waste discharge requirements (Tiered Regulatory Placement).

The vast majority of composting facilities surveyed are private, stand-alone facilities (56%). The next largest group are private, stand-alone facilities affiliated with (or colocated with) a landfill or transfer station. Twelve percent of facilities surveyed were stand-alone public facilities; 6 percent were publicly owned and colocated with a publicly owned landfill or transfer station. Two percent were located at wastewater treatment plants. Overall, the survey indicates 80 percent of responding composting facilities were privately owned, and 20 percent were publicly owned.

Feedstocks Accepted, Tipping Fees

Feedstocks Accepted: Organic material processors surveyed for this report receive a wide array of feedstocks. The breakdown by percentage indicates the percent of facilities that process the feedstocks listed: Green material-98 percent; Wood waste-73 percent (although CalRecycle categorizes wood waste as a subset of green material); Agricultural by-products-37 percent; Food scraps-49 percent; Biosolids-22 percent; and Other feedstocks-24 percent (e.g., liquid wastes, palm). All digesters surveyed accept food scraps and most of the stand-alone digesters also accept green materials.

Of the facilities accepting residential food scraps, about 50 percent allowed residents to include food-soiled paper. As with cocollection of food scraps and residential green material, the inclusion of food-soiled paper appears likely to increase as jurisdictions implement SB 1383 organics diversion programs. Far more facilities allow commercial food scraps programs to include food-soiled paper (71 percent). It is unknown whether this is a direct result of AB 1826, which envisions the diversion of food-soiled paper, or whether it is just the nature of food scraps collection programs. (Mandatory Commercial Organics Recycling)

Numerical diversion targets drive most commercial and residential food scraps collection programs in California, so they tend to be inclusive, allowing a wide array of organic materials (like food, meat, dairy, compostable food service ware, and food-soiled paper). It is hard to find a restaurant or grocery store food scraps collection program that does not include cardboard, especially wet-strength cardboard, in which much of the produce is delivered.

Of the 49 percent of composters receiving food scraps, 40 percent said the amount they take represents between 1 and 10 percent of all organic waste received. Only 8 percent of facilities surveyed report accepting more than 30 percent food scraps. The quantity of food can be difficult to estimate, especially if it comes in commingled with other materials.

Tipping Fees: The vast majority of facilities surveyed (92 percent) charge a tipping fee to accept materials. The facilities that reported not charging a tipping fee were generally biosolids composting facilities associated with the generator of their feedstocks (a wastewater treatment plant owned by the same entity). However, when asked for the details of the tipping fee, few composters were willing to disclose this information. Table 6 summarizes the tipping fee data that was supplied. To further add to the confusion, some facilities charge incoming feedstocks visually (by the cubic yard) versus with a scale (by the ton). Without knowing the bulk density of the feedstocks (some of which vary seasonally) it is very hard to convert these figures accurately.

Markets

The total amount of compost manufactured by the 51 reporting facilities is 2.7 million cubic yards (cy); mulch comprises 1.1 million cy (Table 4). In three previous “Compost-and Mulch-Producing Infrastructure Reports” (2002, 2004, 2010), CalRecycle documented that agriculture is the single largest market for compost. This has not changed since the 2010 report; in fact, based on this current survey, the agriculture market for compost has increased.

In most cases, composters strive to deliver material to local destinations with shorter travel times. With even relatively short haul distances, the cost of transport can easily start to exceed the cost of the product. Several composters reported hauling compost over 500 miles, but these are rare and unusual trips and likely represent compost industry outliers. The most common distance was 21 to 30 miles (26%). Over 20 percent of composters responded that they regularly haul compost over 50 miles. The next largest groups were 11-20 miles (14%) and 41 to 50 miles (12%).

Roughly a third of composting respondents get some revenue from product sales (though tipping fees are more significant to most composters). Table 5 summarizes product revenue from various products. Responses had to be normalized in order to compare apples-to-apples information. In this case, if product revenue was reported in tons, a conversion factor was used to convert to cubic yards.

Some composters provide additional services as a way of adding value and increasing compost sales. These services include delivery (66% of composters provide this service), blending (50%), product knowledge (48%), and testing and analysis (40%). Spreading (at 18%) and bagging (at 12%) are far less frequent services provided by compost manufacturers.

At the AD facilities surveyed, the solid digestate from codigested solids at a WWTP is usually commingled with and managed as biosolids. The majority of biosolids in California are applied to land, at least during the dry months, but some biosolids are composted, some are incinerated, and some are used as ADC. ADC use and direct landfilling are more common during the winter months when land application sites become inaccessible. Most of the stand-alone anaerobic digesters surveyed sent their solid digestate to a composting facility for further processing.

Barriers To Increased Facility Development

The barriers to increasing the quantity and capacity of organics processing facilities fall into two broad categories: lack of processing contracts (i.e., feedstock) and increased regulatory costs for facility development. Fundamentally, it is early in the SB 1383 implementation process and jurisdictions have not yet developed the collection infrastructure to deliver the massive quantities of organic materials envisioned to be diverted under SB 1383; additionally, the costs of facility development continue to increase. Thirty-eight percent of composting facilities that responded to the survey cite costs associated with permit requirements to protect air and water quality as a barrier to developing a new or expanded composting facility.

Overall, 69 percent of facilities have an Air Pollution Control District (APCD) or Air Quality Management District (AQMD) permit that contains an emissions limit. The permit may also limit throughput at the facilities. Of these facilities, 75 percent report that the AQMD/APCD emissions limit may hamper the facility from expanding.

The majority of tonnage included in this report is within the boundaries of the San Joaquin Air Pollution Control District or the South Coast Air Quality Management District (SCAQMD). These two districts both developed prohibitory rules for composting facilities based on limiting VOC emissions. SCAQMD’s Rule 1133 may prove to be particularly limiting for new facilities hoping to help implement SB 1383 programs, as it requires any composting facility accepting food scraps to use forced aeration — technology that the AQMD classifies as air pollution control technology. This designation triggers additional regulatory control and mitigation.