Nora Goldstein

On December 15, Closed Loop Partners released a ‘state of the knowledge’ report — “Navigating Plastic Alternatives In A Circular Economy” — that focuses on biopolymers and compostable packaging as one line of defense against waste. As described in the introduction, the report “aims to demystify the landscape of bio-based plastics, biopolymers and compostable alternatives, and unpack the associated opportunities and challenges within the industry’s move toward plastic alternatives. This report dispels the myths of deceptive vocabulary, lays out frameworks to navigate the challenges of contamination, highlights opportunities to drive value through the recovery system, demands rigorous testing to avoid unintended consequences and calls for more research in the space.”

Hannah Friedman, a Closed Loop Ventures Group Investment Associate and Internal Research Lead, authored the report, with the support of the Closed Loop Partners (CLP) team and in collaboration with CLP’s Center for the Circular Economy. Kate Daly, Head of the Center for the Circular Economy, aptly describes the current landscape of plastic alternatives in the report’s Foreword: “There is no silver bullet solution to the plastics crisis. Redesigning, reusing, repairing, recycling and composting materials are all complementary pieces of a broader puzzle. … This report shines a light on compostable packaging as one tool in the toolbox to transition to a circular economy.”

CLP’s ‘ecosystem’ includes entrepreneurs, industry experts, global consumer goods and technology companies, retailers, financial institutions and municipalities. Its mission is to build a circular economy — a new economic model focused on a profitable and sustainable future. With regard to compostable packaging in this ecosystem, Daly notes in her Foreword: “Brands and packaging manufacturers will need to assess compostable materials with diligence and deploy them with restraint if we are going to get this right. Today, the organics processing infrastructure needed to recapture these materials properly after use is underdeveloped.”

Current Landscape, Vocabulary

BioCycle has been reporting on compostable products since at least 1990, when Procter & Gamble introduced a compostable diaper to the market. The 1990s launched the heyday of products claiming to be oxo-degradable, biodegradable, compostable, made from green plastics and more. It is safe to say that marketplace confusion continues to this day, although it’s been narrowed down (for the most part) to these terms: bio-based plastics, biopolymers and compostable alternatives. Friedman explains that as companies look to this category of plastic alternatives, there has been a “surge of innovation and a flood of new materials entering the market …. Biopolymers and bio-based plastics are growing their market share, expecting to reach nearly $27.9 billion by 2025, up from $10.5 billion in 2020 (Markets and Markets, 2020), with over 2.8 million metric tons expected to be produced in 2025, up from 2.1 million metric tons in 2020 (European Bioplastics, 2020).”

The report does an excellent job of explaining the nuances of today’s terminology and opts to frame its analysis in circular economy terms that “hold material innovations to high standards for sustainably sourcing feedstocks and building end-of-life recovery pathways that recapture material value after use.” CLP elucidates a framework to evaluate materials by applying this “holistic circular economy framework” to biopolymers and compostable alternatives:

- Feedstocks: Material innovations should be bio-based, and when possible, sourced from renewable feedstocks that are waste byproducts.

- End-Of-Life: Material innovations should be complementary to existing recycling systems and create added value in organics processing infrastructure.

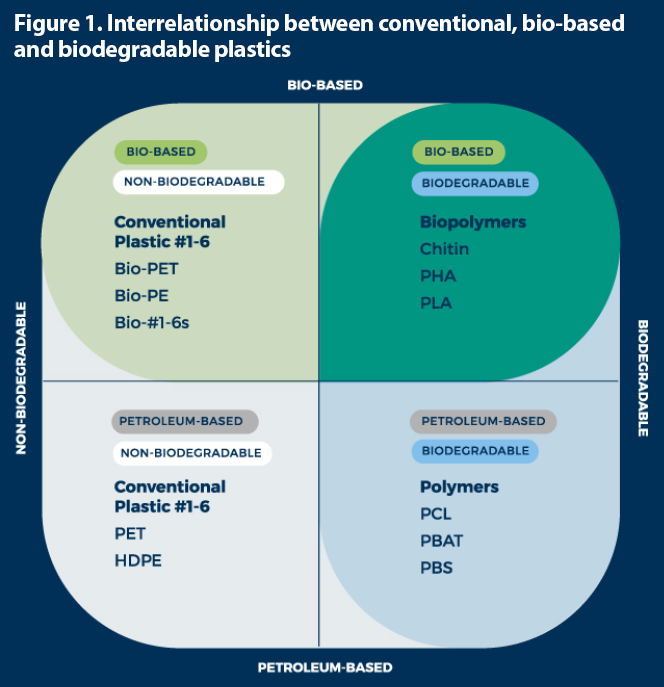

The section titled “Demystifying Alternative Material Innovations” walks through the definitions of bio-based and biodegradable (see Box), and includes Figure 1, which shows the interrelationship between conventional, bio-based and biodegradable plastics. Notes Friedman: “The term biopolymer is often used interchangeably with bioplastics and biodegradable polymers… This flattens complex nuances… Biopolymers are sometimes narrowly defined as the set of polymers that are found naturally or produced by living organisms. This narrow biopolymer definition does not encompass the petroleum-based yet equally biodegradable polymers such as polybutylene adipate terephthalate (PBAT, except where PBAT is partially bio-based).” Friedman adds that “for the sake of clarity and communication about the end-of-life intention for these polymers, we at Closed Loop Partners aim to describe all materials by both feedstocks and end-of-life.”

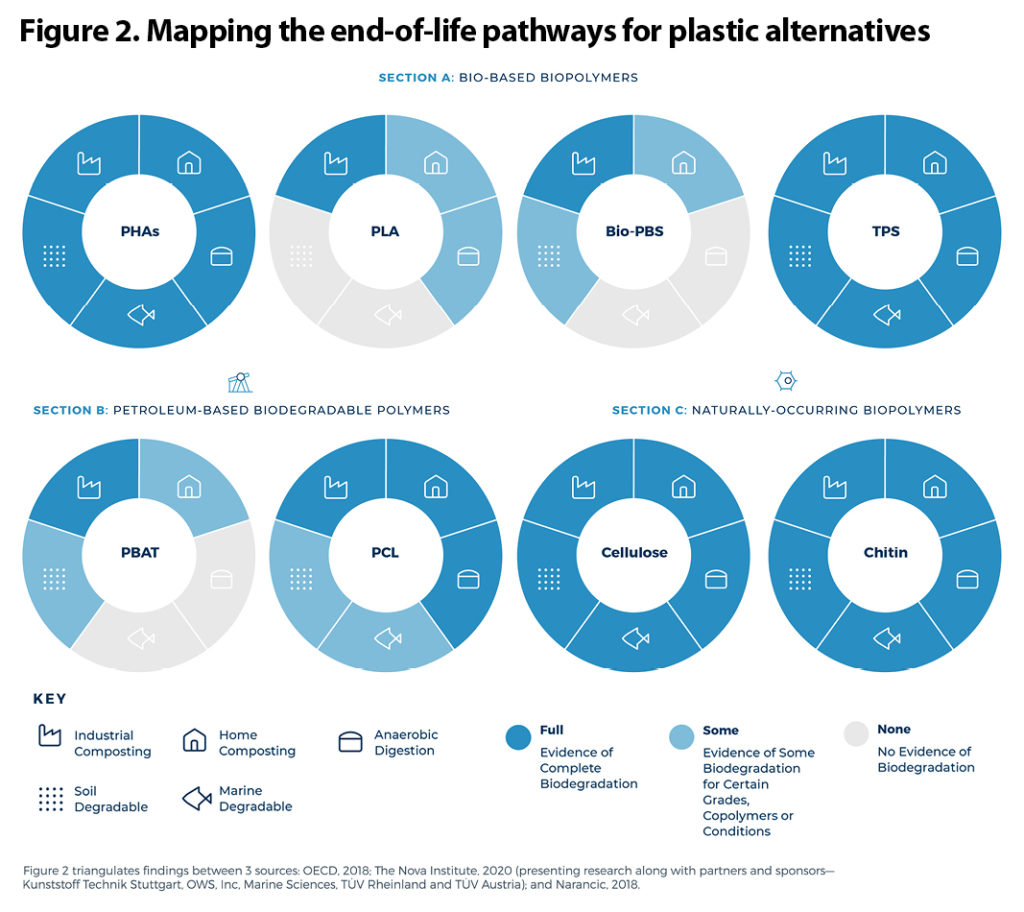

The rest of this section provides succinct and understandable descriptions of Bio-based biopolymers, e.g., PHA, PLA, Bio-PBS; Petroleum-based biodegradable biopolymers, e.g., PBAT, PCL; and Naturally-occurring biopolymers, e.g., cellulose, chitin and proteins. It also clarifies other polymers that are often referenced alongside “bioplastics” and “biopolymers”, e.g., PVOH and PVA, PEF. A very helpful graphic (Figure 2) references a poster from Nova Institute that BioCycle linked to several months ago.

The rest of this section provides succinct and understandable descriptions of Bio-based biopolymers, e.g., PHA, PLA, Bio-PBS; Petroleum-based biodegradable biopolymers, e.g., PBAT, PCL; and Naturally-occurring biopolymers, e.g., cellulose, chitin and proteins. It also clarifies other polymers that are often referenced alongside “bioplastics” and “biopolymers”, e.g., PVOH and PVA, PEF. A very helpful graphic (Figure 2) references a poster from Nova Institute that BioCycle linked to several months ago.

Findings And Company Spotlights

The ‘meat’ of “Navigating Plastic Alternatives In A Circular Economy” is the section highlighting the findings of CLP’s analysis of the current biopolymers marketplace and how it fits into a circular economy framework. Sprinkled throughout this section are company spotlights that feature innovators in the space. The following summarizes the 6 findings, and CLP’s major takeaways, excerpted from the discussion in the report:

- Finding 1: Identify bio-based materials — ideally those that use waste as a feedstock.

Consider using agricultural products such as bagasse (sugarcane residue) or rice husks — currently being landfilled or, in some cases, burned openly in the field — instead of only commodity crops like corn. Globally, estimates suggest 1.45 billion metric tons of such agricultural waste is produced annually (Bentsen et al, 2014). Some innovations source cellulosic feedstocks from waste in the forestry and paper industries, and some naturally-occurring biopolymers, like chitosan, are typically derived from waste streams in the lobster, shrimp, crab and insect protein industries. These existing waste streams create opportunities as feedstocks for biopolymers and compostable packaging.

- Finding 2: Design products and packaging that are clearly intended to be either recyclable or processed in organics infrastructure.

This finding stresses the importance of keeping materials such as bio-based plastics that are chemically identical to their petroleum-based alternatives, e.g., bio-PET, bio-PE and bio-PP, in the recycling stream at their end-of-life. Similarly, biopolymers certified as compostable need to be kept out of the recycling stream. Finding 2 includes a discussion about paper products that could be either recycled or composted.

CLP concludes its discussion about Finding 2 as follows: “There will be a period of transition to ensure these two systems — recycling and organics processing — calibrate to address cross-contamination. Contamination concerns do not mean we should avoid investing in these systems. Instead, greater industry collaboration and communication are required to drive toward optimal, circular outcomes.”

- Finding 3: Deploy compostable packaging both to divert food scraps toward organics processing and to solve for product formats that are not successfully recycled today.

CLP makes the case for deploying biopolymers and compostable innovations in a packaging format that “is not able to be recaptured in the recycling system today. For example, solutions that provide a compostable alternative for foodservice ware, like cutlery, replace a plastic format that typically is too small for the sorting and processing equipment at a recycling facility and literally falls through the cracks. Or, similarly, compostable flexible films may help keep food-contaminated and multi-laminate packaging out of the recycling system where it contaminates otherwise clean bales of recyclable materials. ….. Critically, compostable product formats and packaging should increase or enable the capture of food scraps, which are high-value materials for composting facilities. Food contaminated-products and packaging are a prime opportunity for a shift to compostable packaging. In fact, BPI’s [the Biodegradable Products Institute] eligibility for compostable certification requires that an item be associated with food waste. Many businesses are also putting forward strategies that convert all the packaging and foodservice ware in small, semi-closed environments, like food courts, stadiums and coffee shops, to certified compostable products.”

Supporting the fundamental premise for why compostable packaging is a benefit to composters, CLP notes: “Organics processors will find higher value in the high nutrient-content food scraps that these packages carry into the organics stream than in the packaging itself.”

Finding 4: Select materials and products that are certified compostable by industry-accepted third parties.

Finding 4: Select materials and products that are certified compostable by industry-accepted third parties.

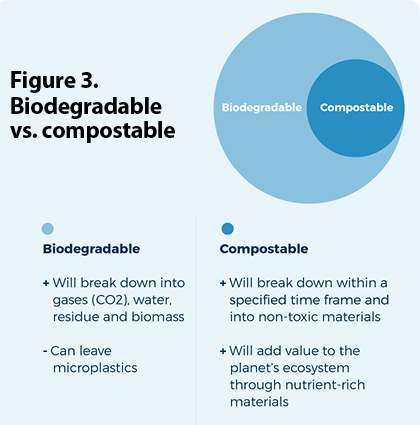

CLP, as BioCycle has done for many years, hammers home a ‘tenet’ of compostable packaging: Biodegradable does not always mean compostable, but everything that’s compostable is inherently biodegradable. The discussion in Finding 4 reiterates the critical importance of third-party certifications such as BPI and its counterparts in other countries, and walks readers through some of the basics. This major takeaway is illustrated in Figure 3.

- Finding 5: Reserve marine and soil degradable certifications for specific use-cases.

This finding applies more broadly to consumer goods such as cosmetics that currently utilize petroleum-based ingredients. Certification for soil and marine degradability likely also means it will be compostable, however, states CLP, “Materials certified as marine or soil degradable achieve complete biodegradation and disintegration within marine and soil environments that are colder and have a less dense microbial populations… [But,] laboratory testing for marine and soil degradable products differs from real-world environments.”

- Finding 6: Avoid landfills and leakage to waterways by designing for recapture within organics processing infrastructure.

A question that has been frequently posed to BioCycle is captured in the opening blurb of the Finding 6 discussion: “Isn’t it better that a material might be biodegradable in landfill, even if that product cannot be certified compostable and recaptured in organics processing facilities? In short, no.”

CLP explains that a product that biodegrades incompletely and does not meet the stringent standards of compostability may leave microplastics in the environment (UNEP, 2015). It created a somewhat complex grid of feedstocks and organics processing end-of-life. Friedman states, “to truly capture the value of materials and drive that value through the end-of-life value chain, compostable materials should be designed down to the biopolymer with their end-of-life scenario in mind.”

A bolded read-out in this section sums up why Closed Loop Partners’ December 2020 “Navigating Plastic Alternatives In A Circular Economy” report is a must-read for the packaging, composting and broader organics recycling communities:

“If a biopolymer — even a bio-based and compostable one — ends up in a landfill or our ocean, we have lost value that could have been recaptured by the organics processing system.”