These estimates form the basis of an outlook for biogas and biomethane supply and demand up to 2040. The report defines biogas “as a mixture of methane, CO2 and small quantities of other gases produced by anaerobic digestion of organic matter in an oxygen-free environment. Biomethane, also known as renewable natural gas, is a near-pure source of methane produced by upgrading biogas to remove any CO2 and other contaminants present in the biogas.”

Key focus areas of the report include how large a role biogas and biomethane can play in the transformation of the global energy system, where the opportunities and potential pitfalls lie, and what policy makers and industry can do to support sustainable growth in this sector. The introduction notes that “the case for biogas and biomethane lies at the intersection of two critical challenges of modern life: Dealing with the increasing amount of organic waste that is produced by modern societies and economies, and the imperative to reduce global greenhouse gas (GHG) emissions.”

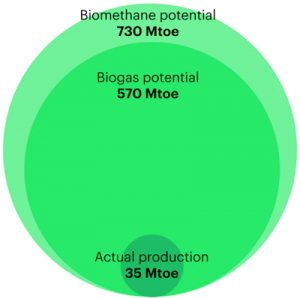

Biogas and biomethane production in 2018 against the sustainable potential today. Image courtesy IEA

A detailed assessment of feedstock availability and production costs across all regions of the world are included in the analysis. These feedstocks include crop residues, animal manure, municipal solid waste, wastewater and — for direct production of biomethane via gasification — forestry residues. The assessment considers only those feedstocks that do not compete with food for agricultural land.

Among the findings:

Biogas and biomethane production in 2018 was around 35 million metric tons of oil equivalent (Mtoe); biomethane represents 3.5 Mtoe of that total. The vast majority of production lies in European and North American markets.

Europe is the largest producer of biogas today. Germany is home to two-thirds of Europe’s biogas plant capacity. Energy crops were the primary choice of feedstock that underpinned the growth of Germany’s biogas industry, but policy has recently shifted more towards use of crop residues, sequential crops, livestock waste and the capture of methane from landfill sites.

In the U.S., the primary pathway for biogas has been through landfill gas collection, which today accounts for nearly 90% of its biogas production. The U.S. is leading the way globally in the use of biomethane in the transport sector, as a result of both state and federal support.

Almost two-thirds of biogas production in 2018 was used to generate electricity and heat (with an approximately equal split between electricity-only facilities and cogeneration facilities). The percentage of biogas produced that is upgraded to biomethane varies widely between regions — in North America it is around 15% while in South America it is over 35%; in Europe around 10% of biogas production is upgraded.

With the exception of some landfill gas, most of the biomethane assessed in this report is more expensive than the prevailing natural gas prices in different regions. The average price for biomethane produced today is around USD 19/million British thermal units (MBtu), with some additional costs for grid injection. However, this report estimates that around 30 Mtoe (~40 billion cubic meters) of biomethane — mostly landfill gas — could be produced today at a price that undercuts the domestic price of natural gas.