![]() BioCycle June 2011, Vol. 52, No. 6, p. 40

BioCycle June 2011, Vol. 52, No. 6, p. 40

Plentiful supplies of low-priced conventional natural gas are no reason to avoid RNG investments.

Peter Taglia

NATURAL gas has always been a complicated bedfellow to renewable energy technologies. The cleanest of fossil fuels can be a friend to intermittent renewable resources like wind and solar by providing a ready backup source of electricity without the high emissions of coal or oil. Because of its flexibility, lower carbon footprint and clean burn, many proponents of renewable energy have also embraced natural gas as a transition fuel, buying time while cleaner forms of energy and a smarter electrical grid are deployed. Unfortunately, low natural gas prices can also compete with renewable energy by providing a cheaper and easier way for utilities to meet either increasing energy demands or to reduce the emissions from dirtier fuels such as coal.

The intersection of natural gas trends and the outlook for renewable energy are likely to become more important in coming years as plentiful supplies of low-cost conventional natural gas make their way to the energy markets. In recent years the development of horizontal drilling and hydraulic fracturing has opened vast swaths of previously inaccessible deposits of natural gas in shale formations across North America. This increased supply has driven the price of natural gas from spot market highs of nearly $14/million btus (mmBtu) in 2008 to around $4.50/mmBtu today.

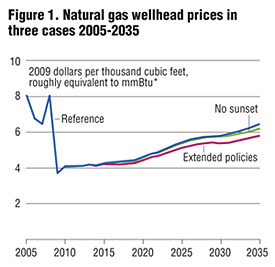

The significance of the new supplies of natural gas and the lower prices are not expected to be transient, either. The Department of Energy’s Annual Energy Outlook (Figure 1), many private sector forecasts, and the futures market forecast low, stable natural gas prices for decades. While history is littered with the unfulfilled forecasts of fuel prices, the outlook for low North American natural gas prices is so significant that large investors are proposing to modify multibillion dollar liquefied natural gas import facilities, built in the expectation of declining domestic supplies, and now hope to reverse the flow and export domestic natural gas to the world market.

The profound changes in the North American natural gas market, however, may not be as damaging to renewable energy projects as a cursory observation would suggest. Three factors provide some optimism for renewable resources, particularly biogas, in the current natural gas market: A recognition that new natural gas supplies may have greater environmental impact than previously thought; new renewable energy policies that level the playing field between different forms of renewable resources; and other, competing demands for natural gas such as vehicle fuel, may blunt some of the oversupply. The fact that almost all natural gas consumed in the U.S. is produced in North America has resulted in a strong energy security argument for using compressed natural gas (CNG) instead of oil as a transportation fuel, potentially increasing demand for natural gas from this sector.

RENEWABLE NATURAL GAS

Nowhere is the relationship between natural gas and renewable energy more connected than with pipeline quality natural gas produced from renewable resources such as biogas. The development of biogas upgrading equipment that can convert biogas from landfills and anaerobic digesters into a direct substitute for conventional natural gas has opened up a vast network of natural gas pipelines in North America as a new distribution method for renewable energy. Not only do natural gas pipelines carry energy through and within the majority of North America, these pipelines ultimately lead to millions of clean and efficient end-use appliances in residential, commercial and industrial applications. In the same way large-scale renewable electricity allowed existing buildings and appliances to instantly switch from being part of the problem to part of the solution, renewable natural gas (RNG) opens up a far larger market to the public and policy demands for greater sustainability. Unfortunately, without any special recognition for the environmental attributes of RNG, it is unlikely that any biogas project can compete with current natural gas prices.

Prior to the current projections of low natural gas prices, the technology to produce RNG was relatively new, with little public awareness and unequal policy treatment of upgraded biogas compared to other renewable resources. For example, biogas combusted on a farm to produce electricity (as well as wind and solar) qualifies for numerous state and federal tax and financial incentives. Conversely, biogas upgraded to RNG and injected into a pipeline at the same location qualifies for much fewer incentives (Table 1).

Unlike the electric grid, the North American natural gas grid has large storage capacity in geologic formations and building additional interstate natural gas pipelines is much easier than building high voltage electrical transmission lines. Both of these aspects of the natural gas grid remove some of the factors that have favored renewable electricity, especially solar. Customer-owned solar power, such as rooftop photovoltaic systems on houses or commercial buildings, is able to offset some of its price premium over conventional power because the output of solar panels is highest when electrical demand is highest (hot sunny days). In addition, many solar power systems distributed in an urban area can reduce the need for expensive power line additions and the construction of power plants that are otherwise built to meet peak demand.

ENVIRONMENTAL VULNERABILITY OF NATURAL GAS

The expanded supply projection and low price forecast for natural gas are both largely a result of one specific type of natural gas: shale gas extracted using hydraulic fracturing. This technology, widely called fracking, is also the source of intense environmental scrutiny of the air, water and greenhouse gas impacts of the new technology. The documentary movie “Gasland,” nominated for a 2011 Academy Award, has been seen by millions of Americans and has given a voice and face to the environmental impacts of fracking. Without dwelling on the factual content of the film, the scrutiny of shale gas plays, particularly in the Northeast, has reached the point where large areas are instituting moratoriums. And recently, a large gas producer took the unprecedented step of halting all fracking operations in Pennsylvania following a well blowout. The heightened awareness of the air and water pollution associated with hydraulic fracturing both reduces the public perception of natural gas as a “clean” fuel and will increase public demand for cleaner substitutes, such as renewable natural gas.

Partially in response to the public scrutiny of fracking in the Northeast, recent scientific studies are confirming some of the allegations that shale gas production has greater environmental impacts than conventional natural gas drilling. Publication of a peer-reviewed study of the greenhouse gas impact of shale gas production by a group from Cornell University (Howarth, et al, 2011) found higher fugitive emissions of methane from fracking than conventional drilling. The emissions were found to be very significant under some scenarios by the Cornell researchers and resulted in mass-media headlines such as “Natural Gas from Fracking Could Be ‘Dirtier’ Than Coal” (U.S. News and World Report, 4/22/2011). Another recent scientific study, performed by researchers from Duke University (Osborn, et al, 2011) has also validated some of the allegations that fracking operations may impact drinking water supplies.

The increased public and scientific scrutiny of conventional natural gas provides many opportunities for RNG. One factor in the Cornell study that had a disproportionate impact on the greenhouse gas footprint of shale gas was use of newer global warming potentials for fugitive emissions of methane. The Cornell researchers pointed to new scientific data that suggests a more appropriate value for methane as high as 105 times carbon dioxide over a 20 year time frame, and 33 times carbon dioxide over a 100 year time frame. (Previously, most international agreements and carbon credit mechanisms have calculated the climate impact of one mass unit of fugitive methane emissions as equivalent to 21 to 25 mass units of carbon dioxide over a 100-year time frame.) The new numbers have not yet been embraced by the broader scientific community or international climate change policies, but may point to a future where anaerobic digesters receive even more carbon destruction credits than current protocols, a development that would have a positive financial benefit to producers of biogas and RNG.

POLICY OPPORTUNITIES

In the near term, the environmental scrutiny of conventional natural gas is likely to increase demand for cleaner alternatives by certain segments of the population that are more sensitive to environmental issues. This demand could translate into more opportunities for utilities to mix RNG with conventional natural gas and offer this to consumers. Already a natural gas supplier in the Midwest, Integrys, offers customers in Ohio a portion of their natural gas from renewable resources under the Ecovations brand name. According to the product description, 8 percent of the emissions from consumption of this natural gas are offset through a combination of upgraded renewable biogas and carbon offset programs. In a similar fashion, large corporate consumers of natural gas such as 3M and Adobe have purchased renewable natural gas to offset a portion of their own consumption as part of corporate sustainability efforts.

Natural gas is also the only near-term options for replacing coal boilers and lowering smokestack emissions at high profile locations such as universities and urban district heating grids. The community groups and advocates who are pressuring these units to switch from coal are likely to face a dilemma with using conventional natural gas as a replacement fuel and will be more likely to support RNG as part of repowering plans. Environmentally conscious homeowners also face limited alternatives to natural gas in existing homes. Passive and active solar heating systems are expensive and logistically-challenging options to provide renewable heat and hot water to the vast majority of existing homes. Renewable natural gas, in contrast, can utilize existing infrastructure and the many highly-efficient natural gas appliances developed in recent decades, such as tankless natural gas water heaters and condensing furnaces.

Finally, new policies are creating opportunities for RNG to avoid competition with conventional natural gas pricing altogether. New rules from the Wisconsin Public Service Commission created in response to recent legislation allow RNG injected into the pipeline to generate renewable electricity credits (RECs) that are used by utilities and entities to comply with renewable electricity mandates or commitments. The rationale for allowing utilities to convert RNG into renewable electricity credits is that utilities already burn natural gas to generate electricity. Since RNG in the pipeline is indistinguishable from conventional natural gas, stakeholders in Wisconsin felt that it was appropriate to allow utilities to count a portion of the electricity generated from natural gas at existing power plants as renewable consistent with the Btu content of RNG purchased by the utility.

The presence of large, efficient natural gas combined cycle power plants provides an opportunity to take advantage of pipeline biogas in a way that is cost-competitive with other renewable electricity resources. For example, the rates used to represent generic long-term contracts for renewable electricity from wind and biomass in a recent construction case at the Wisconsin Public Service Commission were between $0.09 to $0.11/kWh.

To date no utility has taken advantage of this rule and proposed a specific project, but an example calculation can illustrate how RNG can be cost-competitive with wind and biomass alternatives. To produce renewable electricity from RNG injected into the pipeline at between 0.09 to $0.11/kWh is equivalent to a pipeline biogas production cost of between $12 and $15/mmBtu, exclusive of any variable O&M costs at the natural gas power plant. (This example calculation uses a natural gas combined cycle heat rate (i.e., efficiency) of 7,000 Btu/kWh common for the most recent facilities. Data on the non-fuel O&M costs for natural gas combined cycle vary widely. A value of $0.025/kWh has been used by the Congressional Research Service.)

Compared to the current cost of conventional natural gas of between $4 and $5/mmBtu, RNG becomes much more competitive with the large-scale wind projects that have comprised the bulk of renewable electricity used to meet renewable portfolio standards in the country. The American Biogas Council (www.americanbiogascouncil.org), an industry trade group, is also working on Federal efforts to make biogas and RNG eligible for the same tax and construction incentives as wind and solar power, a development that would make renewable natural gas even more competitive.

Peter Taglia recently founded Peter Taglia Energy and Environmental Consulting, LLC, based in Madison, Wisconsin.

References

Howarth RW, Santoro R, Ingraffea A (2011) Methane and the greenhouse-gas footprint of natural gas from shale formations. Climatic Change. DOI:10.1007/s10584-011-0061-5

Osborn SG, Vengosh A, Warner, N, Jackson R (2011) Methane contamination of drinking water accompanying gas-well drilling and hydraulic fracturing. PNAS. DOI: 10.1073/pnas.1100682108

June 16, 2011 | General