What actions are necessary for the composting industry to gain a stand-alone North American Industry Classification System code? The final article in this series suggests a plan and timeline. Part 3

Once a thriving industry with 78 percent market share in retail textile products, the U.S. cotton industry declined dramatically in the mid 1960s after the introduction of synthetics, falling to just 34 percent market share in 1975. In what is one of the greatest examples of the power of industry-wide collective action, cotton growers called for industry cooperation and successfully lobbied Congress to pass an act creating a national cotton marketing and research program. The national program relied on a simple yet powerful funding vehicle — cotton producers and importers were assessed a fee, a small portion of every bale of cotton fiber sold in the U.S. This collective action enabled the industry to create Cotton Incorporated, an entity that went on to build an unprecedented marketing campaign (“The Fabric of Our Lives” and the Seal of Cotton) designed to recapture market share for cotton. Today, 8 out of 10 Americans can identify the cotton logo and cotton comprises two-thirds of the fiber market in the U.S.

Fast forward three decades to the California Milk Processor’s Board (CMPB) and its “Got Milk?” campaign in the 1990s. With sales lagging, California milk processors agreed to finance a marketing campaign by contributing three cents of every gallon of milk processed. The assessment yielded $23 million for the marketing budget. The “Got Milk?” marketing campaign resulted in increased milk sales in California for the first time in a decade and produced one of the most widely recognized commodity ad campaigns in the U.S. with 9 out of 10 Americans recognizing the slogan.

What do cotton and milk have to do with compost? These examples illustrate that an industry can achieve tremendous results as a whole when individual stakeholders come together to support common objectives. More specifically, in the context of collective action, a minimal financial contribution at the individual level on an industry-wide basis can move an industry forward to achieve common goals once thought unattainable. Compost can learn much from cotton and milk.

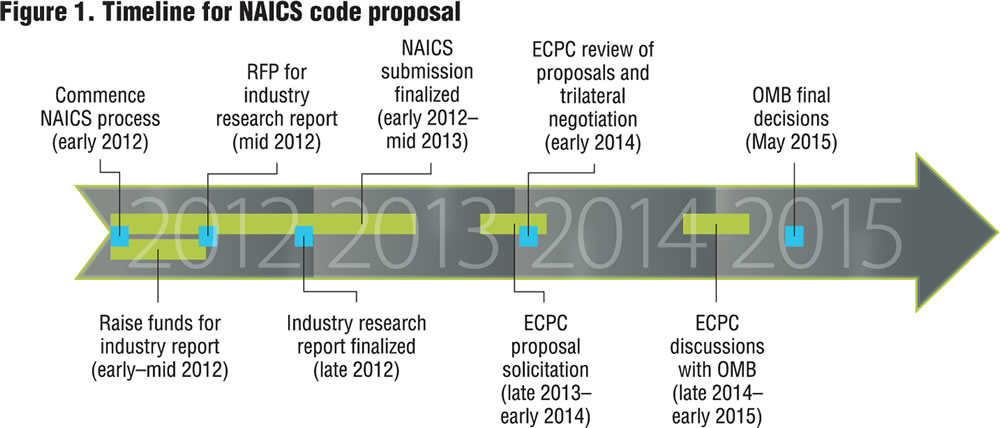

In the previous two articles of this three part series (see “Stand-Alone Industry Code For Composting,” December 2010; and “How To Classify The Composting Industry,” April 2011), we discussed the importance of a stand-alone North American Industry Classification System (NAICS) code and where within the code composting may best reside. The NAICS replaced the Standard Industry Classification (SIC) system in 1997 as the standard used by Federal statistical agencies in classifying business establishments for statistical data describing the U.S. economy (see sidebar). In this final article, we propose a road map and timeline (Figure 1) for attaining a stand-alone NAICS code for the composting industry. Collective action will play a pivotal role in advancing the interests of the composting industry to secure a stand-alone NAICS code — a goal that will yield far reaching and long lasting benefits to the industry.

Key Criterion for Evaluation

To obtain a NAICS code, a proposal for a stand-alone code is submitted to the Economic Classification Policy Committee (ECPC). The ECPC evaluates proposals against a set of criteria, summarized in Figure 2. The key objective is to prepare and submit a compelling proposal. The key criterion include:

Cross-Border Considerations: Proposed changes to NAICS are coordinated and approved by NAICS members (U.S., Canada and Mexico). While cross-border considerations are the province of the ECPC and its Canadian and Mexican counterparts, a coordinated show of support from industry stakeholders within the three countries will be important to the success of the composting industry’s proposal. The U.S. composting community should initiate a dialogue and facilitate coordination of messaging with compost industry associations and operators in Canada and Mexico. Discussion and collaboration with The Composting Council of Canada as well as compost interests in Mexico should commence early in the process of preparing a proposal for a stand-alone NAICS code.

Minimum Size Threshold: Proposed new industries must meet minimum size requirements. A sufficient number of establishments must exist in order for Federal agencies to report on industry statistics without disclosing specific data about the operations of individual firms. The size of the U.S. composting industry is sufficient to meet this threshold, but since the industry is not formally tracked by any single data collection resource, its actual size will have to be assessed and documented by verifiable sources for purposes of the proposal.

Cost Considerations: The ECPC’s goal is to ensure that government agencies can classify, collect and publish data on an industry using its existing resources (i.e., no significant incremental costs are associated with tracking the industry). Portions of composting industry data are already partially captured in existing NAICS codes. Accordingly, the case may be made that the cost to the ECPC to track the industry in a new stand-alone code would not be significant. Tracking composting would be more of an organizational shift rather than a situation of initiating brand new coverage that might cost the ECPC additional significant funds. In addition, with a detailed industry report (as suggested below), the ECPC will have a clear understanding of how and where to get the data they need.

Product Process Description: The proposal will include specific detail about the economic activities associated with composting, especially with regard to production processes, specialized labor skills and materials used.

Relationship to NAICS: The proposal will describe how the composting industry fits within the existing NAICS framework. The authors suggest that composting best resides within the NAICS manufacturing sector. (For an in depth discussion about optimal placement of composting in NAICS see Part 2 in April 2011.)

Interaction with NAPCS: The ECPC will evaluate the proposal to determine whether a stand-alone code for the composting industry is better addressed in NAICS or The North American Product Classification System (NAPCS) or both. As a reminder, NAICS tracks industries; NAPCS tracks products and services associated with the industries defined in NAICS. In the context of composting, the industry could benefit from its own stand-alone NAICS code as well as NAPCS codes that track compost and soil amendment products and the organic waste disposal service composters provide. Tracking both the industry and its associated products and services will enable the public and private sector to get a true sense of the size and value added to the economy by the composting industry — information that will prove critical to government support, private sector financing and the industry’s continued growth.

Industry Report

The most efficient and effective way to address these criteria is through preparation of an industry report. The composting industry’s proposal to the ECPC must set forth a strong and persuasive argument built on credible, complete data that the composting industry deserves its own stand-alone NAICS code.

Ironically, one of the reasons for seeking a stand-alone NAICS code for composting is that without such a code, important industry data and metrics are not formally or centrally collected. Data on the size, scope and impact of the composting industry is scarce, scattered and hard to independently verify. Why does formally organized data tracked by NAICS matter? When composters seek financing from the private sector to upgrade or build new facilities, the financing entity cannot turn to NAICS to verify key metrics needed for due diligence. Without NAICS tracking or formal industry reporting, there are very few places to turn for this information.

The net effect is that composters face a higher diligence bar for the transaction. This impacts the cost of capital and may even determine whether financing is available at all. Moreover, composting related lobbying efforts in Washington or state capitals cannot speak with the full force of the industry because that information has not been captured. How many jobs does the industry create? What is the economic impact of composting products and services? This information matters when an industry seeks a tax credit or support for mandatory organics diversion from local and Federal governments. Without a stand-alone NAICS code or independent industry research reports for composting, this information does not exist. The process of obtaining the code forces the industry to pull the data together.

Data on the industry’s current size and other key metrics must be independently verifiable. The most efficient way to obtain third-party accredited data on an industry not currently tracked is to commission an industry report from a qualified research firm. The report also would provide highly valuable information to composters at the individual and collective level to fill the gap while the industry awaits its own code. Based upon our research, a report of this nature should generally take 12 to 16 weeks to draft and cost approximately $40,000 to $60,000.

Figure 3 outlines the type of data contained in an industry report. Key economic data spans topics such as: market environment (macroeconomic outlook, demographic trends, consumer and commercial demand and spending patterns, regulatory and environment issues, raw materials, pricing issues, historical market trends, etc.); products; markets, applications and end users; regional demographic and economic trends; industry structure (composition, market share, distribution channels, company profiles, etc.); and market outlook, among others. This information is critical for business decisions on investments, strategic business planning, mergers and acquisitions, product development, and expansion into new markets and geographic regions within a given industry. This information must be formally developed and independently maintained.

Drafting a Submission

Once an industry report has been prepared, the composting industry will have the information necessary to draft a proposal for submission to the ECPC. Drafting of the proposal could be handled by an industry association or outsourced to a third party. To move forward, the following steps must be taken:

Funding: The bid to obtain a stand-alone NAICS code for composting creates an opportunity for industry-wide collective action that is unprecedented within the composting industry. Walking in the footsteps of the cotton and milk industry, the assessment of a nominal fee on compost sold has the power to fund a bid for a stand-alone NAICS code. Moreover, in addition to funding an industry report and a NAICS proposal, funds could be used going forward for a number of important initiatives such as national marketing campaigns designed to raise the profile of, and increase demand for, compost. Imagine if 9 out of 10 Americans recognized the compost industry’s slogan and compost displaced petrochemical fertilizers as the soil nutrient of choice in the U.S. market. It could happen, but will take industry-wide collective action.

Timeline: The next NAICS revision will go into effect in 2017, which puts the composting industry in a prime position to begin work on this initiative. The timeline in Figure 1 sets forth a suggested schedule for taking action, from establishing an industry consensus, to commissioning an industry report and creating a strong proposal document to the ECPC. The various NAICS milestones and industry action items will take place over the next three to four years.

Andrew C. Kessler (andrew.kessler@turningearthllc.com) is the President of Turning Earth, LLC, an organics recycling companyfocused on producing biogas, compost and sustainable agriculture. Prior to launching Turning Earth, he spent 15 years as an investment banker. Amy McCrae Kessler (amy.kessler@turningearthllc.com) is EVP & Head of Legal and Regulatory Affairs of Turning Earth, LLC. Prior to launching Turning Earth, she practiced environmental law and international environmental law. Cara Unterkofler is a consultant in Washington D.C., collaborating with organizations on sustainability planning and reporting (www.overwaste.com).

What is NAICS?

NAICS (pronounced “Nakes”) replaced the Standard Industry Classification (SIC) system in 1997 as the “standard for use by Federal statistical agencies in classifying business establishments for the collection, tabulation, presentation and analysis of statistical data describing the U.S. economy,” according to a Frequently Asked Questions fact sheet on the Census Bureau’s website. Canada, Mexico and the U.S. developed NAICS to produce common industry definitions and facilitate economic analyses. The statistical agencies of each country produce information on inputs and outputs, industrial performance, productivity, unit labor costs and employment. In the U.S., NAICS is administered by the Office of Management and Budget (OMB). Included in collecting information and producing statistics are the Bureau of Economic Analysis, the Bureau of Labor Statistics and the Census Bureau.

NAICS groups business establishments (defined as a single location where business is conducted such as a factory, store, facility, warehouse, etc.) into industries according to similarity in the processes used to produce goods or services. A company may own/operate several business establishments performing the same or different types of economic activities. Each business establishment would be assigned a NAICS code based on its primary business activity. The parent company itself, therefore, is not directly tracked but its economic activities are captured through the tracking of its business establishments.

NAICS employs a six digit hierarchical classification system, with each digit in the code representing a series of progressively narrower categories. The first two indicate the economic sector, the third digit designates the subsector and the fourth is the industry group. The fifth digit designates the NAICS industry and the sixth is the national industry. For all three countries, the first five digits are comparable in code and definitions for most NAICS sectors. The sixth digit tracks country-specific detail. NAICS has approximately 1,175 six digit codes. Including Corresponding Index Entries, which provide more specific details and references associated with each six digit code, NAICS identifies approximately 19,720 commercial activities.