Funds are available for project developers, and low carbon fuel market incentives are attractive. Will this lead to more RNG being injected into California’s gas pipelines?

Craig Coker

BioCycle March/April 2018

Biogas is conditioned at the CR&R anaerobic digestion facility in Perris (CA) and then transported about 1.4 miles via a high-pressure steel pipe (shown here) to the SoCalGas interconnection “point of receipt” (see next photo). Photo courtesy of CR&R Waste and Recycling ServicesProduction of Renewable Natural Gas (RNG) or biomethane as the primary energy product of new anaerobic digestion (AD) facilities is being widely discussed and considered in many states, including California. Biomethane can be made from biogas by removing the carbon dioxide, hydrogen sulfide, moisture, nitrogen, oxygen and siloxanes (see “Basics of Biogas Upgrading,” January 2018). It can be used as a vehicle fuel in natural gas engine-equipped vehicles, or potentially be injected into existing or extended natural gas pipelines.

Natural gas demand has risen by 50 percent in the U.S. since 1990, driven in part by population growth and in part from the conversion of solid fuel heating and power plants to natural gas-fueled systems. During that same time period, in California, natural gas demand has remained relatively flat, despite a 31 percent population growth of 9.2 million additional residents, due primarily to greenhouse gas (GHG) emission reduction policies, a switch from fossil-fuel electrical generation to solar and increased hydroelectric power generation with increased rainfall.

The current natural gas distribution system in the U.S. consists of 318,000 miles of interstate and intrastate high volume, high pressure transmission lines feeding into more than 2.2 million miles of Local Distribution Company (LDC) distribution networks that deliver gas to residential and business customers. The pipeline systems of Canada and Mexico connect to this system so that natural gas can flow between the three countries. Interstate pipelines provide California with natural gas from U.S. Southwest and Rocky Mountain sources, along with western Canada. Quantities available to California average about 9.8 billion cubic feet per day (bcf/day) of gas, compared to average daily consumption of about 5.8 bcf/day. On peak demand days, natural gas demand may exceed receipt, or intake, capacity, leading to peak day supply “choke points” and issuance of operational flow control orders by the gas utilities and interruption of gas flows to some end use sectors. Planned pipeline projects underway will improve overall system reliability.

The gas utility monitors the RNG quality at this “point of receipt” location, and then meters and odorizes the volume of RNG put into its pipeline network. Photos courtesy of CR&R Waste and Recycling Services

RNG Landscape

In California, the pipeline injection of landfill-derived RNG was illegal for almost 30 years. In 2012, California AB 1900 lifted that restriction, but the proceedings that followed left in place the most stringent gas quality standards (and associated expenses) in the country. As a result, there is only one operational pipeline injection RNG project — the Point Loma Wastewater RNG project developed by BioFuels Energy, LLC.

Interest in producing biomethane at AD facilities is driven by several factors:

• Feed-in tariffs for distributed sources of generated electricity are holding down prices paid for biogas generated power

• Biomethane qualifies for sale under both the EPA Renewable Fuel Standard (RFS) and under California’s Low Carbon Fuel Standard (LCFS)

• Eligibility for incentives such as those available under Assembly Bill (AB) 2313, which provides increased financial support for pipeline interconnection costs to $3 million (and up to $5 million for dairy cluster biomethane projects).

The gas utility companies have traditionally been reluctant to enter into long-term contracts to purchase biomethane due to uncertainties in the markets for RFS and LCFS, and they have stated that the minimum quantity threshold to make the interconnection economics favorable is 1.0 to 1.5 million cubic feet/day, which is a driver behind recent efforts to “cluster” projects together.

According to the California Air Resources Board’s (CARB) Short-Lived Climate Pollutants inventory, dairy manure, dairy enteric, and nondairy livestock emissions of methane are responsible for more than half (55 percent) of in-state methane emissions. Enteric emissions are expelled directly from animals (such as by burping) and are therefore difficult to capture, but dairy manure is often collected in storage ponds and lagoons, allowing for easier emissions capture. California currently has the largest dairy industry in the United States, and is home to more than 1,400 registered dairies, with nearly 1.8 million milk cows and heifers.

State AB 109 appropriated $99 million from the Greenhouse Gas Reduction Fund (GGRF) to the California Department of Food and Agriculture (CDFA) for early and extra methane emissions reductions from dairy and livestock operations. CDFA’s Dairy Digester Research and Development Program (DDRDP) provides financial assistance for installation of dairy digesters in California, which will result in reduced greenhouse gas emissions. CDFA plans to allocate 65 to 80 percent of the funds as incentives to support digester projects on California dairies. The 2017 round of grant awards, totaling $35.25 million, went to 17 planned dairy AD projects. Eleven of the 17 intend to implement pipeline injection of biomethane (the other six are planning a dedicated pipeline to an ethanol plant). CDFA will make $61 million to $75 million available for the 2018 DDRDP.

In December 2017, the California Public Utilities Commission (CPUC) issued a decision that establishes the necessary framework to direct natural gas utilities to implement not less than five dairy biomethane pilot projects to demonstrate interconnection to the common carrier pipeline system and allow for rate recovery of reasonable infrastructure costs pursuant to SB 1383, which, as part of the mandate to reduce methane emissions by 40 percent by 2030, directs CARB to develop regulations to reduce methane emissions from livestock manure management operations. Participating utilities are Southern California Gas Company (SoCalGas), Pacific Gas & Electric Company (PG&E), San Diego Gas & Electric and Southwest Gas Corporation.

These utilities recently issued a joint Request for Proposals for dairy biomethane pilot projects that would fund development of biogas treatment facilities (not the actual upgrading facility) and collection lines, pipeline lateral extensions and compression facilities to deliver the upgraded biomethane to the utility system’s interconnection point, and the development of the interconnection point itself.

Pipeline Injection Obstacles

The California Energy Commission (CEC) has been investigating obstacles to biomethane pipeline injection projects to understand why there are very few projects in operation, even though California established the LCFS program to support the supply of biomethane as a vehicle fuel. The final report is due out later in 2018. The report’s author, Brian Gannon of Biogas Energy, noted, “In past years anecdotal evidence portrayed utilities as uncooperative parties to the effort to inject biomethane into the pipeline; however, the complexity of the undertaking has been misinterpreted by developer applicants who do not appreciate the complexity of the task.”

Not surprisingly, there are important areas of investigation that should be completed as part of the overall AD facility planning process. These include:

• Is there a distribution or transmission gas pipeline at, or very near the planned AD site? Extending gas pipelines is costly, and best undertaken by the gas utility company, which has eminent domain power and appropriate levels of liability insurance. But, as the pipeline extension is of benefit only to the AD project developer and not the utility’s ratepayers, the cost of the extension will have to be borne by the project.

• Does the pipeline have the volumetric capacity to handle injected biomethane? If not, then a larger capacity pipeline is needed. Multiple line segment upgrades might be needed depending on the relationship between the site and the distribution/transmission grid. The cost of upgrades will likely be borne by the project.

• Is there adequate demand for gas from the pipeline? If gas is not pulled out for consumption, then biomethane cannot be injected in. Like water mains, gas pipelines flow full and the volume consumed has to exceed the volume proposed for injection to make sure there is room in the pipe for the biomethane. Seasonal variations in natural gas demand can also complicate injection as biomethane production is not seasonal.

• Are the users of biomethane downstream from the point of injection? This is a potential issue for AD plants looking to inject biomethane into distribution networks rather than transmission networks. It is not possible to make injected biomethane flow backward into the larger transmission grid.

• Is the pipeline operating pressure near the maximum that pipe can withstand? If so, then an upgrade will be needed, and likely in more sections than just at the point of injection. The natural gas pipeline explosion in San Bruno, California in 2010 was caused by failure in the welds in the steel pipe; the failure was caused by pressure problems.

• Are there safety-related operational constraints in the system? Gas pipelines are constantly inspected for safety-related issues and operating volumes and/or pressures can be reduced for long periods while pipe upgrades are designed and built, which can complicate injection plans.

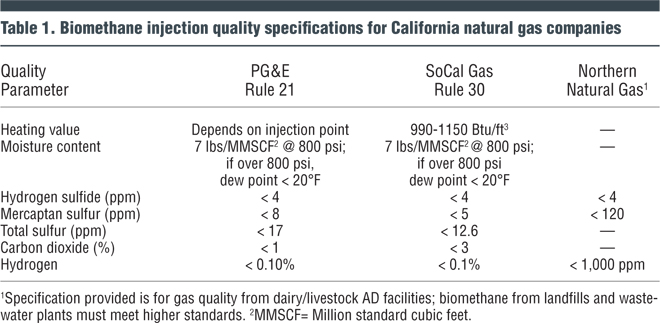

• Can the biomethane be upgraded to meet the requisite gas quality standards of the gas utility? In California, the two main gas suppliers, SoCal Gas and PG&E, have very strict quality standards that have to be met (some referenced in Table 1).

Gannon continued in his explanation of the process: “The utility companies recommend that they be consulted on AD projects as early in the planning process as possible. They will often conduct an informal review of the project and site at no charge, then, if appropriate, will ask the project developer to fund a Preliminary Scoping Study, which will examine issues such as service alternatives, tap location, pipe routing, meter size and associated construction cost. That study can take 16 to 20 weeks and cost upwards of $50,000. Then, if it is still feasible, the utility will perform final engineering, develop cost estimates and arrange for construction, all at the developer’s expense.”

Gas Quality Standards

Gas quality standards must be met for any injected biomethane. Table 1 compares some of the biomethane quality standards of SoCal Gas, PG&E and, for comparison, the quality standards of Northern Natural Gas in Nebraska. Several AD project developers have noted that biomethane deliveries in California are originating out-of-state due to more lenient gas quality standards and lower interconnection costs. This is possible, in part, because the LCFS and RINs programs only require a “paper transfer” of the gas; that means that the specific molecules of biomethane injected into a pipeline in Texas do not have to be used in California. That is different from the requirements for biodiesel and ethanol, where the actual gallons produced have to be shipped to and used in California.

If pipeline injection is unfeasible for any of the reasons discussed previously, there are alternatives. Biomethane can be used as RNG in vehicles fueled at, or near, the AD facility. That is how biomethane is used at the Sacramento Bio-Digester. Incline Clean Energy, which owns the facility, is able to circumvent the difficulties of pipeline injection in California by selling the biomethane produced on-site to Atlas ReFuel, which owns and operates the adjacent CNG fueling station. Another alternative is to truck the biomethane to the point of consumption in tube trailers, which are traditionally used to haul compressed gases over long distances.

One pipeline interconnection success story is the CR&R Waste and Recycling Services (CR&R) anaerobic digester facility in Perris, California (see “High Solids Digester Services California Municipalities,” May 2017). CR&R is developing the facility in four phases of capacities, each at 83,600 tons/year/phase. Two phases are now on-line. Each phase will produce about 1,000,000 diesel gallon equivalent (DGE) of biomethane for CR&R’s fleet of trucks. The project included installing around 1.4 miles of 8-inch high-pressure steel pipe using directional boring machines to provide an extension to SoCalGas’ network. This interconnection, which is in final acceptance testing, is the first RNG-to-pipeline project in SoCalGas’ territory.

“This was a very elaborate and time-consuming process for us,” explains Paul Rellis, Senior Vice-President of CR&R. “We have invested over $7 million in gas upgrading equipment, pipeline installation, and sophisticated gas monitoring equipment. Fortunately, we will get partially reimbursed by the gas company. With completion of all four phases we expect to power about 320 of our 900-truck fleet by about 2020 using our biomethane. We are in the process of multiyear purchase of the new Cummins Westport .02 gram engines with assistance from the South Coast Air Quality Management District. All in all, while it was a long, multiyear process, it ended up as a win-win for CR&R.”

According to Cummins Wesport, its ISL G Near Zero (NZ) NOx natural gas engine is “the first MidRange engine in North America to receive emission certifications from both the U.S. EPA and Air Resources Board (ARB) in California for meeting the 0.02 g/bhp-hr optional Near Zero NOx Emissions standards. … The ISL G Near Zero can run on renewable natural gas.”

Policy Initiatives

Gannon’s report for the CEC offers several policy initiatives for California legislators and state agencies to consider levelling the playing field. “There needs to be a systemic approach to the challenge of creating a new industry, but the state is assisted by the fact that the means of distribution and delivery — the gas pipeline — is already in place and able to accept biomethane today,” he writes. “Just as solar and wind leveraged the existing infrastructure provided by the electrical grid, biomethane can use the pipeline to realize the scalability it needs to have a major impact on the GHG emissions in the state. California has a track record of success in developing the renewable energy industry in other sectors, and the expansion of this effort to include biomethane would bring multiplier benefits to the people of our state. Pipeline injection of biomethane, if supported properly, will bring massive economic and environmental benefits to this state.”

Craig Coker is a Senior Editor at BioCycle and CEO of Coker Composting & Consulting near Roanoke, VA. He can be reached at ccoker@jgpress.com.

Correction, July 16, 2018:

The article erroneously reported the current owner of the Sacramento Bio-Digester as Cleanworld. Cleanworld sold the facility to Incline Clean Energy at the end of 2015.