Mark Jenner

BioCycle July 2007, Vol. 48, No. 7, p. 60

In February, the U.S. Department of Energy (DOE) announced $385 million of funding for six commercial-scale cellulosic ethanol projects. As a biomass energy economist, commercial bioenergy projects rock! A commercial-scale project is the leading edge of a fledgling industry. It is the first facility of its kind to be economically viable from a business standpoint – an industrial rite of passage.

The fervor about cellulosic ethanol grows everyday. The numerous claims of being “the first project of its kind” seem never ending. How can there be so many “first” projects? These claims are based on proprietary technologies, source of feedstocks, geographic location and stage of development. Combinations of these factors create a lot of “first of its kind” projects.

Tracking only commercial projects shows just a part of the picture, however. Four stages (scales) define technology development of a technology – laboratory, pilot, commercial and industrial. These four stages hold for all biomass energy projects, so that is the focus of this month’s column. Because cellulosic energy is such a hot topic these days, it provides an ideal framework to discuss project-scale. For example, we know how to produce cellulosic ethanol in a laboratory and on a small-scale outside of the lab. The challenge is finding the size plant that makes the process economically viable – or profitable.

PROJECT’S PURPOSE

The purpose of a project defines the scale, i.e., lab, pilot, commercial or industrial. Because project capacities are discussed in million gallons per year (MGY), capacities may sound like a way to define a project-scale. It is not. A commercial-scale production capacity in MGY will be different for corn ethanol than for cellulosic ethanol.

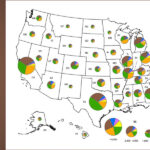

Laboratory-scale is small enough to fit on a lab tabletop. The purpose is on perfecting the process; there are no commercial economic considerations. As interest in ethanol has grown, more public and private research is being cultivated. In 2007, work is underway in California, Florida, Illinois, Indiana, Massachusetts, New Hampshire and New York. BP is funding $500 million at University of California, Berkeley and at the University of Illinois. ADM is partnering on cellulosic research at Purdue University in Indiana. In June, DOE announced another $375 million to be distributed evenly through three new research consortiums in California, Tennessee and Wisconsin. These centers will distribute funds to surrounding states.

Pilot-scale projects are the intermediate step between laboratory and commercial. Technology developers need confidence in their technologies – a proof of concept – to attract investors and clients. The scale of these pilots is large enough to test the equipment at a rigorous level, but small enough to minimize economic risks to the developer. Pilot-scale projects have a dual role of further refining the technology (working out the bugs) and testing the cost of scaling up to a commercial project.

Currently, Celunol/Verenium operates a cellulosic ethanol pilot plant in Jennings, Louisiana that is scaling up from 50,000 gallons/year to 1.4 million gallons/year. New York State has two pilot plants under development. Mascoma and Tamarack are planning a 500,000 gallons/year project in Lyonsdale. Catalyst Renewables is building a 130,000 gallon pilot plant in the same town. The Nett Lake Reservation in Minnesota is exploring a one million gallon cellulosic ethanol project. In May, DOE announced an additional $200 million in funding available specifically for developing small-scale cellulosic ethanol projects.

TRANSITION TO ECONOMIC VIABILITY

The purpose of a commercial-scale plant is to be economically viable. That fits the case of the six projects receiving $385 million of DOE money. These projects are economic experiments. Hundreds of millions of dollars are on the line. The federal money does not guarantee success, but provides some risk protection. Once the “first of its kind,” commercial-scale project risks are removed, subsequent projects should operate without federal assistance.

The six DOE funded cellulosic ethanol plants are: Abengoa in Colwich, KS (11 MGY); Alico in Labelle, FL (14 MGY); Bluefire in Corona, CA (24 MGY); Poet (Broin) in Emmetsburg, IA (26 MGY); Iogen in Idaho Falls, ID (18 MGY); and Range Fuels in Soperton, GA (40 MGY). All six have variations in technologies and feedstocks. In the commercial cellulosic ethanol race, these contestants have an average capacity of 22 MGY.

The competition for the DOE funding was larger than six contestants. Many of the unfunded cellulosic ethanol projects are still proceeding forward without the federal money. These include a 10 MGY plant in Middletown, NY; a 20 MGY plant in Park Falls, WI; a 50 MGY plant in Yuma, CO; a 20 MGY plant in Upton, WY; a 5 MGY plant in Bredesen, TN; a 4 MGY plant in Clewiston, FL; and a 50 MGY plant in Belle Fourche, SD. These additional seven contestants take the commercial-scale racing field up to 13.

Finally, industrial-scale projects are replications of the successful “first” commercial-scale projects. A key factor for the dry-mill corn ethanol industry was that investors knew the established technologies were replicable.

All of these projects discussed are cellulosic ethanol projects. To the casual reader, they may appear redundant. When identified by their various “scales” of production, however, each one is really the “first of its kind.”

Mark Jenner, PhD, is an independent information specialist. Jenner developed the biomass locally grown power plant concept for the Indiana Department of Agriculture’s BioTown, USA project. Jenner has conducted data analysis for USDA-NASS, guided on-farm value-added manure projects and planning. Prior to forming Biomass Rules, LLC, he served nine years as manure visionary for the Farm Bureau.

July 25, 2007 | General