Nora Goldstein

Top: Photo courtesy of UPS

The State of Sustainable Fleets 2020, released on August 11 by Gladstein, Neandross & Associates (GNA), is the first technology-neutral, comprehensive industry report that examines the current state of the most prevalent sustainable vehicle platforms for medium- and heavy-duty on-road transportation fleets across the U.S., and identifies the trends shaping the future of the industry.

Through interviews and surveys, the authors from GNA gathered data from fleets with real-world experience deploying sustainable vehicle technologies, supplemented by data from original equipment manufacturers (OEMs) and infrastructure providers. Notes GNA: “This data is synthesized with leading sources of third-party research to provide insights into the current and future adoption of four sustainable vehicle technologies: Natural gas vehicles (NGVs); Propane (LPG) vehicles; Battery electric vehicles (BEVs); and Hydrogen fuel cell electric vehicles (FCEVs).”

The State of Sustainable Fleets 2020 analysis includes public, private, and for-hire fleets, including school, municipal/shuttle, urban delivery, refuse, utility, transit, short-haul, and long-haul sectors. The report covers vehicle sales trends, anticipated vehicle development timelines, real-world infrastructure and fuel costs, and the growing adoption of renewable fuels such as renewable diesel and biodiesel, renewable natural gas (RNG), and renewable electricity, hydrogen, and propane. Title sponsors of the report are Daimler Trucks North America, Shell Oil Company, Penske Transportation Solutions, and supporting sponsor Exelon Corporation.

Some general takeaways include:

- Fleets confirm no performance loss when switching to most renewable fuels — renewable diesel, natural gas, and electricity — and would use more when it is a cost-neutral, drop-in replacement.

- Historically, fleets have turned to alternative fuel vehicles on the promise of reduced total cost of ownership, which typically requires lower fuel costs relative to diesel or gasoline to offset the higher capital costs of purchasing the replacement vehicle technology. However, the report finds that many U.S. fleets are now transitioning to clean vehicle technologies to meet environmental sustainability objectives as companies seek to reduce climate-altering greenhouse gas (GHG) emissions and regional smog-forming pollutants.

- Of the fleets surveyed, 54% use NGVs. Of these, 40% fuel with RNG — either through a direct supplier relationship, or as a blend in their utility’s natural gas pipeline. Fleets using RNG today expect to continue using RNG over the next two years.

- After decades of development, medium- and heavy-duty NGVs have achieved technological and commercial maturity. Fleets leading adoption of heavy-duty NGVs report seeing low total cost of ownership through fuel cost savings and reduced maintenance, while simultaneously achieving steep emission reductions.

- There are approximately 90 models of Class 2 through Class 8 compressed natural gas (CNG) vehicles. About 85 percent of the 53,000 registered NGVs in America today are in heavy-duty applications, specifically goods movement, refuse, and public transit.

- Over 70% of surveyed urban delivery, transit, utility, and refuse fleets plan to continue purchasing and piloting NGVs over the next two years.

- The report cites a 400% increase in RNG use by U.S. fleets over the last several years.

GHG Emissions Reductions

In addition to enabling fleets to reduce their nitrous oxide (NOx) emissions, heavy-duty NGVs can also reduce life-cycle greenhouse gas (GHG) emissions. “Relative to comparable diesel vehicles, NGVs fueled by fossil natural gas provide a GHG reduction benefit of approximately 11%,” note the GNA authors. “By using RNG as a drop-in replacement for fossil natural gas, fleets can achieve significant additional GHG reductions. Depending on the feedstock, using RNG provides GHG reductions that currently range from about 60% to more than 300% relative to diesel fuel (achievable using RNG produced from “negative carbon” feedstocks, such as dairy gas). In fact, larger volumes of RNG produced from these ultra-low-GHG pathways are beginning to enter the market, providing steep GHG reductions for increasing numbers of heavy-duty NGVs.”

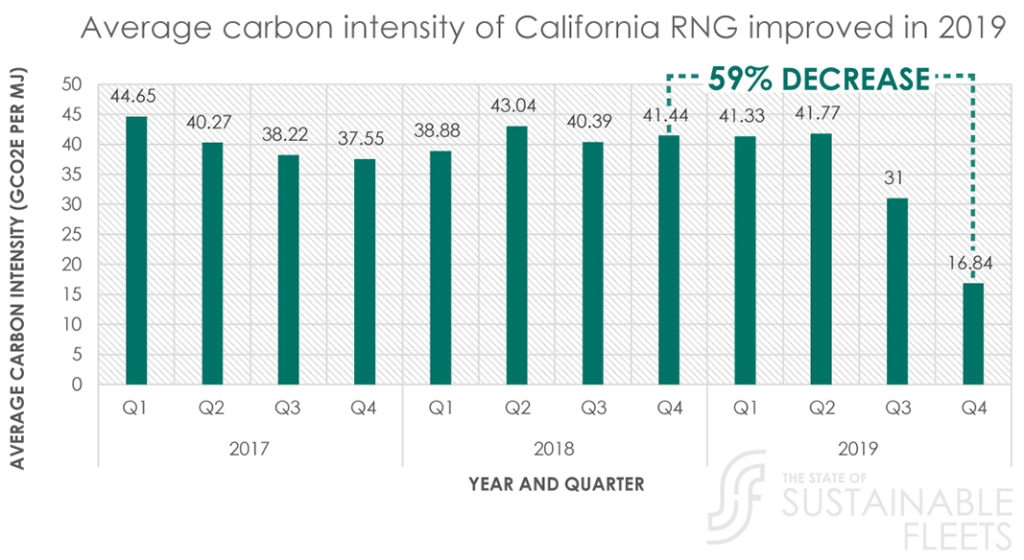

As new RNG facilities are coming online in California using ultra-low GHG production pathways (e.g., dairy biogas), the monetary value of RNG is increasing as the average carbon intensity decreases. For example — as the figure above illustrates — for the last three years under California’s Low Carbon Fuel Standard (LCFS) program (2017 through 2019), the average carbon intensity of CNG made from biomethane (also called “RCNG”) was approximately 39 g/CO2e/megajoule (MJ). This translates to a GHG reduction benefit of approximately 60% compared to current diesel fuel in California. By the fourth quarter in 2019, as greater volumes of fuel became available that were made from “carbon negative” dairy biogas pathways, the average carbon intensity was down to about 17 g/CO2e per MJ (a 79% reduction from fossil natural gas) — and a 59% percent decline from the previous year’s fourth quarter.

The cost of producing RNG can vary significantly, depending on the specific production pathway. According to the report, making carbon-negative RNG from dairy biogas using anaerobic digester technology is “one of the most expensive pathways.” But due to the credits under the LCFS when sold in California, this type of RNG delivers the greatest monetary benefits to producers, which helps pay for higher capital costs. Expanding RNG as a widely available replacement for fossil gas across the U.S. will likely require other states or regions to adopt their own low carbon fuel programs, similar to California’s LCFS and Oregon’s Clean Fuels Program.

Fueling Infrastructure

As noted earlier, the chief concern regarding NGVs among surveyed fleets is the shortage of public fueling stations relative to the network of stations for conventional fuels. According to the U.S. Department of Energy’s Alternative Fuels Data Center, CNG is available at more than 900 public and 700 private stations across the U.S.; many of these are specifically designed to accommodate medium- or heavy-duty vehicles, which dominate today’s NGV markets. Expansion is needed in the nation’s network of public stations that are designed to accommodate heavy-duty NGVs and can fuel them in approximately the same fueling window as diesel vehicles.

Overall, consumption of RNG by fleets has been growing. In 2019, 39% of all on-road fuel used in NGVs was RNG, equating to 277 million gallons of gasoline equivalent (U.S. Energy Information Administration 2020 data). In California, nearly 80% of the natural gas dispensed for on-road transportation in 2019 was RNG (California Air Resources Board data).

The competitive and generally steady price of natural gas relative to diesel is an important factor for fleet adoption of heavy-duty NGVs. “Over the last five years, the average retail price of diesel has generally been rising, peaking at about $3.00/gallon in 2018,” notes the report. “Over this same period, CNG prices have been very stable, averaging about $2.43/diesel-gallon equivalent. The result is that CNG’s price advantage over diesel averaged about 14% for fueling at public stations over the last five years. Furthermore, the price of CNG at most private stations averages 25% lower than public stations. For very large fuel users (e.g., transit and refuse fleets), the savings can be even greater.”