BioCycle November 2009, Vol. 50, No. 11, p. 36

Updated survey finds more state Renewable Portfolio Standards consider biogas from treatment plant digesters – a relatively untapped potential source of green electricity – as an eligible resource under their rules.

Jon Crowe, R. Wilson Hambrick, Jeffrey Snell and Wilson Rickerson

GREEN power refers broadly to renewable energy systems like wind, solar, small hydropower and biomass. The U.S. green power market has exploded during the past decade as concerns over air pollution, fuel price volatility, energy independence and global warming have driven a wave of new federal and state renewable energy incentives. A continuing challenge for wastewater treatment plants (WWTPs) is to find avenues for participating in established and emerging green power markets.

This article focuses on the ability of WWTPs to profit from converting biosolids into renewable electricity under state Renewable Portfolio Standard regulations. It updates a similar article, “Energy Recovery From Biosolids Treatment” (April 2006). Since that time, there is renewed interest in utilizing capacity available in WWTP digesters for nonbiosolids organic residuals such as fats, oils and grease (FOG), source separated food waste and food processing by-products that are delivered to the treatment plant. Addition of these feedstocks can significantly increase biogas production.

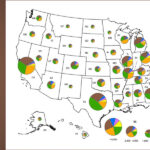

State-level Renewable Portfolio Standards (RPSs) are one of the primary drivers for renewable energy markets in the U.S., and one of the most rapidly evolving. An RPS generally mandates that utilities procure a certain percentage of their electricity from renewable resources by a certain date. When the previous article was written in April 2006, 22 states and the District of Columbia had enacted RPS mandates or voluntary goals. By June 2009, the total had increased to 37, including the District of Columbia and Guam. In addition, all but six of the 22 RPS targets in place in 2006 have been increased through new legislation.

WWTP ANAEROBIC DIGESTER INCLUSION

The most common method of converting biosolids into renewable electricity is through anaerobic digestion. According to the US Environmental Protection Agency (EPA), 544 (50 percent) of the nation’s 1,066 largest WWTPs already employ anaerobic digesters but only 106 (10 percent) use digester methane for heating or to produce electricity. The rest is typically flared. WWTP methane, therefore, represents a large and relatively untapped potential source of green electricity.

In order for anaerobic digesters to participate in RPS, they must be considered an eligible resource under the state regulation. While most state laws broadly include biomass as an eligible resource, the treatment of biosolids is frequently ambiguous. Questions can arise as to whether the term “biomass” implicitly includes wastewater methane, or whether wastewater methane is ineligible.

Table 1 lists the status of WWTP digesters in RPS, gathered from a survey of state laws and from telephone interviews with state officials. This survey revealed that WWTP digester gas is considered an eligible resource in every state but Maine, where no formal decision has yet been issued. It is interesting to note that the more recent RPS regulations tend to explicitly include WWTP methane as an eligible resource, whereas earlier RPS regulations were more vague. Early RPS adopter states, such as Arizona, Connecticut, Iowa and Massachusetts, do not explicitly include wastewater methane. More recent RPS policies (e.g. 2007-2009) in states such as Kansas, Missouri, New Hampshire, Ohio, Utah and Washington, however, each explicitly classify “sewage sludge,” “municipal wastewater digester,” or other variants as eligible resources. This appears to reflect an emerging appreciation among the renewable energy policy community of the potential contribution of WWTP resources.

RPS VALUE TO TREATMENT PLANTS

While eligibility is a prerequisite for RPS market participation, the value of RPS markets to WWTPs depends on regulatory mechanics. For example, North Dakota, South Dakota, Utah, Virginia, Vermont and the territory of Guam have set voluntary renewable portfolio goals and no formal compliance procedure exists. It is therefore difficult for WWTPs to reliably generate revenue through the RPS market in these states.

In states with mandatory RPS requirements, utilities generally demonstrate compliance by acquiring renewable energy credits (RECs) from renewable energy generators. For each megawatt-hour (MWh) of electricity that a renewable energy facility produces, a REC is generated. A utility can acquire these RECs by owning renewable generation, purchasing RECs directly from renewable generators under contract, or by buying and selling RECs on the open market.

RECs have emerged as a recognized commodity and they form the basis of formal green power markets nationwide. However, REC market structures vary widely from state to state. In some regions, such as Midwest and West, utilities tend to purchase electricity and RECs bundled together under a long-term contract. In regions such as New England and mid-Atlantic, RECs tend to be traded, bought and sold on a short-term or spot market basis, rather than under long-term contract.

The market prices for tradable RECs vary significantly over time and from one region to another. According to REC broker Evolution Markets, RPS credit prices ranged from $30/MWh in Massachusetts to only $0.90/MWh in Texas throughout the month of July 2009. This compares to prices closer to $50/MWh in Massachusetts and $12/MWh for Texas in 2006. As discussed below, the structure and mechanics of different REC markets can have important implications for whether or not a WWTP can use the RPS policy to finance biosolids methane projects.

Beyond the RPS, WWTPs also can contract with green power marketing firms to sell their RECs on what is known as the voluntary green power market. Businesses, universities, government agencies and private citizens, for example, purchase RECs in order to claim either that a certain percentage of their electricity is derived from renewable resources or to meet environmental goals. A large portion of the voluntary REC market adheres to the Green-e Energy standard, administered by the Center for Resource Solutions (CRS). Green-e is the leading green power certification program in the U.S. for voluntary green power products. According to CRS, methane from wastewater treatment plants is an eligible resource under the Green-e standard, and several green power marketers incorporate WWTP digester gas into their green power products.

Around the country, different WWTPs have taken varying approaches to participating in RPS markets. The following section reviews four brief case studies.

TRUCKEE MEADOWSWATER RECLAMATION FACILITY

The Truckee Meadows Water Reclamation Facility (TMWRF) serves the cities of Reno and Sparks in western Nevada. Situated along the Truckee River some 25 miles northeast of Lake Tahoe, the facility processes 26.5 million gallons/day of wastewater for a population of 310,000. Originally built in 1964, the regional water treatment facility underwent a $42 million renovation and expansion from 2002 to 2007. Currently, the plant generates on average approximately 319 million cubic feet of methane on an annual basis.

Truckee Meadows has a long history of burning gas onsite to generate heat and reduce its overall energy costs. The facility first harnessed its biogas in the late 1970s, though not for electricity. At that time, a 12 cylinder Waukesha engine was installed that mechanically drove one of the plant’s aerators and powered the facility’s heat loops.

In 1992, the plant installed its first cogeneration system, a 16 cylinder Caterpillar 3500 series engine with a 1 MW capacity that was derated to 650 to 700 kW because of the high altitude. This cogeneration system has been in operation ever since, having been rebuilt multiple times. Even so, the system currently runs approximately 90 percent of the time and generates over 5 million kWh annually while powering the plant’s heat loop that serves both the treatment process and buildings. This one cogeneration system saves Truckee Meadows an estimated $1,200/day or $438,000 on an annual basis, this for a plant with a total electricity budget of $3.3 million.

In addition, during its renovation the plant began to generate and sell Portfolio Energy Credits (PECs) as a result of Nevada’s Renewable Portfolio Standard, (which requires that at least 20 percent of the energy that utilities sell be from renewables by 2015). Starting in 2004, TMWRF entered into a long-term agreement with Nevada Power to sell its PECs to the utility, providing an estimated annual income of approximately $62,540. Between 2004 and 2007, Sierra Pacific paid the City of Sparks $187,719 for the PECs produced at the plant, providing an additional revenue stream while allowing the utility to meet its RPS obligations. It should be noted that only $25,000 of these PECs was the result of the cogeneration system. The remainder consisted of credits the plant received under the Nevada RPS for fueling its sludge heaters and boilers with onsite biogas.

Truckee Meadows does not utilize all of the gas it produces onsite. The plant still flares its excess gas even after powering a cogeneration system, three boilers, and five sludge heaters. Going forward, TMWRF has plans to expand its cogeneration system to 1.5 MW when the financing is available. The plant sees this as an opportunity to further tap an underutilized resource while becoming even more efficient and reducing the greenhouse gas intensity of its operation.

DAVENPORT WATER POLLUTION CONTROL PLANT

The City of Davenport Water Pollution Control Plant (DWPCP) is one of the largest wastewater treatment plants in the state of Iowa, serving a population of approximately 134,000 people. In the early 1990s, DWPCP teamed up with Fox Engineering to implement a number of energy-saving, environmentally friendly measures at the plant. This included construction in 1995 of two anaerobic digester plants and accompanying 600kW generators that burn the digesters’ waste methane gas to generate electricity.

Although Iowa’s RPS, known as the Iowa Alternative Energy Law (AEL), does not explicitly define wastewater treatment gas as an eligible resource, DWPCP was able to participate in the program. The AEL was the country’s first RPS, and was originally created in 1983. It has been amended several times, and currently requires the state’s two major electrical utilities, Interstate Power & Light and MidAmerican Energy Company, to purchase a combined 105 MW from alternative energy sources. Under the AEL, DWPCP entered into a long-term, 33-year contract with MidAmerican and currently accounts for approximately 1.28 MW of Mid American’s 55.2 MW obligation.

While RPS participation has produced a tremendous benefit for DWPCP, its experience with the Iowa RPS is fairly unique. First, Iowa’s relatively modest target of 105 MW has already been met by the utilities, and the utilities are not required to produce additional resources. It is unlikely that other regional WWTPs in Iowa will be able to participate under the RPS. Another relatively unique quality of the Iowa RPS is that it does not allow electricity that is used to offset the onsite load to participate in the RPS. Many other RPS states allow generators to earn RPS credit whether or not their electricity is sold into the grid or consumed “behind the meter.” Although the DWPCP facility generates enough electricity to supply approximately 80 percent of its onsite load, it sells the electricity generated to the utility at a premium wholesale rate.

DEER ISLAND TREATMENT PLANT

The Deer Island Treatment Plant (DITP) serves 2.5 million people in the Boston region. Operated by the Massachusetts Water Resources Authority, it is the second largest wastewater treatment facility in the country. DITP processes on average 360 million gallons/day of wastewater. As part of its treatment process, Deer Island recovers methane from its 12 3-million gallon egg-shaped digesters and uses the gas to fuel boilers. High pressure steam from the boilers goes through an 18 MW steam turbine generator. The turbine produces low-pressure steam that is used in the plant heating loop, and generates electricity. This process generates enough electricity to provide power for roughly 1,000 households annually. While WWTP digester gas is not explicitly mentioned as an eligible resource in Massachusetts’ original RPS legislation, DITP applied for, and was granted, RPS eligibility in 2002.

In the October 2004 issue of BioCycle (“Wastewater Treatment Plant Builds Profit Center From Anaerobic Digestion”), it was reported that DITP sold its renewable energy credits for between $30 and $48 per REC. After the article’s publication, however, renewable energy market conditions drove credit prices up to an average of $51.43 in 2005 before they fell again to approximately $25 to $30 per REC in 2009. In 2005 and 2006, DITP generated approximately $1 million in revenue from REC sales. With the decrease in REC value, it is likely that 2009-2010 revenues may be lower. Although all REC revenues are redirected back into the general budgetary fund for the plant, DITP has aggressively invested in additional renewable energy opportunities, including a 100 kW photovoltaic system in 2008 and two 600 kW wind turbines in 2009.

In addition to the Massachusetts RPS, DITP also applied for eligibility in Connecticut. While the Connecticut Department of Public Utilities Control (DPUC) acknowledged the eligibility of WWTP digester gas, the DPUC concluded that only in-state onsite generators could participate in the RPS. Because DITP consumed the entirety of its digester gas on-site and out-of-state, it was judged ineligible. Recent changes in RPS regulation now allow out-of-state on-site generators like DITP to sell credits in Connecticut. However, the Connecticut RPS market has been even more volatile than the Massachusetts market. Since 2006, REC prices have crashed from over $30/MWh to $2/MWh, and then climbed again. Therefore, although DITP is positioned to sell RECs in either state’s RPS markets, DITP has not sold any RECs into the Connecticut market as of September 2009.

ESSEX JUNCTION TREATMENT FACILITY

A final example is the Essex Junction Wastewater Treatment Facility, which processes 1.9 million gallons/day of wastewater (MGD) in the suburbs of Burlington, Vermont. Prior to 2003, the Essex Junction plant had flared 45 percent of its anaerobic digester methane and burned the rest to provide heat for the digestion process. In 2003, however, it hired Northern Power Systems to install two 30 kW Capstone microturbines on-site that convert the methane output of the plant into electricity. As a result, close to 100 percent of the waste methane is converted into electricity.

The microturbines generate approximately 350,000 kWh/year of electricity, which is used onsite to power pumps and other water treatment equipment. They are configured to produce power at peak times when electricity is most expensive. This has led to savings upwards of $37,000 in some years. The facility also uses the heat generated when the methane is burned to heat the digester tanks.

To finance the project, Essex Junction relied on a mix of state incentives and the voluntary green power market. Efficiency Vermont, the state energy-efficiency utility, provided an incentive of $40,000 to move the project forward. Essex Junction also signed a contract to sell RECs to NativeEnergy, a marketing firm that sells green power-based products to public and private sector customers. NativeEnergy blended RECs from Essex Junction with RECs from regional farm energy and other biomass projects to create its CoolHome green power product.

Unlike many green power products, NativeEnergy markets CoolHome as a greenhouse gas reduction product. Rather than purchasing RECs as a way to be “green powered,” customers sign up to offset six tons of CO2 emissions each year. NativeEnergy purchased the 15-year REC output of the Essex Junction digester upfront. This arrangement lowered the payback of the digester to a period acceptable to Essex Junction, allowed the project to move forward, and gave CoolHome customers an opportunity to help build a new renewable generation capacity.

The Essex Junction project is also fairly unique because of its small size. According to a recent report prepared for the US EPA, “Opportunities For And Benefits Of Combined Heat and Power at Wastewater Treatment Facilities,” it is neither technically nor financially feasible for wastewater plants with an influent rate below 5 MGD to implement a green power project. The fact that Essex Junction, with 1.9 MGD per day, was able to move its project forward demonstrates that smaller-scale projects can be feasible given the right mix of incentives.

EXPANDING ENERGY RECOVERY OPPORTUNITIES

The experiences of the wastewater treatment plants profiled in this article demonstrate that the green power landscape can be complicated to work within. In each of the cases, WWTPs are successfully participating in green power markets, but the rules of the game are different in each instance: in Nevada and Iowa, the WWTPs sell their output under long-term contracts; in Massachusetts, Deer Island plays in the regional tradable credit markets; and in Vermont, Essex Junction took advantage of an upfront payment from a voluntary green power marketer in exchange for its future REC output.

Although the number of RPS laws has expanded dramatically since the 2006 article was written, and although almost all state RPS regulations allow WWTPs to participate, it remains difficult to generalize about whether RPS laws will significantly expand WWTP energy recovery opportunities. For WWTPs that already generate electricity from digester gas, selling renewable energy credits into the RPS or voluntary markets can be a relatively low-risk source of revenue.

For WWTPs that are hoping to finance new digester capacity, however, RPS markets can be difficult to navigate. In markets such as Nevada’s, for example, the transaction costs associated with securing and negotiating a long-term contract with utilities may be too high for new WWTP projects to handle. In markets such as Massachusetts, by contrast, the unpredictable revenue stream associated with tradable RECs makes new projects difficult to finance.

Ultimately, the ability of a broad range of wastewater treatment plants to finance energy recovery from biosolids using green power markets may hinge on the development of more tailored RPS compliance mechanisms. These could include long-term contracts, standard offer contracts, or feed-in tariffs that both streamline the contracting process and create investor security (see “Feed-In Tariffs Strengthen Markets For Biogas Power,” July 2009, and “Financing Wood-Fired Generating Facilities,” February 2007). Although the rapid spread of green power markets around the country has given WWTPs more options to develop onsite energy sources, it remains to be seen if RPS will be sufficient to enable a significant amount of the untapped biosolids methane resource to be brought online.

Jon Crowe, Jeff Snell, and Wilson Hambrick were Sustainability Fellows with Meister Consultants Group in 2009 while completing Masters degree programs focusing on environmental and energy policy. Wilson Rickerson is Executive Vice President at Mesiter Consultants Group and serves on the Editorial Board of BioCycle.

November 19, 2009 | General