A refresher on workers’ compensation requirements, rates and premiums for facility owners and operators.

Craig Coker

BioCycle November/December 2018

Operating composting and anaerobic digestion facilities for recycling organics is not without risks of injury to employees. Moving mobile equipment, rotating machinery, intense concentrations of toxic gases and use of hand tools have all been cited as causes of injuries (and in some cases, fatalities) to employees at composting and digestion facilities.

Employees injured on the job are eligible to collect workers’ compensation benefits while they recuperate. Workers’ compensation is a form of employer insurance that is meant to provide injured employees with a way to receive money while out of work for work-related injuries. It is usually irrelevant whether the employee or the employer was at fault for causing the injury; if the employee was injured while on the job, then he or she can file a claim for workers’ compensation benefits (subject to a few exceptions).

Workers’ Compensation Basics

Because an injured worker and his or her family can experience sudden hardship caused by the unexpected loss of income, workers’ compensation benefits are intended to provide injured workers with a way to pay bills and medical costs during the recovery period. The benefits pay costs associated with medical care, lost wages, and retraining if the injury forces the employee to seek a new position or line of work. Workers’ compensation payments don’t account for any pain and suffering that the injured employee might experience.

For a work-related injury, an employee may be eligible for compensation for any of the injuries listed below:

• Preexisting conditions that the workplace accelerates or aggravates. Examples may include a back injury, even though the employee does not notice the pain from the injury until later.

• Injuries caused during breaks, lunch hours, and work-sponsored activities (such as a company picnic), and at-work injuries caused by company facilities, such as a chair in the company lunchroom.

• Diseases such as lung cancer, or exacerbations of existing ailments like asthma, if contracted by exposure to toxins at work as a result of normal working conditions.

• Injuries resulting from mental and physical strain brought on by increased work duties or work-related stress. In some states, this includes employees who develop a disabling mental condition because of the demands of the job and a supervisor’s constant harassment.

There are some injuries, however, that may not be covered by workers’ compensation. State courts are divided on whether an employee can recover for an injury sustained during horseplay at work. Many states will not award benefits to employees injured while intoxicated or who deliberately inflicts injury on themselves. If a worker leaves the employer’s premises to do a personal errand and is injured, he or she might not be entitled to workers’ compensation benefits.

The system involves a trade-off: Injured workers receive payments quickly, but these payments are capped. An employer is protected from lawsuits but must provide benefits to injured workers (through workers’ compensation insurance) even if the employer wasn’t at fault.

Workers’ compensation is usually considered a substitute for a lawsuit against the employer. Prior to the creation of the workers’ compensation system, employees had no choice but to go to court to recover compensation for their work-related injuries. Now, most employees are automatically entitled to workers’ compensation, but at the same time, the employer is automatically protected from most employee lawsuits. An employee still may be able to bring a lawsuit if the injury was caused by someone other than the employer, or by a defective product used on the job, such as a piece of equipment that malfunctioned.

Employer Requirements

In most states, employers are required to purchase insurance for their employees from a workers’ compensation insurance carrier. In some states, larger employers with enough assets are allowed to self-insure, or act as their own insurance companies, while smaller businesses (with fewer than three or four employees) are exempt. “This is a compulsory law in Virginia,” explains Jill Brooks, Vice-President with McGriff Insurance Services in Roanoke, Virginia and a Certified Insurance Counselor. “If you have more than 3 employees and don’t buy a policy, the penalties are daily fines of $250 up to a maximum total of $50,000.”

When a worker is injured, the claim is filed with the insurance company (or self-insuring employer), which pays medical and disability benefits according to a state-approved formula. Unless they fall within limited, exempt categories, employers without workers’ compensation insurance are subject to fines, criminal prosecution, and civil liability.

In addition to providing workers’ compensation coverage, in most states, your company must perform some, if not all, of the following duties:

• Post a notice of compliance with workers’ compensation laws in a conspicuous place at each job site.

• Provide immediate emergency medical treatment for employees who sustain on-the-job injuries.

• Furnish further medical attention if an injured worker is unable to select a doctor or advises the employer in writing of a desire not to do so.

• Complete a report of the injury and mail it to the nearest workers’ compensation board office. A copy of the report should also be mailed to the employer’s insurance company. An employer who refuses or neglects to make an injury report may be guilty of a misdemeanor, punishable by a fine.

• Make a written report of every accident resulting in personal injury that causes a loss of time from regular duties beyond the work day or shift on which the accident occurred, or that requires medical treatment beyond first aid.

• Comply with all requests for further information regarding injured workers by the workers’ compensation board or the insurance company.

Employers often appear to frown on employees who file workers’ compensation benefit claims, and some discriminate against such employees. To protect employees in these situations, most states prohibit employers from punishing, discriminating against, or discharging employees who exercise their rights under workers’ compensation laws, and allow employees to bring civil actions against their employers for the tort of “retaliatory discharge.” Besides termination, retaliation may take the form of more subtle types of discriminatory treatment, such as demotion or salary reduction. Injured employees are protected from discriminatory conduct immediately after an injury and before a formal workers’ compensation claim is filed. An employee’s “cause of action” (a set of facts sufficient to justify a right to sue in court) may be successful even though all the employee did was give notice to the employer of a claim.

Calculating Rates And Premiums

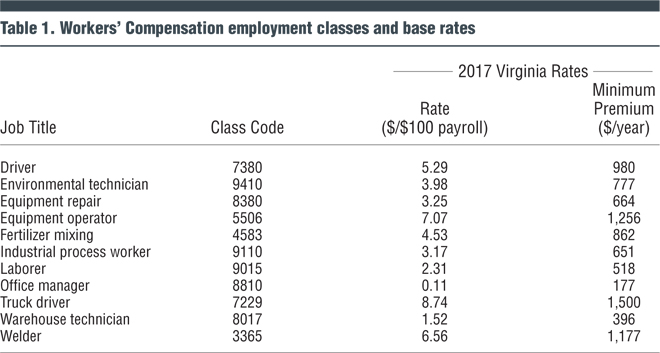

Workers’ compensation insurance premiums are calculated according to how employees are classified (with regard to the specific type of work they perform) and the rate assigned to each employee classification. The premium rate itself is expressed as dollars and cents per $100 of payroll for each class code. In most states, the National Council on Compensation Insurance (NCCI) determines the classification rate and experience modification factor (MOD).

“We sit down with a business to understand what job functions each employee will do during the course of a normal business day,” notes Brooks. “There is not a class code for every type of job out there. We have to find one that best fits what the employee is doing. Once we have a class code and a rate, we start talking to insurance companies. Each company has a different appetite for risk. For example, most will write policies for floral shops but fewer will write policies for asbestos abatement.”

Premiums for workers’ compensation insurance are calculated by the formula below:

Payroll (per $100) x Classification Rate x Experience Modifier = Premium

“The class codes provided by NCCI are considered ‘base rates’,” she adds, “and each insurance company has its own rates. The classification rate used in the premium calculation is a combination of the base rate and the insurance company’s rate, so it pays to shop around.” Example labor classifications typical of organics recycling facilities and base rates for Virginia in 2017 are shown in Table 1.

The MOD factor compares your workers’ compensation claims experience to other employers of similar size operating in the same type of business. Your company’s actual losses are compared to its expected losses by industry type. Factors considered are: company size, unexpected large losses, and the difference between loss frequency and loss severity. Your Experience MOD represents either a credit or debit that’s applied to your workers’ compensation premium.

A MOD of 1.0 is considered to be the industry average. A MOD factor greater than 1.0 is a Debit MOD — your losses are worse than expected and a surcharge will be added to your premium. An Experience MOD under 1.0 is a Credit MOD, which means losses are better than expected, resulting in a premium discount. The Experience MOD is calculated by the NCCI or in some states, by an independent agency. “If your annual workers’ comp insurance premium is less than $5,000, then you don’t have to have a MOD,” explains Brooks. “And if you need one, the NCCI will calculate your first MOD, good for three years, based on industry statistics.”

Ways to maintain a low Experience MOD include:

• The Experience MOD is influenced more by small, frequent losses than by large, infrequent ones. So, the fewer losses you have, the better.

• Create a sound safety program and think of ways you can be proactive about injury prevention.

• Create or improve an effective return to work program to help lower your Experience MOD.

• Report injuries promptly. Studies reveal that prompt injury reporting reduces the cost of claims.

• Implement an active claims management program to manage outstanding reserves and focus on efficiently resolving open claims.

• Train front-line supervisors and managers on how to manage injured employees. Supervisors play a key role in managing the injury and recovery process. When there’s a good relationship between the injured employee and the supervisor, chances are you’ll get better results.

• Practice due diligence during the hiring process. Hiring an employee who is not fit for the essential functions of the job will increase the risk of an injury.

Workers’ compensation insurance policies are written on an annual basis, and the insurance underwriter will audit a policy within 60 days of policy expiration (even if you renew with the same company) to compare actual payroll to projected payroll. “A good insurance agent will work with you to avoid big additional premium charges following an audit,” says Brooks. “We call it ‘Pay-As-You-Go,’ where we work with you to report actual payroll on a monthly basis. This frequent reporting allows cash flow to absorb any increases during the premium year, rather than have to come up with a large lump sum additional premium payment after the audit. With Pay-As-You-Go, you won’t get a big audit bill at the end of the term.”

Changing A Job Classification

Only the appropriate workers’ compensation regulatory authority in your particular state can change a job classification category for your firm. An individual insurance agent or insurance company does not have that authority. If a job classification category is not changed officially by the regulatory authority, you could be liable for additional back insurance premiums at a future date if the change was not an official one.

For 31 states, NCCI is the official regulatory authority empowered to change a job classification category. In 6 states (Nevada, North Dakota, Ohio, Washington, West Virginia and Wyoming), workers’ compensation insurance is provided only through a state fund administered by the appropriate state agency responsible for regulating the fund. In the remaining 13 states, independent workers’ compensation rating bureaus have the authority to change job classification categories.

National Trends

Periodically, state insurance regulators will survey workers’ compensation rates around the U.S. The Oregon Department of Consumer and Business Services publishes a biennial study that ranks workers’ compensation premium rates for all 50 states and Washington, D.C., based on a survey of insurance regulators and workers’ compensation rating bureaus. The study is based on methods that put states’ workers’ compensation rates on a comparable basis, using a constant set of risk classifications for each state.

In the 2018 study, premium rate indices were calculated based on data from 51 jurisdictions, for rates in effect as of January 1, 2018. The 2018 median value is $1.70/$100 of payroll, which is a drop of 7.6 percent from the $1.84 median of the 2016 study. This is the largest drop in the study median since 2012, and is believed to be due to greater attention to safety and less severe on-the-job injuries. National premium rate indices range from a low of $0.82 in North Dakota, to a high of $3.08 in New York. There were 17 states that had an index rate that was within plus or minus 10 percent of this median benchmark value. In the upper part of the rate distribution, 14 states had index rates higher than 110 percent of the median, while 20 states were below 90 percent of the median.

These insurance costs are part of the costs of doing business in composting or in anaerobic digestion. Keeping a current estimate of premiums allows for those costs to be accurately factored into pricing decisions on tip fees and/or on compost or digestate sales or renewable energy pricing. Those planning new facilities should factor estimates of workers’ compensation premiums into either a separate overhead category or into estimates of labor costs loaded with payroll taxes and fringe benefits.

Craig Coker is a Senior Editor at BioCycle and CEO of Coker Composting and Consulting (www.cokercompost.com) near Roanoke VA. He can be reached at ccoker@jgpress.com.