Top: Photos courtesy of José M. Álvarez de la Puente, CalTrans, Rebecca Ryals

Nora Goldstein

A few months ago, I came across an article in BioCycle, “Compost Supply And Demand,” that was published in January 1993. The article was based on a study conducted by Battelle that provided a quantitative analysis of the potential supply and demand for compost in the U.S. “Our study estimates the total production of compost from four major sources to be approximately 100 million cubic yards (51 million tons/year) and demand for compost by nine important markets to be approximately one billion cubic yards (500 million tons) per year, 10 times greater than the potential supply.”

To the best of my knowledge, a national compost market analysis with a similar scope has not been conducted in the U.S. since the Battelle study — at least not one that is publicly available. I make this sweeping statement with sincere hope that I am proven wrong. There have definitely been market analyses in states; California comes to mind. And BioCycle has had articles over the years that have included estimates, some of which are cited below.

1992 Battelle Study

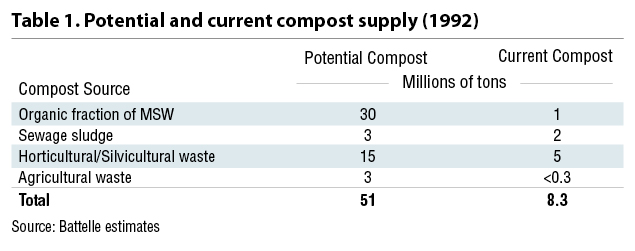

The original study, “Potential U.S. Applications For Compost,” was prepared by Battelle in 1992. It was commissioned by The Composting Council (today the US Composting Council), with support from the American Paper Institute. The four major sources of organic waste that were used to estimate the potential supply were:

- Organic fraction of municipal solid waste (MSW): Battelle estimated that the organic fraction comprised 60% of the MSW generated or 120 million tons, based on total generation of 200 million tons. Of that, the article notes, “about 40 million tons will be incinerated, leaving 80 millions tons of compostables that will yield roughly 40 million tons of unrefined compost. (Two tons of organic MSW will yield roughly one ton of compost.) During refinement, it is estimated that 10 million tons will be screened off and landfilled, leaving 30 million tons of finished compost.”

- Sewage sludge: Battelle estimated that 15% of the estimated 7.7 million dry tons of sludge produced annually would be composted. The authors explained that one dry ton of sludge plus bulking agent produces about 2.5 tons of compost. Assuming 15% of sludge is composted, that would yield 3 million tons of compost.

- Horticultural/silvicultural wastes: Includes bark, used mushroom media, sawdust and other horticultural and landscape residuals. Potential compost from this source was estimated to be 15 million tons.

- Agricultural wastes: Study noted that the vast majority of about 180 million dry tons of manure produced annually by livestock and poultry are directly land applied by animals and farmers. Therefore it used some assumptions to arrive at the potential for compost that could be produced — 3 million tons.

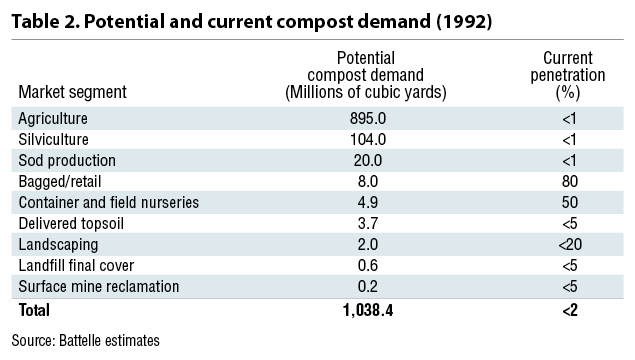

Table 1, excerpted from the 1993 BioCycle article, summarizes this compost supply information; data on current (at that time) compost supply are included. The next step in the Battelle research was to study the application of compost in nine market segments that comprised about 95% of the demand for compost at that time. “This segmentation was chosen to take advantage of available national statistics and avoid the potential of double counting due to overlap,” noted the authors. Table 2 from the 1993 BioCycle article shows the potential compost demand by these 9 segments and the current penetration of compost into these markets. “It is assumed that the compost would be of sufficient quality to meet user needs,” they added. “The potential demand estimates do not consider possible future segment growth and, therefore …. should be considered conservative.” The full report that Battelle completed provided a state-by-state tabulation of these segment estimates.

A scan in PDF format of the “Compost Supply And Demand” article is available. The article includes details about the 9 market segments, and a brief explanation of Battelle’s methodology.

A scan in PDF format of the “Compost Supply And Demand” article is available. The article includes details about the 9 market segments, and a brief explanation of Battelle’s methodology.

Excerpts From BioCycle Archives

A scan through the BioCycle archives found a handful of articles with estimates on the size of the national compost market. Other articles, especially those authored by Dr. Sally Brown, provide calculations that can be used to estimate potential compost demand. Here are a few excerpts with links to the full articles.

“Characterizing The Composting Industry,” December 2004: Authored by BioCycle editors Nora Goldstein and Craig Coker, this article took a stab at identifying tools to measure the economic vitality of the industry. This excerpt discusses annual sales: “At this juncture in the composting industry’s history, it would be safe to say that no one really has a clue what the annual sales are industry-wide. Some people cite the fact that the private sector composters are privately held businesses that don’t want to divulge sales figures. Others cite the lack of uniformity in product pricing and product weights and volume (for the same category of product). These obstacles aside, there are some industry generalities that can be used as a starting point to estimate annual industry sales. For example, say that a realistic average price for compost is $10/cubic yard (before value added via blends, erosion control mixes, etc.). A recent survey conducted by Matt Cotton under contract with the California Integrated Waste Management Board [now CalRecycle] found that 4.7 million tons of organic feedstocks were composted in 2003 in California. With volume reduction during composting, let’s estimate that 2.5 million tons of compost were produced (based on average bulk density of compost of 2.1 cubic yards (cy)/ton). Therefore, one could estimate that 5.25 million cy of compost were produced in California in 2003. At a price of $10/cy, annual sales of the composting industry in California were $52.5 million.”

“Valuing The U.S. Composting Industry,” December 2009: Compost marketing consultant Ron Alexander wrote this industry analysis from the vantage point of assessing the composting industry’s worth by assigning a dollar value to compost use benefits. He started the article as follows: “Beginning in the late 1970s, the biosolids composting industry started in earnest with the ban on ocean dumping of sewage sludge on a nationwide basis. Through the late 1980s and early 1990s, landfill bans on yard trimmings were adopted by an increasing number of states and the volume of composted materials grew to an all time high. While this was happening, mixed waste composting expanded, then contracted, because of the cost of operation and product quality issues. On-farm composting of manure also expanded, although the actual number of facilities is difficult to track.

“Even with all of this expansion, there is still significant room for growth. In the U.S., annual generation of manure is 66 million dry tons, biosolids is 7 million dry tons and MSW organics (food waste and yard trimmings) is 55 million tons (wet weight). Certainly, composting of food residuals has also expanded, but not to the level that many of us would have expected by now. It has been estimated that 4,500 to 5,000 composting facilities exist in the U.S. But how many of these facilities are commercial scale, and how much material is really composted? On the end use side of the picture, compost markets have expanded greatly, with a minimum of 50 million cubic yards distributed annually in the U.S., and new applications being invented all the time.”

Alexander cites a variety of benefits — from water infiltration to drought resilience to nutrient availability, and then segued into why quantifying the dollar value of these benefits is critical to attracting research dollars and industry investment: “We need to develop easy-to-use formulas that assign a dollar value to known benefits. For example, is there a formula to quantify compost’s value in improving the availability of water and healthy soils? What about a way to calculate the value of compost addition in slowing climate change (e.g., carbon sequestration, NOx reduction, etc.)? A worldwide system to sell carbon credits based on carbon addition to the soil needs to be established in order to assign a dollar value. The end goal in these mathematical exercises is to develop a metric that can be used to measure the total financial worth — on an annual production/output basis — of compost that can provide the environmental and agricultural benefits (e.g., compost that meets specific end use and product parameters). Having this data will allow composting facility owners and operators to better sell the industry to investors, as well as political decision makers who can assist (or devastate) it through policy making.”

“Recycling Every Drop Of Organics,” March/April, 2014: A sidebar to an article, “Compost And Mulch Aid Drought Survival” by Sally Brown, provided some metrics that could be used on the “back of a napkin” to calculate the potential for compost production in the U.S. Brown focused on how much yard trimmings, food scraps and biosolids are available: “Each person generates about 60 dry pounds each of biosolids and food scraps, and 1.5 times that quantity (90 lbs) of yard trimmings, annually. If the food waste and yard trimmings are composted, that makes about 75 lbs of compost per person.” Brown calculated that the biosolids would be directly land applied. Let’s go with the Battelle estimate that 15% of biosolids are composted, and that one dry ton of sludge plus bulking agent produces about 2.5 tons of compost. Therefore 9 dry pounds of biosolids are composted, equaling 22.5 dry lbs of compost/person/year. So, 75 lbs of food scrap and yard trimmings compost/person/year — plus 22.5 lbs of biosolids compost — equals close to 100 dry lbs/person/year of potential compost.