Top: Graphics courtesy ICF

Massachusetts has had a commercial food waste disposal ban in place since 2014. In 2016, the Department of Environmental Protection (MassDEP) hired the consulting firm ICF to conduct an economic impact analysis of the ban. Results of that analysis showed growth in jobs generated, tonnage diverted, labor income, industry activity, value added and tax revenue compared to 2010 baseline data in the Commonwealth’s 2010-2020 Solid Waste Master Plan.

This year, ICF completed another economic impact analysis for MassDEP, using 2024 data. MassDEP distributed surveys to 117 contacts in the organics industry and received 37 unique responses from 30 companies. Those responses were categorized by industry segments: organic waste collection/hauling, organic waste processing, food rescue organizations, and other organizations, such as food manufacturers, emergency food pantries and compostable products distributors. ICF reported averages and extrapolated survey results to the full industry segments. Combining the three sectors surveyed, the quantity of food waste rescued, collected/hauled or processed was about 713,300 tons.

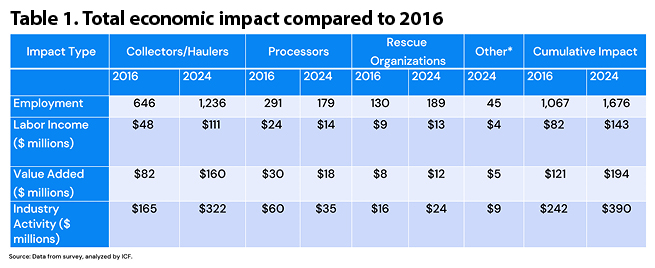

Among key trends identified, the study notes growth in both institutional and residential customers. In terms of tonnage, the food rescue segment has grown the most since the 2016 study — 93%. Total employment by the industry has continued to grow. From 2010 to 2024, the average number of employees increased by 97% for haulers, 30% for processors, and 6% for food rescue organizations. The biggest jump in employment in those three segments occurred following the ban implementation in 2014. (“Other” was not included as an industry segment in the 2010 and 2016 studies.)

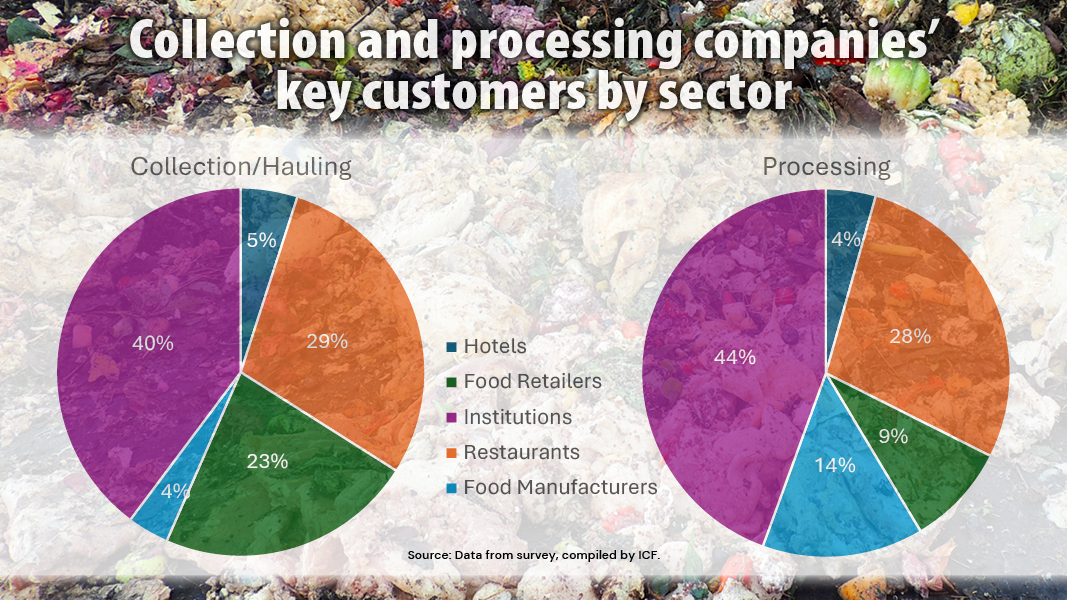

Revenue likewise increased for all three segments from 2016 to 2024, with processors seeing the smallest increase and collectors/haulers seeing the largest. The study also asked about capital investment, finding that collection/hauling companies reported the highest average annual capital investment. In 2024, institutions and restaurants were the largest customers by tonnage for both haulers and processors, making up a combined 69% and 72% respectively. For food rescue organizations, food retailers were the largest customer, making up 59% of the tonnage managed in 2024.

ICF used the Lightcast input-output model to calculate the direct, indirect and induced impacts associated with organic waste industry activity. The total economic impact of all four industry segments is significant (Table 1), showing that the ban has been good for business:

- 1,676 jobs

- $143 million in labor income

- $194 million in value added

- $390 million in industry activity

The survey also asked about perceptions of the 2022 expansion of the food waste ban to generators of a half-ton or more per week (the original ban covered generators of a ton or more per week). Survey responses indicated that generators of more than a half-ton/week were largely already complying with the initial ban, which may be why processors saw less growth following the 2022 expansion than perhaps was anticipated. Perceptions of the ban are “universally positive, and many organizations noted that the deliberate pacing has allowed capacity to keep up with demand.” Respondents mentioned opportunities for more education to raise awareness and support for the ban among stakeholders and policymakers and continued support for federal and state tax credits to support food rescue/donation. Challenges mentioned include zoning requirements for processing facilities and communication with customers around noncompliance and enforcement.